A powerful on-chain signal suggests that Bitcoin bulls may have reason to be confident, according to blockchain analytics firm Glassnode.

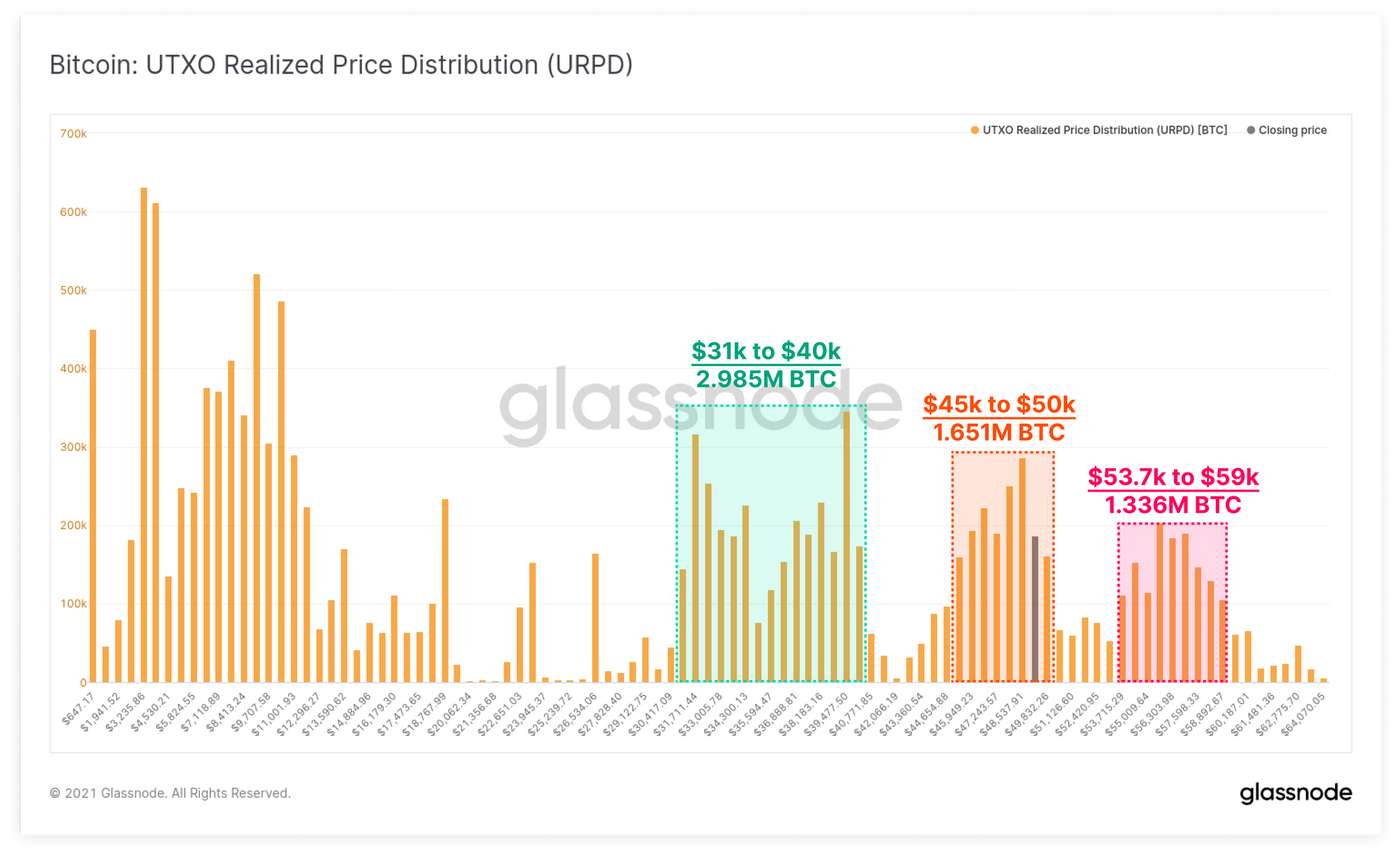

In their weekly report, Glassnode identifies three price ranges in Bitcoin where large quantities of BTC were last transacted.

According to the firm, the first range is the $31,000 to $40,000 area, which they call a potential “price floor.” The second range is between $45,000 and $50,000, in which 1.65 million Bitcoin have a cost basis. The third range is $53,000 to $59,000, where Glassnode notes Bitcoin’s trillion-dollar asset status lies.

