The below is from a recent edition of the Deep Dive, Bitcoin Magazine‘s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

On August 9, one of the best buy indicators in bitcoin flashed a buy signal:

Hash Ribbons.

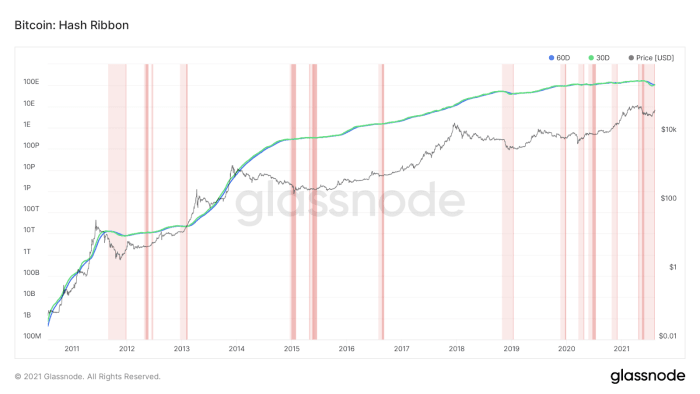

The Hash Ribbons Indicator created by Charles Edwards uses the thirty- and sixty-day moving averages of bitcoin hash rate to determine when miner capitulation has occurred, and uses this to estimate local bitcoin bottoms.

Below is the history of the bitcoin price and every time that the hash ribbons indicator has flashed:

Miner Capitulation

Hash ribbons serve as such an effective and historically accurate buy indicator for bitcoin because it uses the changes in bitcoin hash rate to measure miner capitulation in the bitcoin market.

During periods where mining operations are turning off their rigs, it shows that it is uneconomical to mine. Hash rate declines, blocks are mined slower than the 10-minute block target, and eventually difficulty will adjust downwards to encourage these miners to plug back in.

This is typically the process in which miners turn off their machines in large numbers, which is subsequently followed by the hash ribbon indicator signaling capitulation, followed by an eventual buy signal.

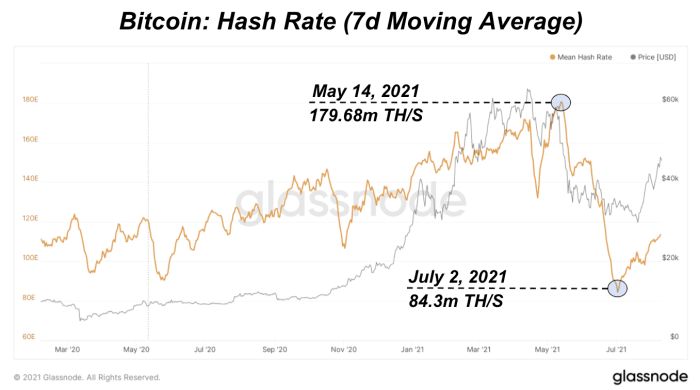

However, the cause for the massive decrease in hash rate wasn’t entirely caused by increased competitiveness in the mining industry driving profits down, but rather because of political decree in what ended up being the largest nation-state attack on bitcoin ever, from the arms of the Chinese Communist Party.

Over the course of six weeks the bitcoin mean hash rate declined by 53%, and although the capitalution event was more artificial, the decline in hash rate still had a very meaningful impact on miner revenues for those who still remained plugged in.

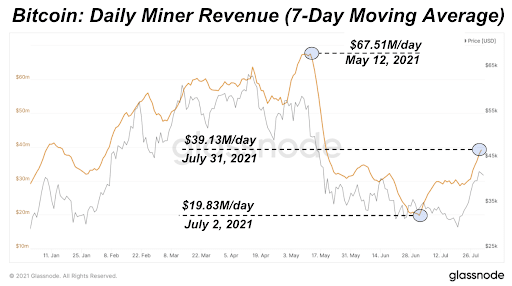

As seen in the July monthly report, daily revenue for bitcoin miners declined from a high of $67.5 million per day in May to a low of $19.8 million per day in early July.

Not only were the remaining miners squeezed while difficulty was lagging in the midst of four straight downwards adjustments, but mining operations in China who were abruptly faced with moving their entire operations out of the country most definitely had to liquidate reserves, of which a majority can be assumed to have been stored in bitcoin (as is the case with all miners, who aim to hodl as much bitcoin as possible).