The biggest Ethereum (ETH) whales in the world are eyeing up several altcoins within the decentralized finance (DeFi) sector as crypto markets turn green.

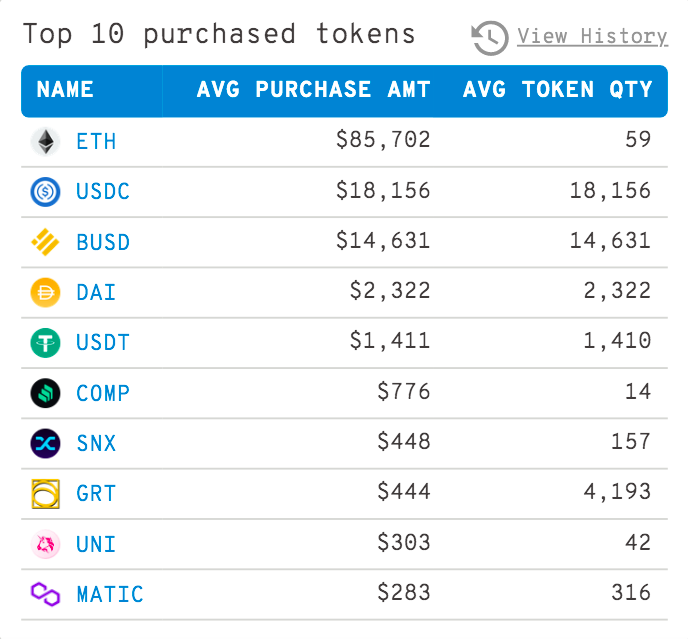

Data from blockchain tracking service WhaleStats show that the top 1,000 Ethereum whales have been accumulating a slew of stablecoins over the past 24 hours, including Circle’s USDC, Binance’s BUSD, Maker’s DAI, and Tether (USDT).

Besides stablecoins and ETH itself, the whales have their sights on lending and borrowing protocol Compound and its governance token COMP. COMP is currently the most purchased altcoin among the top 1,000 Ethereum whales in the past 24 hours, save for ETH and stablecoins.

Right behind COMP is Synthetix (SNX), a protocol that allows for the issuance of synthetic tradable assets on Ethereum, such as commodities or indices. At time of writing, SNX is the 2nd most purchased altcoin among Ethereum’s biggest whales.

After SNX is The Graph (GRT), an indexing protocol and a global API that aims to organize blockchain data. GRT has struggled for the past year and is currently down 80% year on year. However, at time of writing, GRT is the third most purchased altcoin among Ethereum’s top 1,000 whales and is up 18% over the last two weeks.

The fourth altcoin from the DeFi space that ETH whales are scooping up is Uniswap (UNI), the benchmark Ethereum-based decentralized exchange (DEX). According to WhaleStats, Ethereum whales have purchased an average token amount of 42 UNI in the last 24 hours.

Ethereum itself is up 28% in the last seven days, currently trading for just over $1,500.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Kyyybic