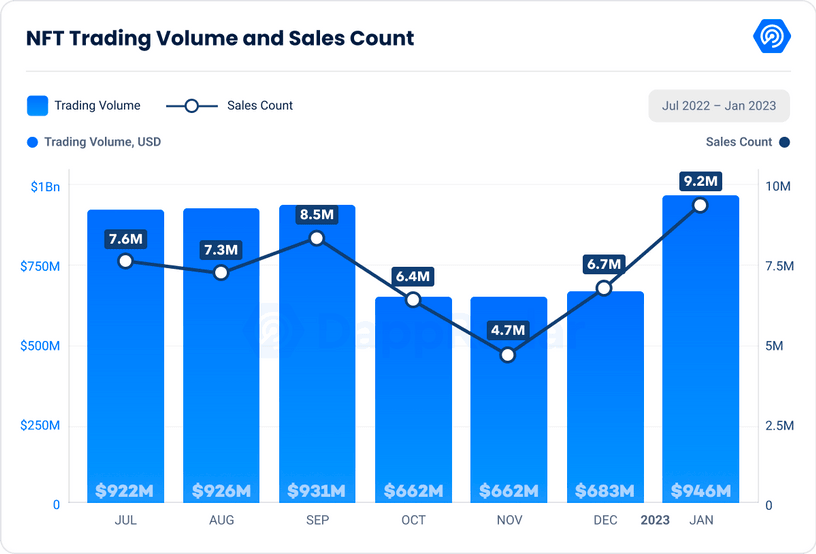

The trading volume of non-fungible tokens (NFTs) skyrocketed in January as the crypto markets mounted a recovery from a months-long bear market.

According to new data from market intelligence platform DappRadar, NFT sales jumped up by 38% on a month-to-month basis to $946 million in January, the highest trading volume recorded since June 2022.

It also finds that NFT sales soared 42% from December 2022.

“The NFT market seems to be recovering with the surge of NFT trading volumes and sales counts in January 2023. The NFT trading volume recorded a 38% increase from the previous month, reaching $946 million. This is the highest trading volume recorded since June 2022. The sales count of NFTs also increased by 42% from the previous month, reaching 9.2 million.”

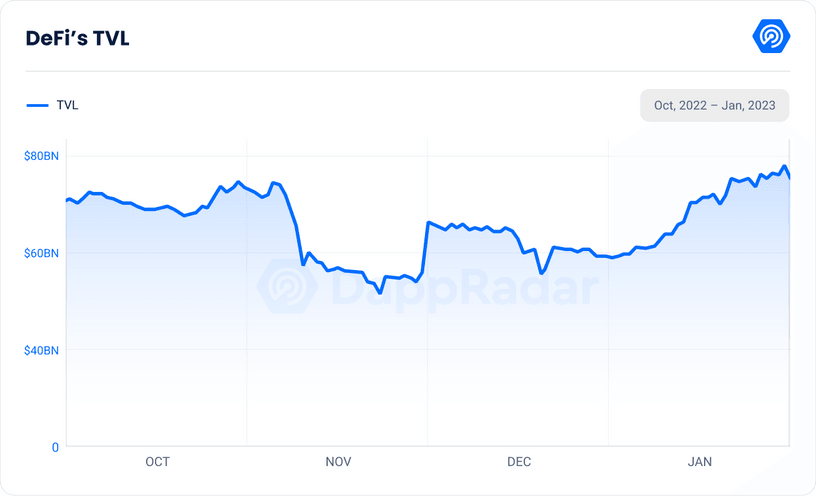

DappRadar also finds that the decentralized finance (DeFi) sector of the industry is also regaining strength as the total value locked (TVL) on DeFi has risen 26.8% from December to January.

“The DeFi market showed signs of recovery in January 2023 as the [TVL] increased by 26.82%, reaching $74.6 billion from the previous month. While this metric has been highly benefited from the rally in crypto prices, other on-chain indicators signal a bull trend.”

The analytics platform also brings up statistics related to liquidity provider Lido Finance and the leading smart contract platform Ethereum (ETH) as further evidence for DeFi recuperating.

According to DappRadar, Lido has surpassed Maker DAO, the creators of stablecoin DAI, to become the largest DeFi protocol due to the rising popularity of liquid staking protocols caused by ETH’s switch to a proof-of-stake consensus mechanism last September.

“Lido Finance has become the largest DeFi protocol by toppling Maker DAO this month. This has been largely driven by the growing popularity of liquid staking derivative (LSD) protocols, with Ether up by a significant 33% over the past 30 days.

Ethereum’s shift to proof-of-stake (PoS) has been a catalyst for the growing interest in LSDs. Lido has been quick to capitalize on this, and its fee revenue has been directly proportional to Ethereum PoS earnings, as it sends received Ether to the staking protocol.”

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney