Last Week In Bitcoin is a series discussing the events of the previous week that occurred in the Bitcoin industry, covering all the important news and analysis.

Summary of the Week

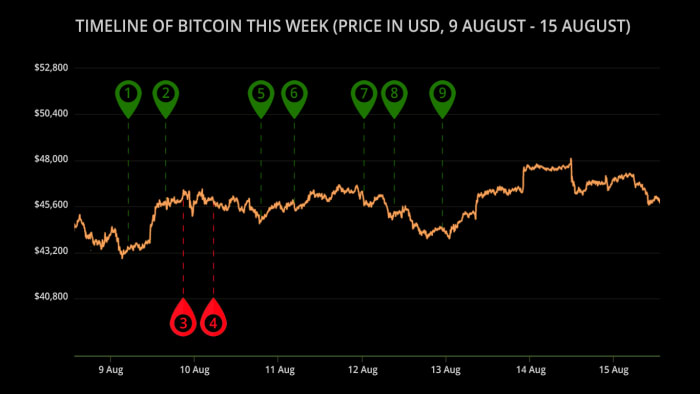

After briefly dipping below $43,000 on Monday, bitcoin has remained relatively steady around $46,000 during the week, briefly surpassing $48,000 over the weekend. It may be too early to call, but it appears as if it’s time to get overly bullish for the short term. Over the past week, the U.S. Senate passed their controversial U.S. infrastructure bill, Bloomberg and Kraken’s CEOs seem to agree bitcoin is heading to $100,000 this year, and the president of Argentina says the country is open to adopting bitcoin as legal tender. Here’s last week in bitcoin:

Timeline Of Bitcoin This Week

Bullish News That Proves Bitcoin Is Heading Upwards

❶ On Monday, bitcoin mining firm Argo announced record profits for the second quarter of 2021. They went on to state they own 1,100 BTC and have no intention of selling their holdings. This bullish sentiment appears to be shared across the market as miners continue to hold most of the bitcoin they mine.

❷ On Tuesday, Reddit darling AMC Theatres announced they would soon start accepting bitcoin payments for movie tickets and concessions. Whether moviegoers want to pay with bitcoin remains to be seen; however the company currently sits on a cash reserves pile worth $2 billion, which would be able to buy nearly 44,000 BTC, a larger stockpile than Tesla’s.

❺ On Wednesday, a Bloomberg Intelligence report stated that bitcoin is still on track to surpass $100,000 later in this year. If that’s not bullish enough, Kraken’s CEO, Jesse Powell, shared a similar opinion, suggesting bitcoin may far exceed $100,000 in the months ahead. As mentioned before, I share this same outlook and bitcoin’s performance over the last two weeks seems to indicate that we’re ready for liftoff.

❻ Also on Wednesday, digital car insurance firm, Metromile, announced that they purchased $1 million in bitcoin with plans to purchase an additional $10 million. They also stated that they would enable bitcoin payments on the platform soon.

❼ On Thursday, Choice, an $18 billion investment firm, launched a new investment option through their app that will allow users to invest in bitcoin tax-free. Users will be able to hold custody of their bitcoin or have Fidelity act as its custodian. The platform, launched last year, already manages over 125,000 retirement accounts.

❽ Also on Thursday, one of Mexico’s richest men, Riccardo Salinas Pliego added laser eyes to his Twitter profile. The business magnate, worth over $15 billion, later tweeted “I think #bitcoin has a great future and it will change the world…. we will see.”

❾ Finally, on Friday, Alberto Fernandez, the president of Argentina, was asked if the country would follow in El Salvador’s footsteps in an interview with local broadcaster, Filo News. He responded by saying “I don’t want to go too far out on a limb […] but there is no reason to say no.” This may end up being very bullish. The country has long struggled economically and embracing bitcoin as legal tender could bring relief to its millions of citizens.

Bearish News, Although Bitcoin’s Price Doesn’t Care

❸ On Tuesday, Black Rock Petroleum announced plans to install up to 1 million bitcoin miners in Canada’s Alberta province. Although that may seem bullish, this is a company that still utilizes fossil fuels and it may lead to a long term negative sentiment regarding bitcoin’s energy use, a hot topic as of late. A million mining rigs is bullish; more carbon emissions associated with bitcoin, not so much.

❹ Also on Tuesday, the U.S. Senate voted and pushed through the controversial $1 trillion US infrastructure bill, choosing not to allow any of the proposed amendments to the “crypto clause.” All hope is not lost however as it still has to go through Congress and even if it does pass without amendments there, it’s only likely to be implemented sometime in 2023.

The Verdict: Bullish Growth Ahead

Bitcoin has shown steady growth over the last three weeks. It’s already up over 50% since dipping below $30,000 on July 21st and there appear to be no signs of stopping anytime soon. In just a few short weeks El Salvador will start its nationwide rollout of bitcoin as legal tender in the country — the first phase of which will likely push more countries to adopt bitcoin as legal tender and a hedge against deflation.

Furthermore, more and more miners are opting to HODL their newly minted coins instead of selling them, indicating that they agree with the bullish sentiment that many investors and analysts are pushing out. More and more individuals and institutions agree that bitcoin may very well surpass $100,000 in the coming months, something I’ve blabbered on about incessantly as well.

The amount of companies investing in bitcoin is growing by the week. The amount of companies accepting bitcoin payments is growing by the week. I don’t believe it would be too far-fetched to say that soon the amount of countries accepting bitcoin will grow by the week. As inflation rises, fiat currencies like the dollar continue to lose their value, but bitcoin doesn’t.

Bitcoin adoption is growing by the week and if you’re not stacking while it’s a five-figure asset, you’re going to regret it when it’s a six, or even seven-figure asset. So, stack up, strap up and get ready for a wild ride in the months ahead…

This is a guest post by Dion Guillaume. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.