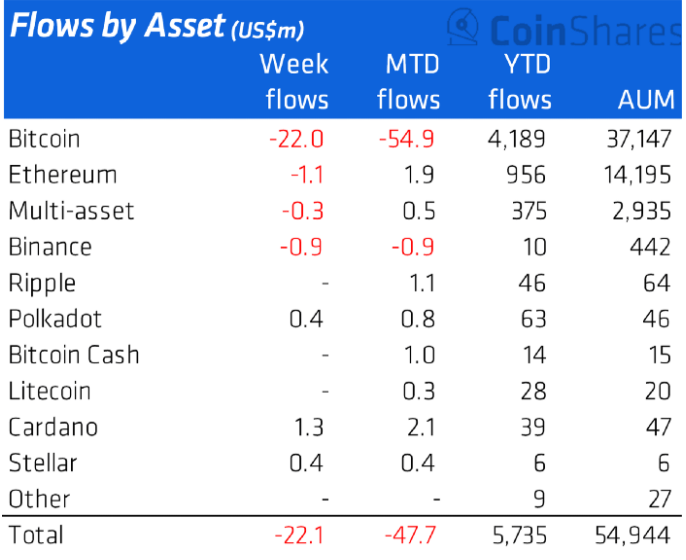

Crypto asset management firm CoinShares says that institutional investors are taking an interest in Cardano (ADA) as the broader crypto markets show signs of recovery.

In a new weekly report, CoinShares says that the Ethereum competitor registered inflows worth $1.3 million in the past week. Year-to-date, Cardano has witnessed institutional investments amounting to $28 million.

Polkadot (DOT) and Stellar (XLM) also saw minor inflows last week. Both the interoperable blockchain and the multi-currency transaction network printed inflows of less than $1 million.

As for Bitcoin, CoinShares notes that the leading cryptocurrency remains the “main release valve for investors” after BTC recorded outflows of $22 million in the second week of August.

Looking at Ethereum, CoinShares says the leading smart contract platform saw minor outflows of $1.1 million in the past week.

CoinShares highlights one reason driving the weak institutional investments across all digital asset products.

“Despite the continued negative sentiment, it comes at a time of low investor participation likely due to seasonal effects as seen in other asset classes. Volumes are now at $3.1 billion per week in investment products compared to $7 billion per week in May.”

However, the crypto asset management firm notes that the recent rally in the crypto markets has contributed to a surge in the value of total assets under management (AUM) in all investment products.

“In contrast, sentiment looks to be recovering in the overall crypto market judging by recent price rises. This has pushed total

investment product AuM to $55 billion, rising 10% week-on-week.”

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Sergii Molchenko