The digital currency industry printed a bearish fall-off for the better part of Monday, the first trading day of the week. The slump was notably fueled by the financial crises of China Evergrande, the Asian giant’s largest property developer.

The Crux of the Matter and Crypto’s Response

China Evergrande is facing a major liquidity crisis, grave enough that the Hong Kong stock market has plummeted with Evergrandeh. Hang Seng Index has fallen as much as 3.3% on Monday. While battling a debt of about 2 trillion Chinese Yuan (about $300 billion), the crisis is currently projected to send a ripple effect across the global market. If not adequately managed, China Evergrande could reprint history such as the mortgage crisis of 2008.

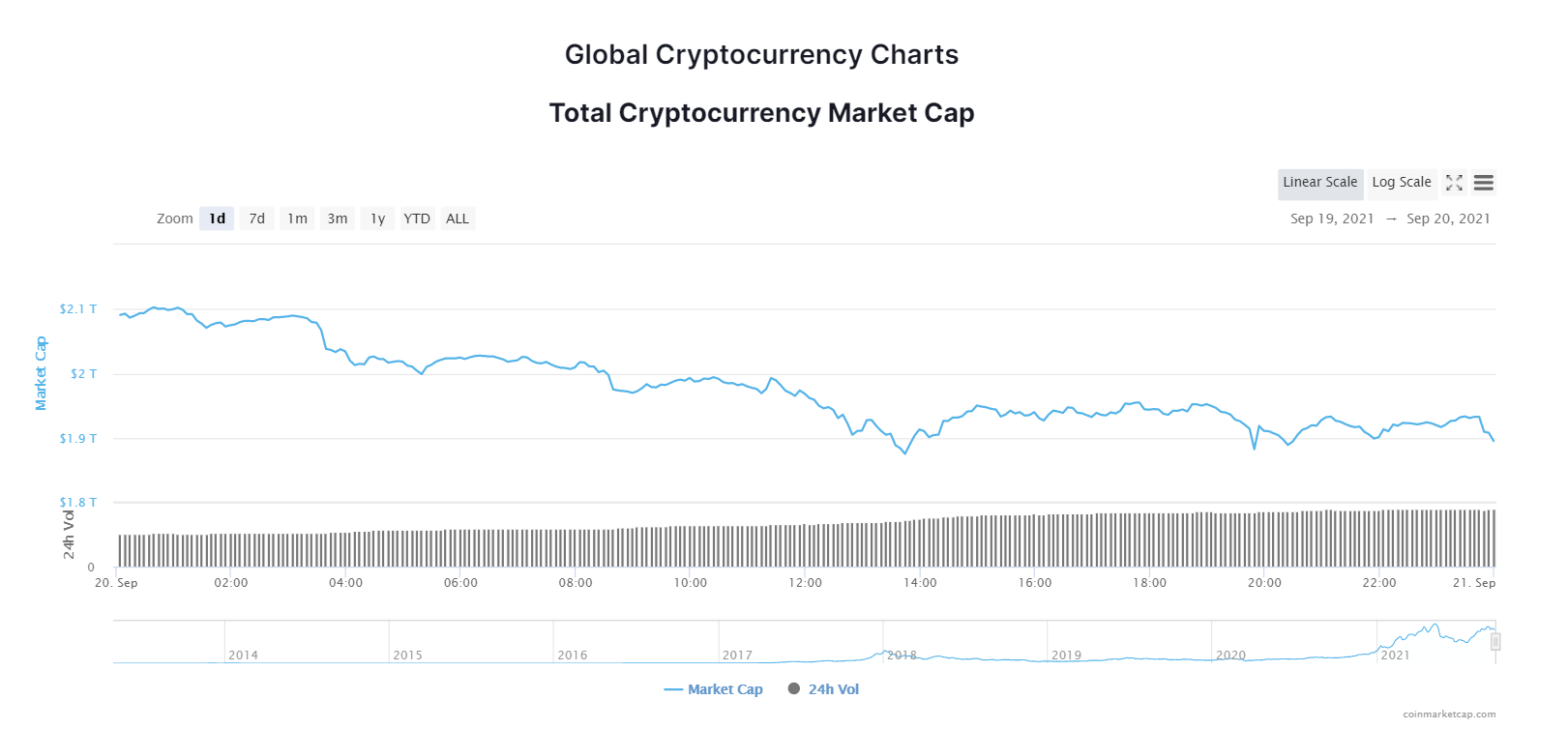

Stimulated by the financial crisis, Bitcoin (BTC) fell to its lowest price point of $42,669.05 in the past 24 hours, leading to a broad market sell-off. The global crypto market capitalisation has slipped below the $2 trillion benchmarks because of the price slump.

While many financial firms are projected to be caught in the crosshairs of the China Evergrande liquidity crisis, a number of market observers are concerned about how resilient the digital currency ecosystem will be to the ongoing sell-offs.

Positives for Bitcoin, Cryptocurrencies

The advent of Bitcoin aims to serve as a reliable digital currency in cases where traditional options are failing. Over time, the use cases of Bitcoin have evolved to include its functioning as a hedge against inflation. Playing its role in this regard will best come in handy at times like this when the global financial terrain is facing a fundamental strain.

Alongside other cryptocurrencies, the chances of playing the role of hedge against inflation will be further projected with the response or recovery at this time when compared with more traditional investment assets. In all, more investors’ sentiment may be positively tilted towards Bitcoin and altcoins if the issues prove to persist beyond control.

Image source: Shutterstock