The below is from a recent edition of the Deep Dive, Bitcoin Magazine‘s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

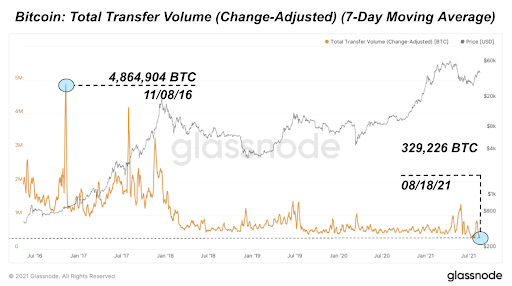

Bitcoin on-chain volume (change adjusted) has touched a five-year low in bitcoin terms, currently at 329,226 BTC per day over the last seven days. Low on-chain volume has been a short term bearish indicator, as it demonstrates low demand to use the network.

There are a few reasons for this development, one of which is the explosive growth of the Lighting Network, coupled with the secular trend over the last decade of an increasing BTC/USD exchange rate. The same chart in U.S. dollar terms looks quite different.

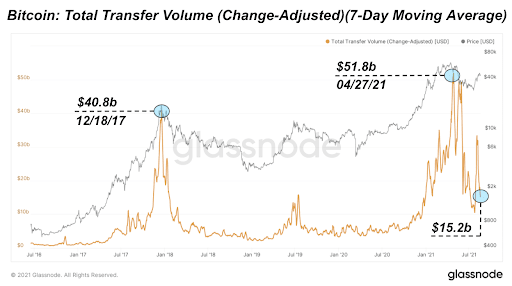

Looking at the change-adjusted volume transfer of the network in dollar terms shows just how effectively bitcoin is scaling as a monetary network. Currently, the total change-adjusted transfer volume (seven-day moving average) on the Bitcoin network is $15.2 billion, off from a high of over $50 billion this April, in part because of the rebounding hash rate and faster-than-average block times.

Similarly, fees as a percentage of bitcoin mining revenue has fallen sharply, and is currently at 1.46%. With the block subsidy trending to zero over time as supply issuance is programmatically reduced in quadrennial fashion over the next 120 years, fees will eventually make up 100% of miner revenue. However, currently, with miner profit margins extremely large, this is not a worry and competition is extremely strong as miners are pulling in near-record revenue across 2021 (in dollar terms).