The below is an excerpt from a recent edition of the Deep Dive, Bitcoin Magazine‘s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

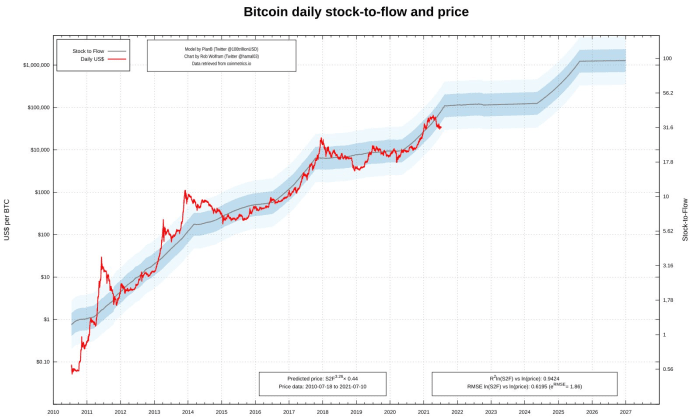

It is close to make or break for the stock-to-flow (S2F) model. First released in March 2019 by the pseudonymous Plan B, the stock-to-flow model attempted to quantify the relationship between the relative scarcity of bitcoin and the price of the asset.

With the model first being released with the price of bitcoin around $3,000, the price of bitcoin impressively oscillated around the model over the past two years, but over the past three months as the price has retraced 50% from April’s highs, the deviation from the model value has widened to historic levels.

At around $25,000, the price would be two standard deviations below the model, which some would argue invalidates the model entirely. While S2F serves as nothing more than an evaluation framework for bitcoin, it can be assumed that a lot of capital inflow occurred on the basis of the S2F model over the last two years.

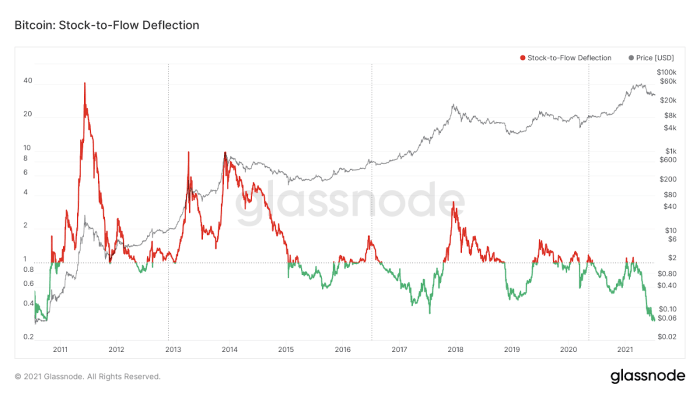

Currently, the S2F deflection multiple is at its lowest point since October 2010, when the price of bitcoin was $0.06, with the deflection multiple currently at 0.31. While there was obviously no S2F model back in 2010, and little to no investor activity on the network, this demonstrates how far the current deviation is from the models historical price point.