The below is from the latest monthly report by the Deep Dive, Bitcoin Magazine‘s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

$100,000 before years end? It is not as crazy as it may sound, and here is why:

The reflexivity of a bitcoin bull market is truly something to behold. Following a “bubble top,” price draws down and consolidates for months/years, all the while more individuals come to understand the monetary attributes of bitcoin, companies continue building services on top of the protocol, more hash rate comes online to secure the network, and the Lindy effect continues to take hold.

Price slowly but surely begins to creep toward the former all-time high, and once it is broken, bitcoin goes on an absolute tear as global FOMO (fear of missing out) occurs. Not many assets trade in the same cyclical fashion as bitcoin, going parabolic time and time again.

- Why does this dynamic occur?

- Why do bull markets always see a blow-off top after an order of magnitude appreciation?

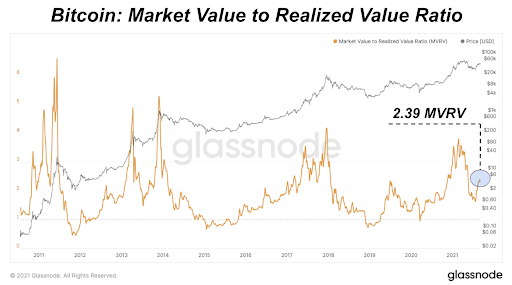

For the most part, it is about the psychology of market participants and the underlying activity of these participants. An examination of price, realized price, and the ratio between the two is telling.

How might a potential run to $100,000 before this year’s end look for bitcoin, and why is it not as far-fetched as many may think? While history doesn’t repeat, it often rhymes, which is why looking at previous bull run cycles can be helpful to provide context.

At the beginning of September 2017, the price of bitcoin was hovering around $3,500, giving the asset a market capitalization of approximately $50 billion. The realized price of bitcoin was approximately $1,600 at the time ($25 billion market capitalization).

Over the following four months, the price of bitcoin went parabolic, touching $20,000 ($329 billion market capitalization) for nearly a 500% increase. However, the realized price “only” increased by 200%, and this is quite telling.