“The chart below shows the price bands where the current BTC coin supply was last transacted. Since breaching last cycle’s $20k ATH [all-time high], three distinct on-chain volume bands have formed:”

Glassnode says these three volume bands may act as the solid support that BTC bulls need for any future upward price action.

“On net, this indicates that a fairly strong set of high conviction investors remain in the market and is a powerful signal for the bulls.”

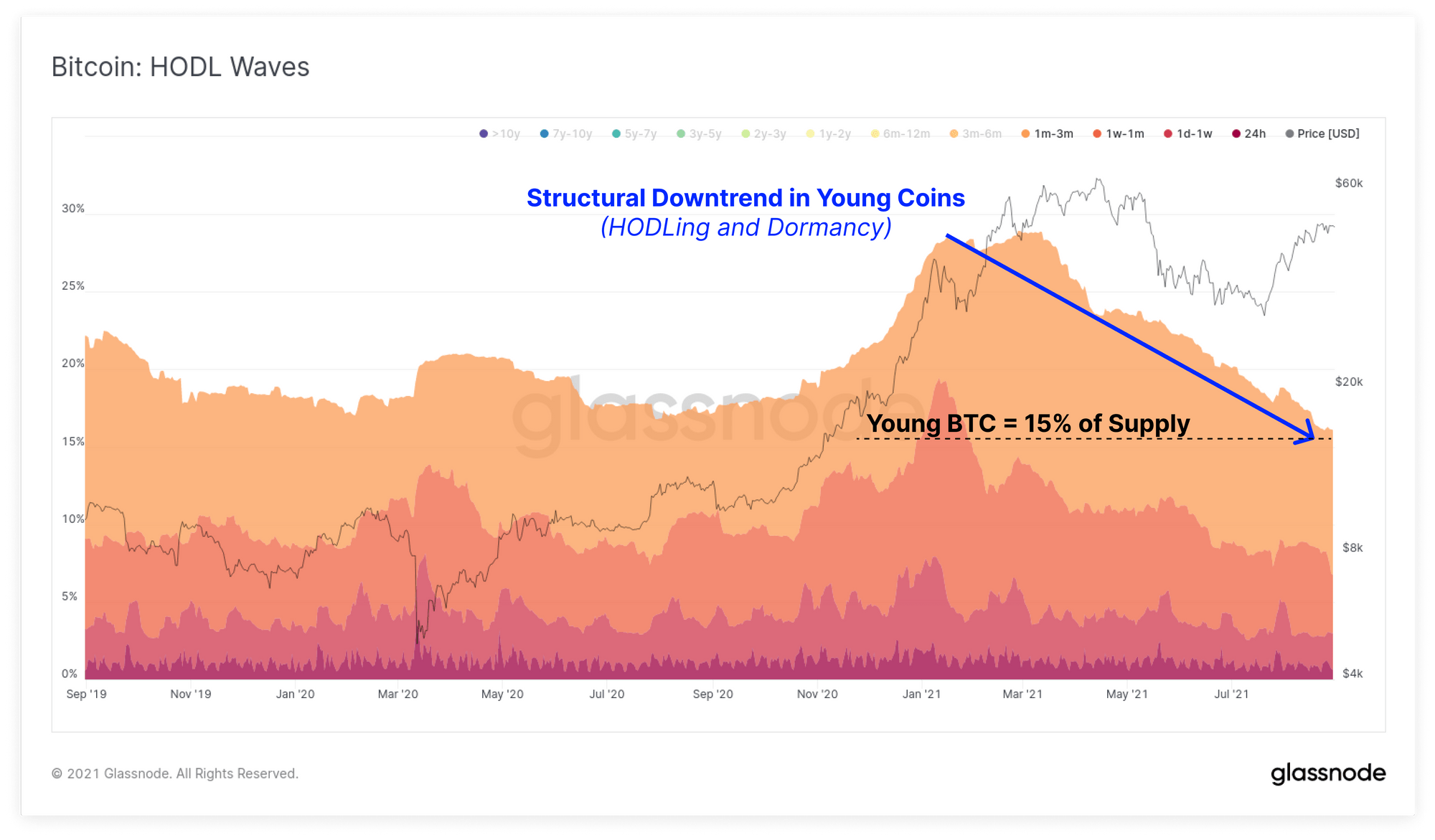

The analytics firm says that while not all on-chain data is flashing clear bullishness, supply dynamics such as coin maturity – the length of time coins are held onto – are historically sitting in a healthy spot.

