In a recent podcast episode with Stephan Livera, I made a claim that Bitcoin was the greatest charitable movement in history and that its “donors” were those who actively support Bitcoin on a daily basis through automated buying of Bitcoin, mining (“donors of last resort”), educating and promoting (i.e., “stacking stackers”) and generally making Bitcoin more useful and accessible to others (development and building products). Until a better meme comes along, I will refer to these people as “The DCA Army.”

In this piece, I will not talk about the why or the how of the Bitcoin charity (that will be a much longer piece coming soon), but will focus on the mechanics of how it is entirely possible to create permanent price growth and stability through a coordinated, mass charitable effort.

So, strap yourselves in, suspend disbelief for the next seven minutes, and allow me to show you an extreme example of how the wealthiest, most charitable 2% of the world’s workforce — about 70 million people (less than 1% of the close to eight billion people alive today) — could very realistically create a permanently upwards sloping price floor for bitcoin, and drive the price toward a (relatively) stable price of $1 million per coin within a year or so.

I will first commence with the key definitions and assumptions, before diving into the hypotheticals and running the numbers.

Key Definitions

For me, DCA stands for “daily charitable act,” but it is sometimes confused for “dollar-cost averaging,” well known as an investment strategy. It should be understood that buying bitcoin automatically on a daily or weekly basis, regardless of price or reason, is not an investment, or anything to do with money really — it is simply guaranteeing prompt victory for Bitcoin, so that it’s true charitable impact can be realized.

You may not be interested in the war, but the war is most definitely interested in you! We are, for better or worse, currently engaged in financial warfare against the legacy, proof-of-stake fiat system — “army” is a perfectly appropriate term.

Soldiers in the DCA army are fully on board with Bitcoin’s core philosophical and economic principles, and are simply migrating away from the Legacy system with every paycheck. Words are nice, but even the founding fathers of the United States knew that money would have to be involved:

Just as the ability to speak does not make one intelligent, ownership of bitcoin does not make one a Bitcoiner. It is estimated that there are already over 70 million bitcoin owners, however, if you aren’t buying every day or week, you can consider yourself a speculator.

Consider this; you have accepted Bitcoin for what it is and what it does. Why would you not slowly move all of your capital into bitcoin over time, then? Why would you buy bitcoin once, continue in wage slavery, keep bringing in fiat income and then not migrate a fixed portion of that fiat into the new parallel Bitcoin economy as soon as you receive it? It absolutely boggles the mind. I lose sleep over this question.

“Available for sale” refers to any bitcoin that hasn’t been bought by the DCA army and/or hasn’t been lost. It is assumed that all “non-soldiers” are weak-handed speculators ready to dump bitcoin for fiat gain at any opportunity.

Although bitcoin is a finite currency, its inflation is quite high, and regardless of whether or not miners hold or sell newly-mined coins, the fact that they have been brought into existence needs to either be accounted for through the market cap or through the price.

Using large round numbers to illustrate, let’s say we have 1 million BTC worth $1,000 each. The “market cap” for bitcoin in this case is $1 billion:

- On schedule, another 10,000 bitcoin comes into existence. If the market cap is to remain $1 billion (i.e., no new coins have been purchased), then the price of bitcoin must reduce to $990.10. If the price is to remain at $1,000 (i.e., all new ones are bought), then the market cap must increase to $1.01 billion.

- As long as there is new supply, either market cap or price must adjust accordingly, whether new supply is actually sold or not.

Key Assumptions

All bitcoin bought by the DCA Army will reside on an exchange for a maximum of three months after initial purchase, and will be held for a minimum five-year period from date of purchase (minimal rehypothecation risk). Due to the popularity of auto DCA platforms that also enable Lightning withdrawals, such as Bitaroo (Australia), Bottlepay (U.K./EU), GetFlitz (EU) and Bipa (Brazil), all should be able to withdraw in a cheap and timely fashion. Other providers will adopt the Lightning Network or go bankrupt from competition. Sustained action from the Army for five years will mean the circular economy has been bootstrapped, and that the collateralized lending industry has flourished. It is likely that all coins bought by the Army will never see the fiat world again.

