A leading crypto asset manager says institutional investors bought Bitcoin’s (BTC) low last week, giving digital investment products their first week of inflows since early April.

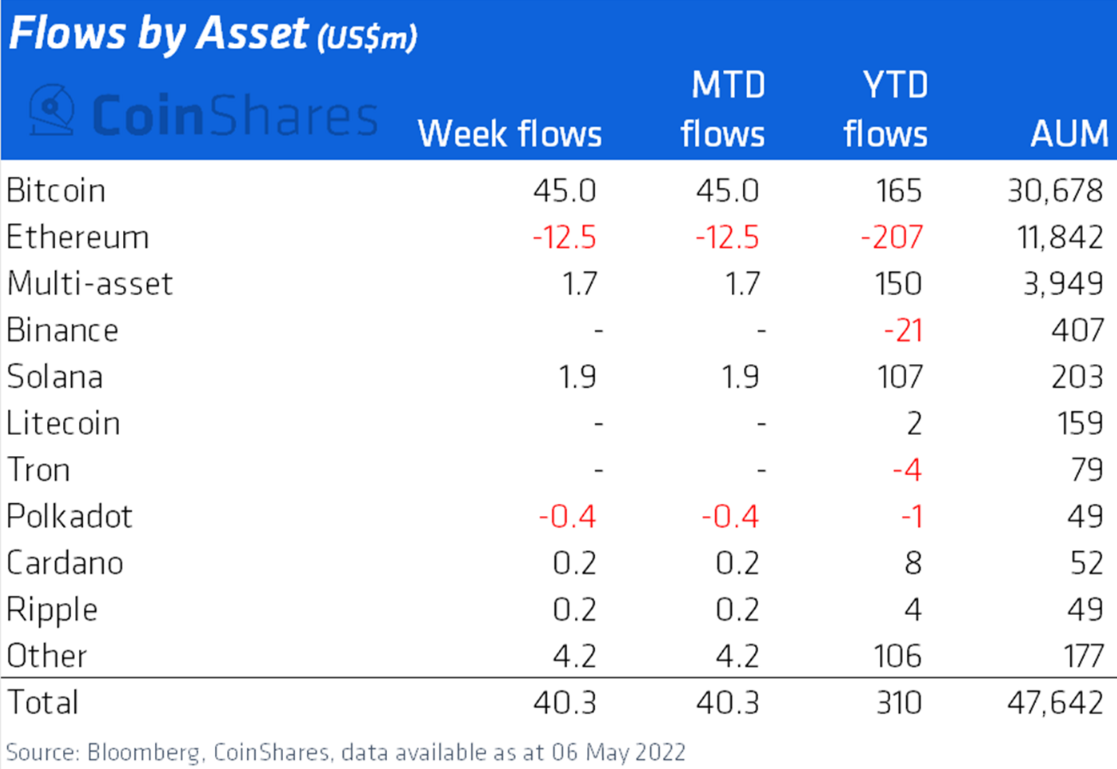

In the latest edition of their weekly Digital Asset Fund Flows Weekly Report, CoinShares finds institutions invested $45 million in BTC products despite the market crash.

“Bitcoin saw inflows totaling $45 million, the primary digital asset where investors expressed more positive sentiment, although…

Short Bitcoin saw the second-largest weekly inflows on record, totaling $4 million. AUM [assets under management] is now at a record high of $45 million.”

Overall, North American investment products saw far more activity than European products.

“Flows were lopsided with inflows of $66 million in North American investment products while Europe saw outflows totaling $26 million.”

Ethereum (ETH) rival Solana (SOL) had the most notable inflows of any altcoins last week, totaling $1.9 million. Multi-asset investment products, those investing in multiple digital assets, enjoyed $1.7 million in inflows, while XRP and Cardano (ADA)-focused investment products enjoyed $0.2 million of inflows each.

Ethereum-focused products continued to struggle last week, bringing ETH’s total year outflows to over $200 million.

“Negative Ethereum sentiment continues however, with outflows totaling $12.5 million last week, bringing total outflows year-to-date to $207 million.”

Check Price Action

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Julien Tromeur/Sensvector