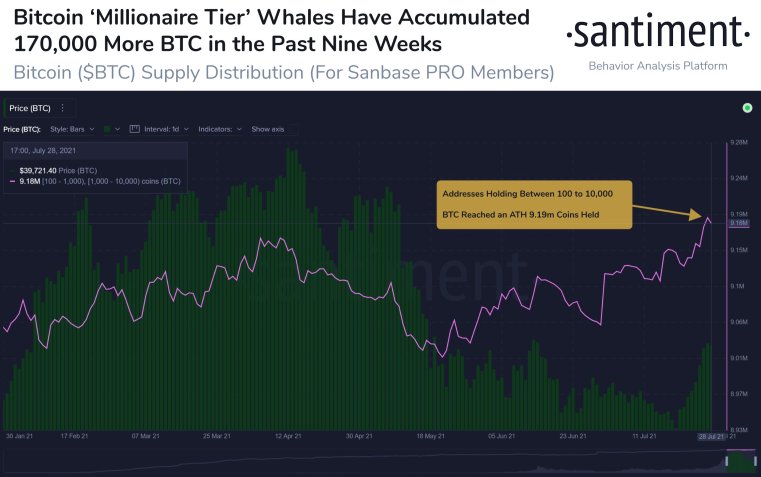

Crytpo analytics firm Santiment says Bitcoin (BTC) whales are rapidly accumulating more of the flagship cryptocurrency.

Santiment says large Bitcoin holders, or those who hold 100 to 10,000 coins, have added 130,000 BTC to their wallets in the past four weeks.

“Bitcoin’s whales have been staying busy, and addresses holding between 100 and 10,000 BTC just reached a combined all-time high 9.19 million coins held.

They have added 170,000 more BTC since May 22nd, and a staggering 130,000 BTC in the past 4 weeks alone.”

The firm notes that Bitcoin’s social and trading volumes have recently skyrocketed and that on-chain address activity has rallied.

“How did Bitcoin recover to $40,000 out of the blue? 3 of our key leading metrics all skyrocketed! BTC’s social and trading volumes both hit a 5-week, and address activity hit a 3-week high.

When this trio jumps in unison, good things typically happen.”

Santiment is also tracking key events that might have instigated Bitcoin’s latest rally.

“Several major events impacted Bitcoin’s price this week. The rally started after a report that Amazon intends to accept BTC payments by year end.

Then, Tether news caused volatility, followed by Amazon publicly denying crypto payment intentions.”

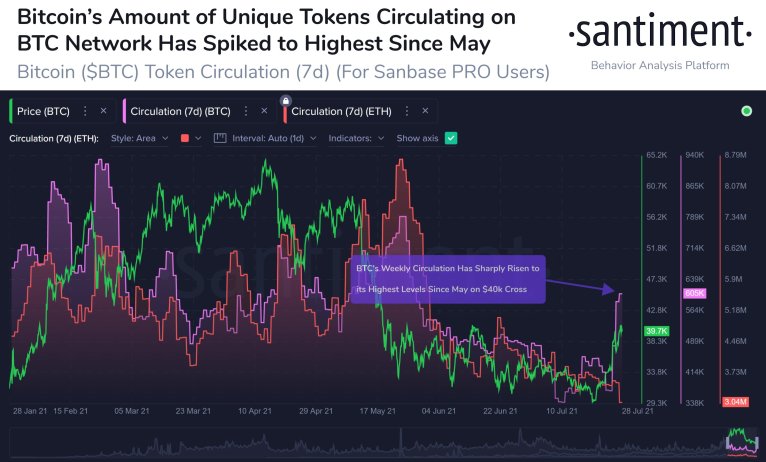

The firm also says that the quantity of unique BTC in circulation is the highest it’s been since May.

“Bitcoin’s amount of unique tokens being circulated has jumped to levels not seen since May. This is a big development considering BTC’s stagnancy leading up to this week.

This is one of our top leading price indicators that our community focuses on.”

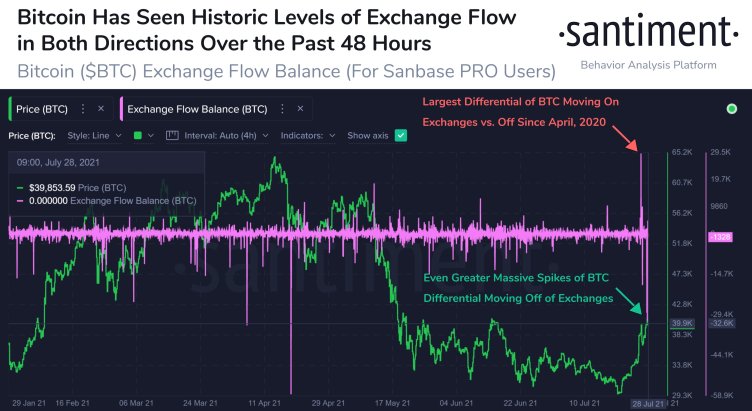

Santiment is closely watching the number of Bitcoin heading to and from crypto exchanges, which the firm says has been fluctuating. This week a large spike occurred in the ratio between Bitcoin inflows and outflows, according to Santiment.

“Bitcoin is seeing wild patterns of coins moving on and off exchanges currently. There was a +29,288 BTC inflow vs. outflow differential in a single hour, which was the highest in 15 months.

Now, we’re seeing even larger exchange outflow differentials.”

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/bekirevren/Tithi Luadthong