It is assumed that the DCA army is “religious,” and therefore tithes a tenth of its gross income to bitcoin, not dissimilar to the billions of the world’s religious adherents. We will assume that the typical soldier matches the profile of the average Organization for Economic Cooperation and Development (OECD) wage earner of $49,165 per year, or $13.47 per day. Let’s just call it $10 per day for individuals, and $700 million per day for the entire army.

Coins exist on exchange for one reason, and one reason only — leverage gambling or simply selling. It is assumed that all two million coins on the top-12 exchanges are available for immediate sale, and can mostly be bought by stealth with no slippage (see next assumption).

It is assumed that, due to the size of the 70 million-strong army, that the time distribution of its automated purchases would average out over the day, so, $700 million / 86,400 seconds = about $8,100 per second.

Corporations and governments move way too slowly and will not be able to handle the extreme pace of change when an army is at the gates, relentlessly bringing $700 million per day, and increasing. Eventually, 10% of workers will save 10% of their wages, and you’ll have $3.3 billion coming in daily. When you freak out about the numbers I’ve run for $700 million per day later in this piece, you can let your imagination run wild. Then imagine 20% of workers saving 10%.

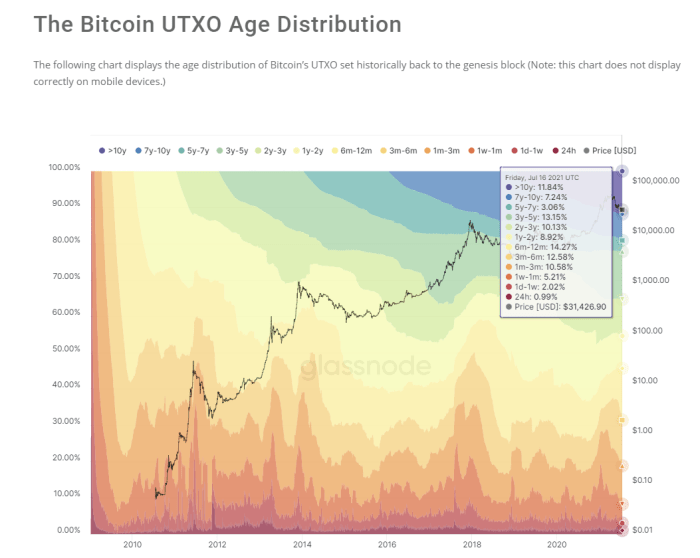

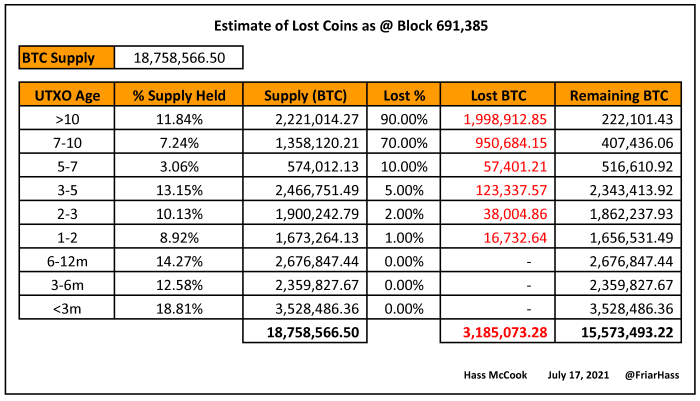

The current bitcoin supply at time of writing (block 691,385) is around 18.76 million BTC. I will assume that 90% of coins unmoved for over a decade are lost, and 70% of those unmoved between seven and 10 years are lost. It is unreasonable to assume that so few people with such immense wealth would not take advantage of migrating from a legacy wallet to a SegWit and/or multisignature wallet, or cash in on what would have also been immense wealth in the Bitcoin forks. I’ve made some other assumptions on loss in the table below, and take a guess that there are just over three million coins lost, with about 15.6 million up for grabs.

