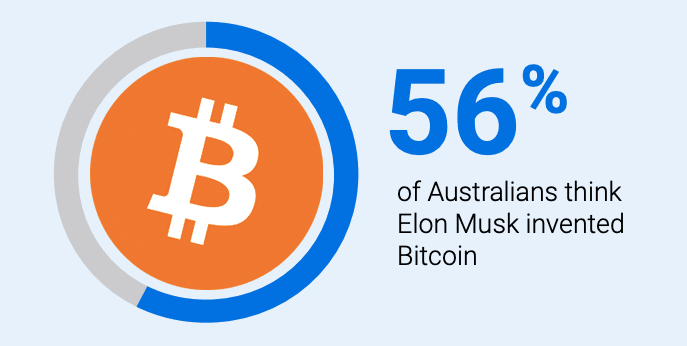

A report about the state of Bitcoin and cryptocurrency in Australia for August released by Finder suggests that 56% of Australians believe Elon Musk invented Bitcoin. Finder, who carried out the study, qualified these beliefs as “incorrect.”

The report explains that Bitcoin was actually created by an anonymous person or small group of people under the name Satoshi Nakamoto, as most Bitcoiners know. Apparently it is not that Australians believe Elon was Satoshi, but rather they believe that Elon simply “invented” Bitcoin.

Though it is absurd to think Elon invented Bitcoin, it is understandable that when pressed to name an creator, or if Elon’s name was presented in a list of candidates, it would stand out to the mind of an average Australian, as the report also indicates that more than half of Australians get their news from social media platforms on which fiat figures like Elon have an outsized reach in proportion to their understanding of Bitcoin. While Elon has a very rudimentary understanding of Bitcoin, he does enjoy a massive following on Twitter, and his Twitter antics are often correlated with temporary market movements.

According to Finder, which is Australia’s biggest comparison website, 9% of Australian’s own Bitcoin. It is unclear what the definition of “ownership” is in this case. It’s important to point out that many Bitcoiners would not consider simple Bitcoin price exposure through platforms like Robinhood and Venmo to be real Bitcoin ownership. Still more Bitcoin maximalists would argue that any coins left on any exchange, any coins that are not self-custodied are nothing more than an I-owe-yous and do not qualify as Bitcoin ownership. Finder, however, made no such distinction in their studies.

The Finder study also suggests that 35% of Australians believe “Bitcoin will eventually overtake fiat”, or be transacted more widely than it. Among Gen Z, Finder showed 52% shared that prediction. Many Bitcoiners across the world share the belief that the hard store of value will suck the monetary energy out of all assets people use to store their wealth as a hedge against fiat inflation.

Half of the participants indicated they believed Bitcoin to be a “legitimate investment.” This was consistent with the study’s finding that 1 in 3 Australians haven’t bought Bitcoin because they would rather store their money in shares or savings accounts.

“Over the past three years, Bitcoin has been growing at a faster rate than property. If the past three years of growth were to continue indefinitely, one Bitcoin would be worth more than the average Australian home by as early as 2045,” Finder reported.

Finder’s study methodology is to track consumer sentiment through a survey pool of just over 1,000 Australians. Finder’s panel of experts predicted the price of Bitcoin will exceed $300,000 (U.S.) by 2025. Over half of Finder’s panel of experts anticipate Bitcoin will replace fiat currency and become the dominant form of global finance by 2050.