“On the other hand, supply dynamics, particularly looking at coin maturity, provides a fairly robust signal in either direction. Whilst observations of accumulation and HODLing is usually a long range indicator (i.e. takes time to play out), the current market trend is historically strong for the bulls…

A decline in the young coin HODL waves indicates the market is preferring to HODL and not spend. Young BTC now represent only 15%% of the coin supply and a very strong downtrend is in play.”

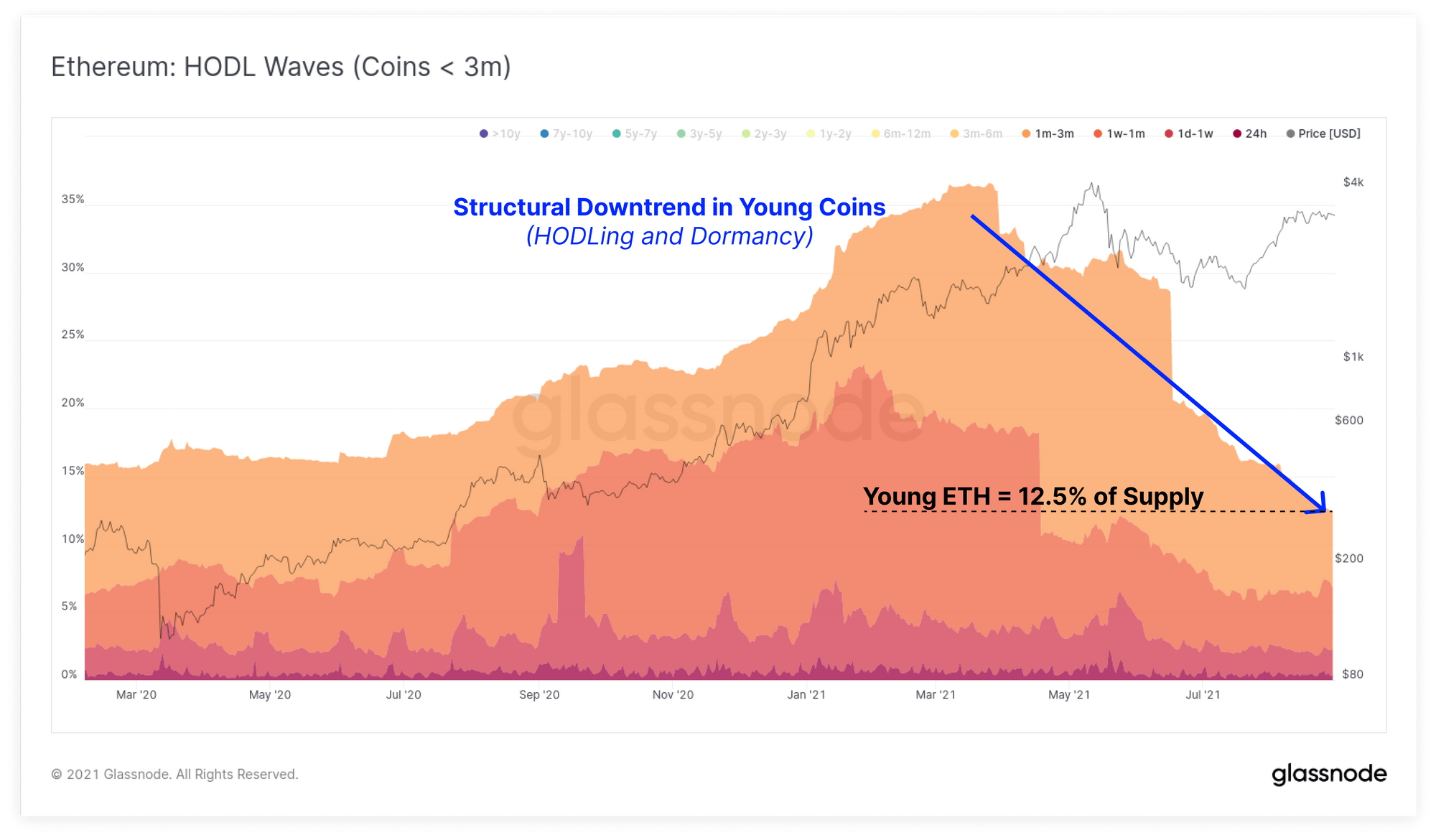

Glassnode says Ethereum’s supply dynamics look almost identical to Bitcoin.

“Ethereum HODL waves are almost the same chart, with young coins trending down towards a long-term low of 12.5% of the circulating supply.”

Check out the full Glassnode report here.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/IM_VISUALS