It is assumed that the majority of exchange activity is illegitimate, and most volume comes from wash trading, leverage and manipulation. The DCA army tends to buy bitcoin at spot, unleveraged, from smaller, Bitcoin-only vendors. The only critical element to watch is the absorption of daily inflation.

Running The Numbers

My assertion is that, with a well-funded DCA army, in long term equilibrium (i.e., when the entire available balance of bitcoin has been bought and self-custodied by the army), then the price will tend to $700 million per 900 coins per day, or, $777,777.77 (assuming no additional demand). Based on this logic, you can rationalize that today’s “stable” price of $30,000 as a mere 2.7 million people migrating $10 worth per day, or 0.085% of the global workforce.

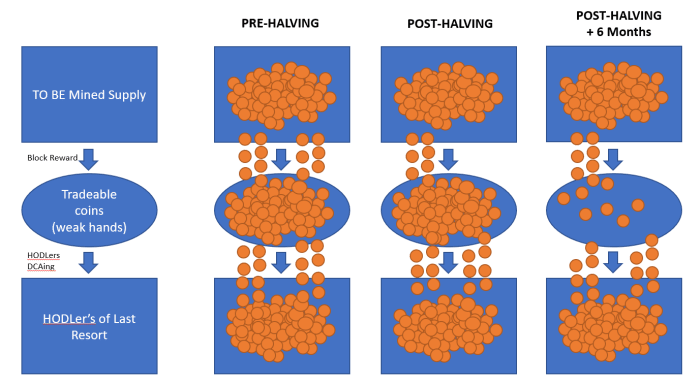

After the next halving in 2024, this will double to $1,555,555.55. This isn’t exactly a miracle or anything — it’s very basic supply and demand as illustrated very well by @Croesus in his piece, and in the diagram below:

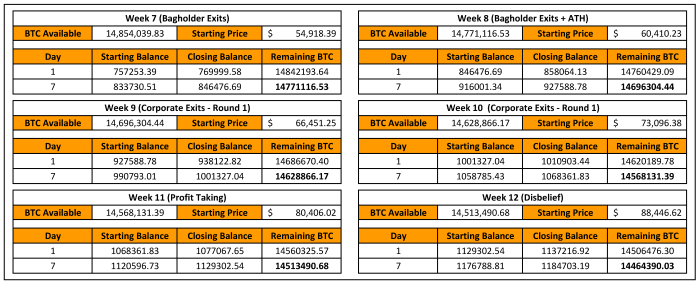

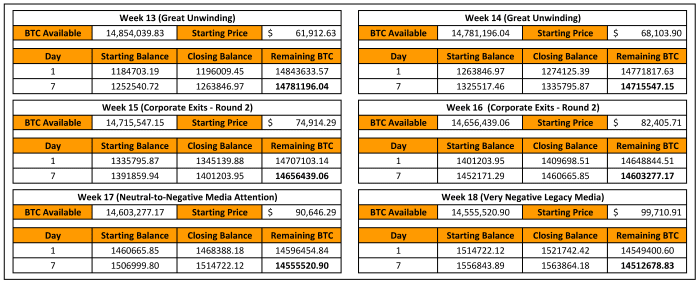

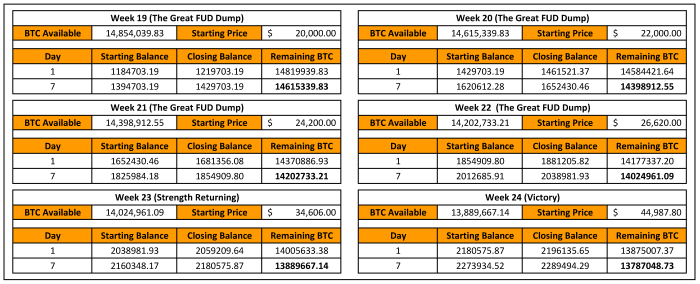

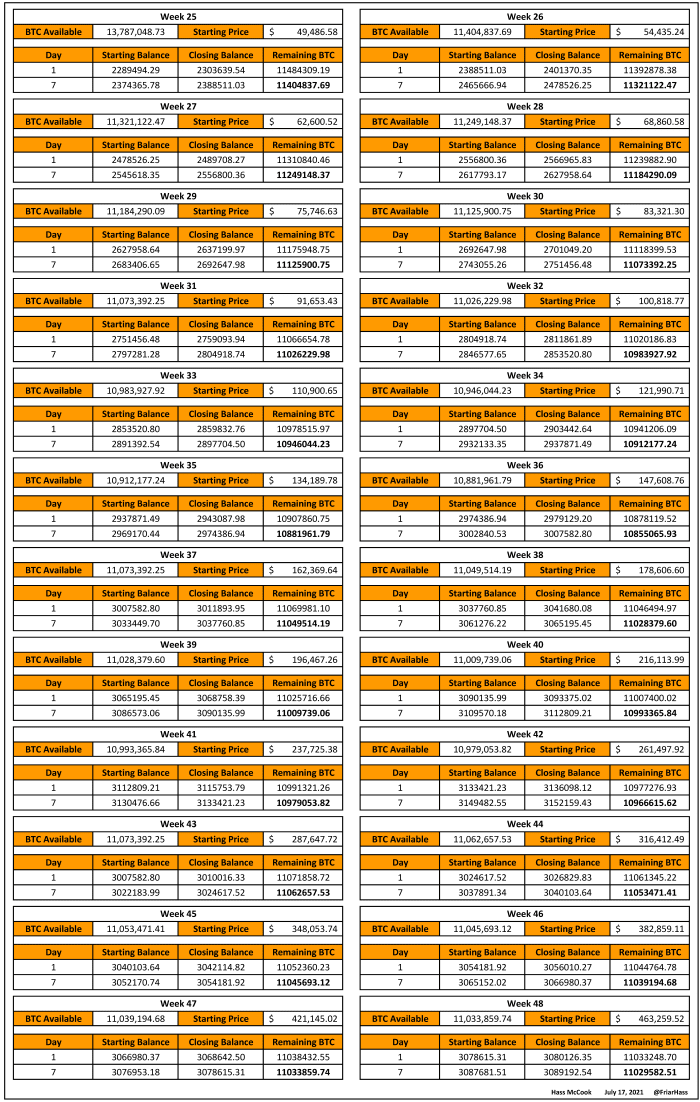

Instead of illustrating it with orange circles, I’ll give a hypothetical scenario of what might possibly happen if Bitcoin were to suddenly be hit with $700 million per day, relentlessly, over a one year period. Glorified fan fiction, essentially. It will be split into two 24-week phases; phase one is the “mobilization and victory phase,” and phase two is the “normalization” phase. The calculation figures show price assumptions, as well as the total balance acquired by the DCA army.

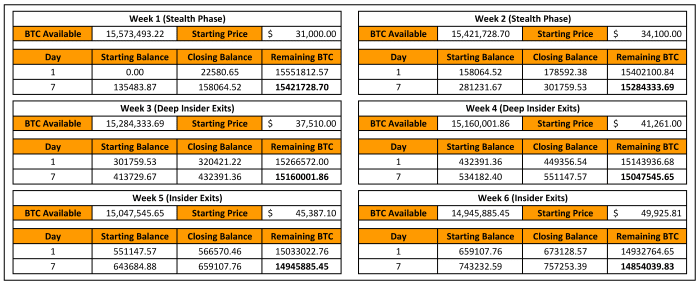

The first two weeks is the stealth phase of the operation — $1.4 billion to play with. Due to incessant small spot orders, it is very difficult for the market to react and several sellers and shorts are caught off guard. Price would increase 10% per week over this fortnight, and the army will have stacked over 300,000 BTC, including all 12,600 BTC mined in this period.

