A popular crypto analyst is exploring buyer interest at different price levels to see where leading smart contract platform Ethereum (ETH) is headed next.

In a new strategy session, the anonymous host of InvestAnswers tells his 440,000 YouTube subscribers that, despite a rough start to 2022, ETH has held firm at $1,720 and has since pushed back above $1,900.

“Ethereum has been very volatile, very beaten down. It held up very strong at that $1,720 level of support, which is historical support from 2021.

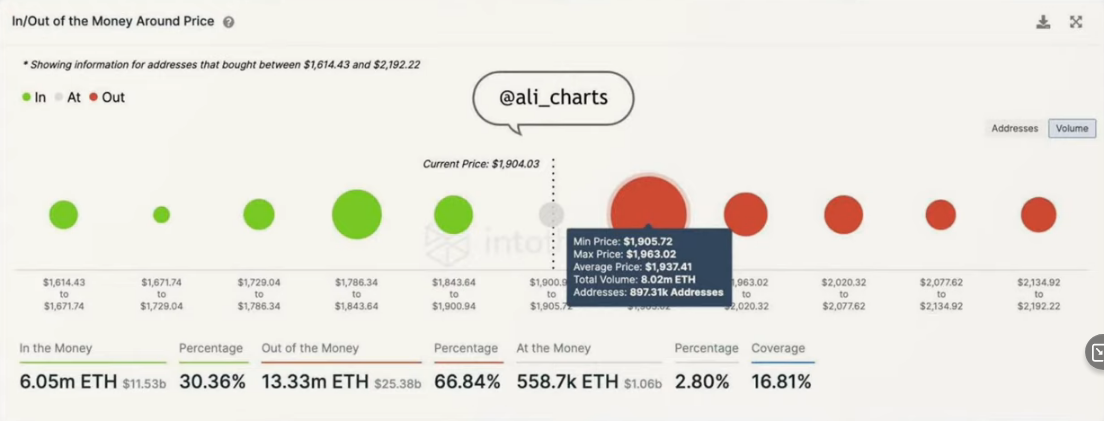

But this on-chain data shows a stiff supply barrier between about $1,906 and $1,963 where roughly 900,000 addresses acquired over eight million ETH.”

The analyst goes on to say that if ETH can break out of the $1,906 to $1,963 resistance zone, it might very well blast past $2,000 by another 10%.

“ETH has to overcome this resistance to be able to get back above $2,200. Maybe expect a little bit of what I call ‘glass tapping’ required to bust through that level, to get through $2,000 straight to $2,200.

Watch that space carefully.”

Ethereum has experienced some choppy price action to start the week, down 2.77% at time of writing and trading for $1,817.

The InvestAnswers next looks at the Bitfinex futures contracts bought on margin to gauge whether Bitcoin (BTC) might be primed to break out after losing over 50% of its initial 2022 value of $47,292.

“Margined longs hit an all-new, all-time high. Notice that the longs, which is typically a bull indicator, vastly increased in mid-May and currently stand at about nearly a hundred thousand Bitcoin contracts, its highest ever registry.

To understand how severe this movement was, one might compare it to June/July of 2021, the previous all-time high of 50,000 contract longs. It’s doubled in size.”

The analyst concludes by saying he thinks the renewed interest in Bitcoin futures is a bullish indicator.

“These Bitfinex margin longs don’t get it right all the time but they do get it right about 75% of the time, so this a bullish sign that we have bottomed.

I don’t promise we’ve bottomed, but all roads are really pointing to that.”

Bitcoin is currently trying to recover from a big drop on June 6th when it flash-crashed from $31,518 to $29,419.

BTC recaptured the $30,000 level but is down 3.62% over the last 24 hours and is changing hands for $30,615.

https://www.youtube.com/watch?v=YjX9kodxARk

I

Check Price Action

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/johavel/monkographic