A leading digital assets manager says that institutional investors are converging toward the safety of Bitcoin (BTC) as altcoins see very little capital flows.

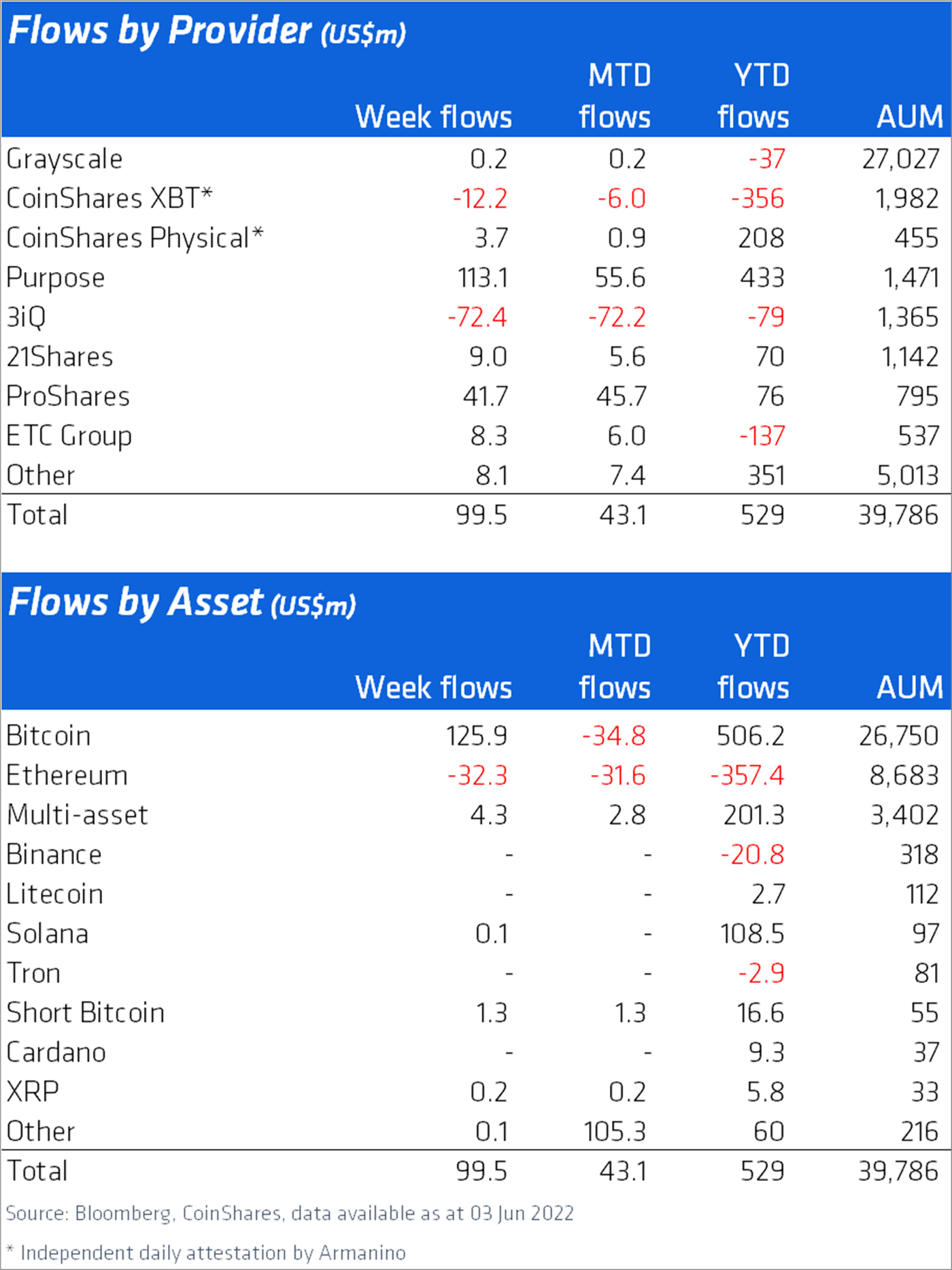

In the newest Digital Asset Fund Flows Weekly report, CoinShares finds that the top crypto asset by market cap saw total inflows of $126 million last week, bringing its total inflows to $506 million on the year.

CoinShares says Bitcoin’s dominance of last week’s institutional attention stems from investors looking for a safe haven in the flagship crypto asset.

“Altcoins saw virtually no inflows last week, highlighting investors are flocking to the relative safety of Bitcoin.”

The crypto asset manager also says that Ethereum (ETH) is no exception to the trend, with ETH seeing its ninth straight week of outflows, signaling negative sentiment on the top smart contract platform by market cap.

“Ethereum continues to suffer, with another week of outflows totaling $32 million. Ethereum has endured nine straight weeks of outflows implying negative investor sentiment. However, since the outflows began in December 2021, they only represent about 7% of the assets under management.”

According to the data, the only altcoins that saw positive inflows last week were Solana (SOL) and XRP, coming in at about $100,000 and $200,000 respectively.

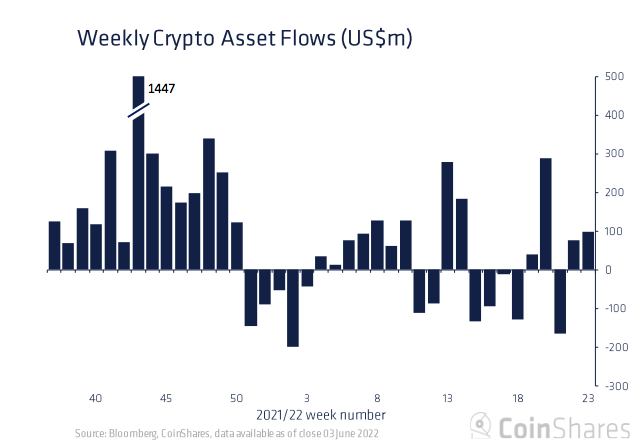

Despite the caution in the altcoin market, institutional capital flows were overall significantly higher than the previous two weeks, according to CoinShares’ data.

Check Price Action

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/New Africa