Watch This Episode On YouTube

Listen To This Episode:

In this episode of Bitcoin Magazine’s “Fed Watch” podcast, hosts Christian Keroles and myself, Ansel Lindner, had a conversation about current Federal Reserve policy, headlines in the financial press and rumors. Then, we touched on PBOC and Evergrande Group problems in China. Lastly, the fun started when we talked about the proposed U.S. infrastructure bill and offered some hot takes about what to take away from it. It’s one of our longest episodes and a must listen for contrarian Bitcoiner opinions.

Calls For The Federal Reserve To Taper, Reverse Repo And Jerome Powell’s Future

Starting with the Fed, calls for taper are getting louder. In the YouTube version of the podcast, we show the articles and read through some quotes.

From Reuters, “Atlanta Federal Reserve Bank President Raphael Bostic said he is eyeing the fourth quarter for the start of a bond-purchase taper.”

It is interesting that calls for tapering are converging on Q4, because that is also when the Fed’s standing repo facility is starting. Creative tapering plans might be in the works to minimize any taper tantrum this time around. We went into some of the mechanics behind this theory, but there is room for more work in the future. Bottom line for tapering: it is looking likely it will start in Q4 this year.

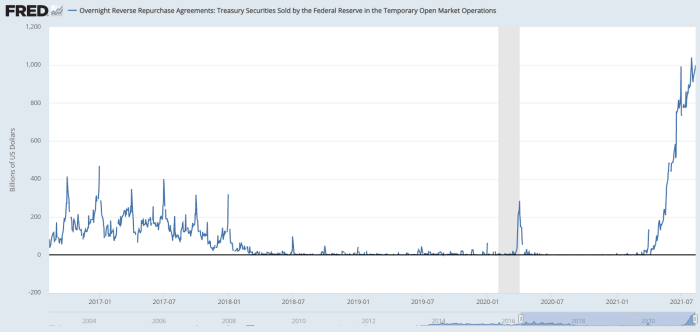

Next, we spent some time discussing the state of the reverse repo facility and the coming standing repo facility. Two interesting aspects of the standing repo facility: It is starting at 25 basis points and it will be open to international foreign monetary authorities. These two factors can give us clues into what the Fed is planning.

The last part of Fed news we covered was the possibility that Jerome Powell might not get a second term as Fed chairman. He is losing some popularity among progressives like Senetor Elizabeth Warren, although he does still have the support of the administration for the time being. His main competition is Lael Brainard. She differs from Powell in being for slightly more regulation and, important for us here, she seems to be backing central bank digital currencies (CBDCs).

In a recent speech reported by PYMNTS.com, she said, “The dollar is very dominant in international payments, and if you have the other major jurisdictions in the world with a digital currency, a CBDC offering, and the U.S. doesn’t have one, I just, I can’t wrap my head around that. That just doesn’t sound like a sustainable future to me.”

There are two sides forming in the Fed about CBDCs. Those who unknowingly think there is some benefit to a CBDC, and those who have done their homework and are skeptical. In the latter category, we can put Powell and Waller. Waller recently gave comments to the American Enterprise Institute, saying, “After careful consideration, I am not convinced, as of yet, that a CBDC would solve any existing problem that is not being addressed more promptly and efficiently by other initiatives.”

The Latest Macro Factors Coming From China

On to China. The Chinese Communist Party is starting to face some major economic issues. In the podcast we outlined several, like the worst floods in decades, raging delta infections, slowing economic activity and the accelerating default of the country’s largest real estate developer, Evergrande. This is a great Twitter thread on the Evergrande situation by @TheLastBearSta1. As long-time listeners will know, we are bearish on the CCP in the coming years, and right now it is looking particularly difficult for them.

Bitcoin And The Proposed U.S. Infrastructure Bill

Finally, we got to the U.S. Senate’s proposed infrastructure bill and the drama around the Bitcoin provision argued about over the last week. We have some very hot takes on the process from a Bitcoiner perspective. We suspect many Bitcoiners are like us.

In a puzzling turn of events, the White House and U.S. Treasury were the ones fighting the Bitcoin perspective, while the supposed Bitcoin advocates were desperately trying to save altcoins.

We don’t agree with the government picking winners and losers, or interfering in the market, but that is why Bitcoin is decentralized. Government interference cannot be mitigated by direct challenge. Bitcoiners should not feel obligated to come to the rescue of altcoins, fraudulent scams, in the name of “innovation.” This innovation was decentralized for the very reason of being censorship resistant in the first place. If the altcoins must rely on advocacy instead of decentralization, their innovation is worthless.

We also quickly mentioned the theory that the U.S. government is closer to recognizing bitcoin than previously thought. This thread on Twitter by @_log_scale_ points to many connections with MIT, the Fed and the White House. It also fits with my observation that the only central bank free to act in the great game of monetary assets is the Fed due to the dollar’s global reserve currency position. It’s a theory at least worth entertaining.

All of that and much more is found in this jam-packed episode. It’s a must-listen Bitcoin podcast.