Last Week In Bitcoin is a series discussing the events of the previous week that occurred in the Bitcoin industry, covering all the important news and analysis.

Summary

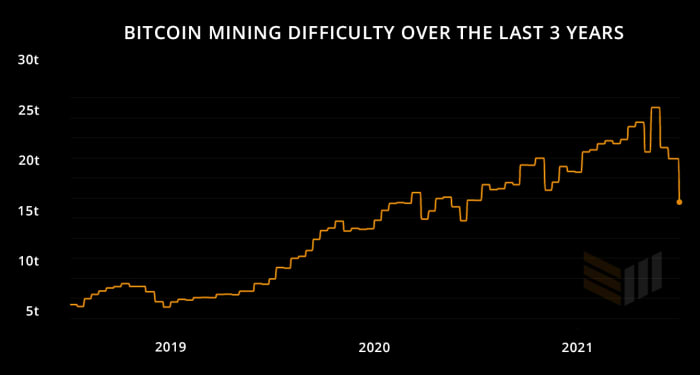

As the fallout of China’s crypto crackdown continues, the effects of over half of the world’s bitcoin miners going offline have been felt. Being the product of absolute genius, bitcoin’s mining algorithm adjusted, decreasing the difficulty to mine bitcoin by nearly 28% — the highest drop ever — making it easier and more profitable for the miners who remain to earn from their operations.

Highlights

Chart of the Week

Bitcoin mining. It’s all the rage nowadays, and for good reason. No mining means no bitcoin, it really is as simple as that. The China FUD, crackdown and subsequent drop in the bitcoin hashrate has forced the bitcoin mining algorithm to adjust the mining difficulty, prompting the largest bitcoin mining difficulty drop in the 12 years of bitcoin’s existence. In a nutshell, every 2016 blocks — once every two weeks, roughly — bitcoin’s mining algorithm adjusts itself to ensure that a block is mined every 10 minutes or so. Before the most recent adjustment, blocks took between 14 and 19 minutes to mine, meaning an overall slower network, but more importantly less revenue and profit for miners.

Happy miners make a happy bitcoin network. Miners make the (bitcoin) world go round, and it’s not just their mining activities that are key to keeping the market stable. Whether they buy or sell the coins they earn affects the market as well. So, with the recent drop in the price per bitcoin, mining has made miners less money. This meant that many had to reevaluate whether to continue operating at a loss, or switching their rigs off until it becomes financially viable once more to mine some coin.

With over half of bitcoin miners being forced to shut down their operations, some relocating to more favourable locations such as Kazakhstan, it’s a good time to be a miner. Throughout the week, several miners have been in the spotlight. Argo Blockchain secured a $20 million loan to back their Texas bitcoin mining farm, TeraWulf ordered 30,000 Antminers aiming to become one of the leading miners and Hut 8 ordered over 11,090 mining rigs to expand their operations.

Besides this, Michael Saylor and Elon Musk’s Bitcoin Mining Council released their first report regarding the misconceptions around bitcoin mining’s energy usage, the current state of the mining market and how members are addressing concerns about the energy mix their operations use. Once again mining becomes a key point in the bitcoin market; it’s been the main talking point in Elon Musk’s FUD campaign, and shows the importance of mining and its effect on the price of bitcoin.

Miners appear to be keen on expanding their operations. Several states and countries are pushing favourable narratives inviting miners to relocate, and the China FUD is slowly fading into the background. Overall, the massive drop in bitcoin mining difficulty will pave the way for investment in mining operations, which should yield greater benefits for the overall market.

Bullish News

Besides all the news related to bitcoin mining and miners, there have been some other developments in the market over the last week. George Soros, who called bitcoin a bubble just three years ago, is getting into bitcoin, joining several other billionaires and investment firms who have backtracked on previously bearish, blatantly anti-bitcoin statements. Another wholly bullish announcement from the last week has been Mercado Bitcoin, Latin America’s largest crypto exchange, raising $200 million from SoftBank. With El Salvador’s bitcoin adoption and rumours and reports of more countries in Latin America pursuing plans to adopt bitcoin as legal tender, it makes sense that investors are fueling growth in the industry. SoftBank has a great track record, so this investment could very likely bring much more positive sentiment marketwide.

Bearish News

It may be bullish, it may be bearish; George Soros has joined the “bitcoin fam.” This is the same George Soros who famously “broke the Bank of England” in 1992 with a speculative attack on the British Pound, and we are forced to wonder whether this is something he may very well try to do with bitcoin? Speaking of billionaire FUD kings, the July 21 “B Word” event with Jack Dorsey and Elon Musk is a little over two weeks away. Knowing Musk’s propensity to spew anti-bitcoin nonsense, he is likely to tweet out some bitcoin-related content soon, which is likely to have a negative effect on the market, whether we’d like that or not. Then again, Bezos and Branson’s upcoming space flights may keep him focussed on Space X instead of blatant market manipulation.

Besides the U.K.’s short-lived attack on Binance and South Africa’s crackdown on citizens buying or moving crypto abroad, most countries seem to be relatively quiet on the FUD front overall. However, it is likely with El Salvador’s official adoption of bitcoin in September, that the likes of the World Bank and the powers that be push back against the likes of bitcoin and ask member countries to do the same.

Verdict

What’s mined is yours. Yes, I am all about the mining puns. Over the last few months we’ve seen how much an effect mining has on the overall price, performance and perception of bitcoin. Musk’s FUD campaign relied entirely on a narrative that bitcoin mining was inefficient and harmful to the environment. We’ve seen China bring bitcoin to its knees by banning bitcoin mining. We’ve seen El Salvador inspire hope, and cool concept artwork, with a push for 100% clean volcano-powered mining. Mining makes the (bitcoin) world go round and this week we’ve seen positive moves which should benefit bitcoin sooner, rather than later…

This is a guest post by Dion Guillaume. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.