The explosion in popularity of non-fungible tokens (NFTs) topped its sales to some $25 billion in 2021, data from market tracker DappRadar showed.

Reports showed that prices of some NFTs rose at high-speed last year that speculators sometimes ‘flipped’ them for a profit within days.

Although the growth of NFTs was monumental, DappRadar also reported that there were signs of growth slowing towards the end of 2021, which raises questions about the performance of the speculative crypto asset in 2022.

NFT sales volume totalled $24.9 billion in 2021, compared to just $94.9 million in 2020, said DappRadar – a company that collects data across ten different blockchains, which are used to record who owns the NFT. DappRadar also said that wallets trading in NFTs saw a rise to about 28.6 million, up from some 545,000 in 2020.

Data providers may vary in providing estimated volumes but transactions that take place ‘off-chain’, such as major NFT art sales at auction houses, are often not captured by the data, Reuters reported.

While CryptoSlam – which also tracks multiple blockchains – reported $18.3 billion as total sales for 2021, NonFungible.com – which tracks the ethereum blockchain only – saw $15.7 billion sales in 2021.

According to the data from NFT marketplace, OpenSea, last year’s sales peaked in August, then declined in September, October and November before picking up again in December.

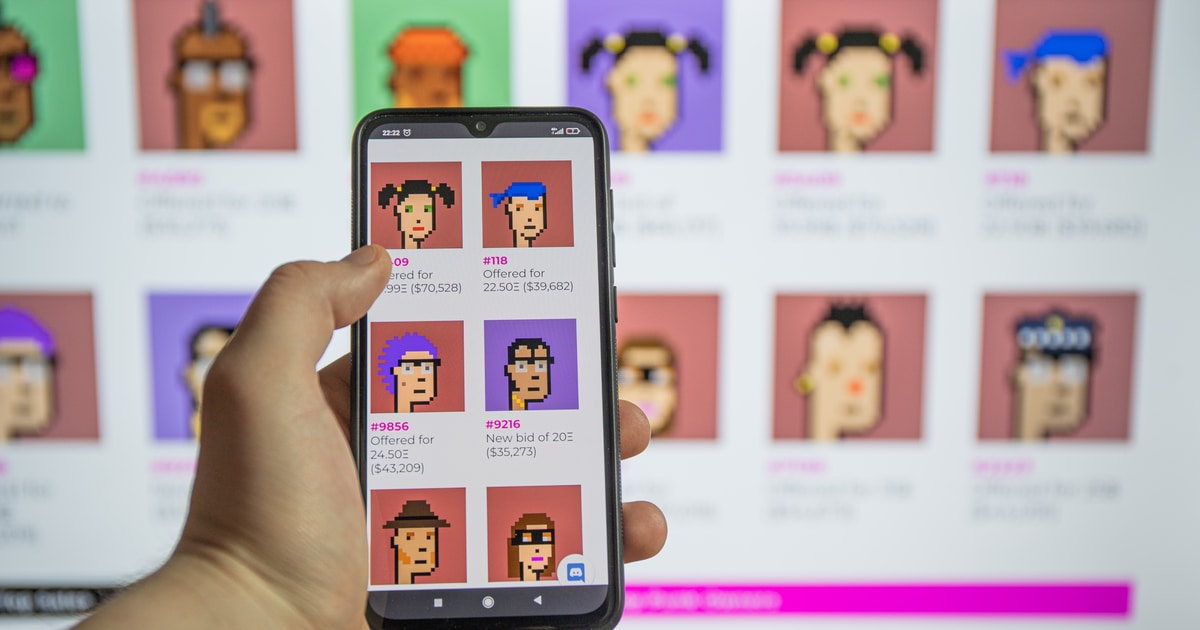

CryptoSlam data showed that prices of the most sought-after NFTs were highly volatile in 2021. The average sale price of a CryptoPunk image saw an increase from around $100,000 in July to nearly $500,000 in November, and by December it had fallen to around $350,000.

Although NFTs recorded an unprecedented sale volume, just 10% of traders accounted for 85% of all NFT transactions, research published in the journal Nature said.

NFTs are crypto-assets representing a digital item such as an image, video, or even land in virtual worlds. They are unique and non-interchangeable units of data stored on a blockchain – a form of the digital ledger – and are able to verify ownership of a work of digital art.

The increase in value of NFTs was a lucrative opportunity for the art world last year. Auction houses sold NFTs representing simple cartoons for millions of dollars with no physical objects changing hands. Meanwhile, some of the world’s top brands, including Coca Cola and Gucci were also quick to cash in on the hype and have already sold multiple NFTs.

“Everydays: the First 5000 Days,” the top NFT artwork sale last year fetched a record $69.3 million at a Christie’s sale in March. The artwork was created by Mike Winkelmann — the digital artist is also known as Beeple – who became the top three most valuable living artists after the sale of his work.

While Beeple’s NFT sale was the most expensive, a common price range for the sale of NFTs was $100 to $1,000 in 2021, NonFungible.com said.

Virtual real estate investor Republic Realm bought land in the virtual world The Sandbox for $4.3 million in November.

Riding on last year’s success of digital assets, 2022 is also likely going to be a positive year for crypto as the first trading week of this year has already seen cryptocurrency investment net outflows totalling a record $207 million, as reported by Blockchain.News.

After experiencing four consecutive weeks of outflows since mid-December 2021, the cryptocurrency sector reached a total of $465 million, or 0.8% of total assets under management, Blockchain.News reported.

Meanwhile, from the first week of 2022 to Jan. 7, 2022, the world’s largest cryptocurrency in terms of market capitalization, bitcoin posted outflows of $107 million, it added.

Image source: Shutterstock