The below is from a recent edition of the Deep Dive, Bitcoin Magazine‘s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

Bitcoin looks poised for its next leg up.

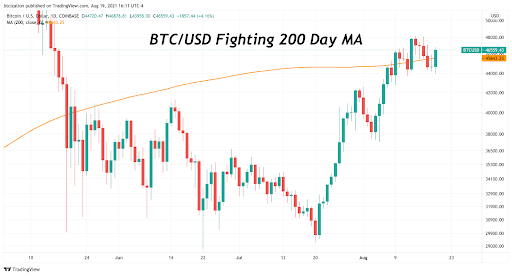

An ongoing battle between the bulls and bears is currently underway for the 200-day moving average of the bitcoin price. The 200-day moving average is often viewed by traders and market analysts alike as a key indicator for the momentum of a given asset, thus the recent resistance and chop above and below the indicator is quite telling.

However, bears beware, as one of the most significant bitcoin market trends over the past two years is foreshadowing some extreme strength in the price of bitcoin over the coming weeks/months.

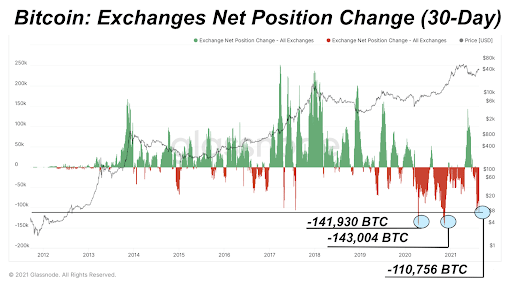

The bitcoin exchange balance, often covered in The Daily Dive, continues the dominant trend it has been following since the start of 2020 — massive accumulation and withdrawal of coins from exchanges.

In fact, there have only been two other times that more bitcoin have been withdrawn from exchanges on a net basis in the history of Bitcoin. The first was directly following the COVID-19-induced derivatives blowup, which tanked global markets and crashed the price of bitcoin by nearly 50% in a single day.

The second occasion was in November of last year, following the announcement of an adoption of a corporate bitcoin standard by business intelligence firm MicroStrategy, as well as a $50 million purchase by fintech company Square.

When looking at the percentage of the circulating bitcoin supply not on exchanges and the price of bitcoin, there has been nearly a one-to-one correlation over the last 18 months, with the occasional lag in price.

We saw this occur in the summer of 2020 as bitcoin was being withdrawn from exchanges on a net basis at a feverish pace while price remained dormant until November, when bitcoin began its violent uptrend.