With price recovering, deep insiders and exit scammers in the Bitcoin and altcoin worlds will see weeks three and four as potentially the last opportunities to get out before a prolonged bear market, so despite another $1.4 billion of buying power, price still only increases 10% week on week. The army now has over 550,000 BTC (up 250,000 BTC from last fortnight), with about 100,000 BTC due for withdrawal to self custody.

Weeks five and six see the continuation of the “shitcoin waterfall,” but now at the lower tiers, and therefore continued heavy selling. Despite that, price is still rising only 10% week on week. This fortnight, all 12,600 mined BTC were gobbled up, alongside another 200,000 coins for a total stash of over 750,000 BTC, of which 250,000 is now in self custody.

The next two weeks see traumatized at-time-high buyers and other bagholders selling violently at their breakeven price. This is followed by another two weeks of selling by corporations citing “environmental concerns,” but truly because they’ve secured their five-times fiat return, what most of them came here for, and now it’s time to get out. Another two weeks of profit taking by people who simply can’t believe that price has been consistently rising 10% per week follows that.

The end of week 12 sees the DCA army in offline custody of over 750,000 BTC, with an additional 400,000 BTC awaiting withdrawal from exchanges over the coming month.

Disaster. With so much spot buying going on, and so many bitcoin being withdrawn, the implosion of one of the world’s largest, highest-leverage, least-regulated shitcoin casinos was all but guaranteed in unlucky week 13. The “trading and crypto community” has had billions in wealth evaporate, with the negative media over the following fortnight dropping the price by over 30%, and driving another some 220,000 BTC into the hands of the army.

More corporations exit in weeks 15 and 16, yet price just keeps going up by 10% per week and they are now out of a position. They hate Bitcoin now. The shorts are placed, and the financial-media complex starts to get warmed up, but it will be at least another two weeks before it has proper momentum. Week 18 ends with the Army in custody of 1.1 million BTC, with another 450,000 BTC waiting for withdrawal. Importantly, the week ended with Elon Musk having his final meltdown, and Tesla dumping its entire position on the open market.

With the price now back to $20,000 thanks to Musk and friends dumping mercilessly for a period of one month, The DCA army picked up an additional 800,000 BTC in weeks 19 to 22. With all speculative, weak-handed coins almost completely absorbed, the price bounces back very strongly, gaining 30% week on week in weeks 23 and 24. The old enemies of Bitcoin had now been dispatched, with all of their capital burnt on leveraged shorts. The new enemies are still figuring out how to manage their wave seven lockdowns. They will be distracted for a lot longer than it will take for bitcoin to reach $1 million. The DCA army now holds two million bitcoin, with 200,000 BTC pending withdrawal.

Over the next 24 weeks, nothing spectacular happens – hence the name “normalization.” Price simply goes up 10% per week, with the Army patiently stacking tens of thousands of coins per week — short sellers, institutions and general onlookers in disbelief. Even in week 48, when the 10% week-on-week growth has led to a price of $463,000, the DCA army is still absorbing the 900 coin daily supply, plus an extra 600 coins. Only nine more weeks of this price action would get the price to $1 million, but alas, the DCA army would only be able to provide a floor at $777,777.77 as explained in the introduction of the previous section. The army is in custody of three million coins at this point. You’d think that, after such a stellar year, and with so many tens of millions of people in the army, you might even say attracting new recruits would be easier than ever!

Conclusion

While some of the above may happen, I will guarantee that none of it will happen at the pace or in the order described above. The above is merely illustrating that, with enough time, the entire available supply will eventually go into the hands of the religious zealot auto DCA army based on pure attrition alone. The above hypothetical left only 11 million coins available for sale at the end of only 48 weeks, and obviously, not all coins are available at all prices. The result is that in long-term equilibrium, the fiat-denominated price of bitcoin will be the amount of fiat brought to market daily by the army, divided by the miners’ subsidy (mined coins plus fees). Eventually though, fiat will come into bitcoin in such astronomical quantities, that fiat will cease to exist.

Have you enlisted in the DCA army yet? See this tweet for all of the places in the world where you can arm yourself with the best defensive weapon ever conceived, Bitcoin!

This is a guest post by Hass McCook. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.