Bitcoin adoption in Africa has skyrocketed over the past year, growing over 1,200%, according to a report by Chainalysis. The increased activity in the region has been fueled by retail investors, who resort to bitcoin every day for savings, remittances, and peer-to-peer (P2P) trading.

Artur Schaback, COO and co-founder of P2P exchange Paxful, told Chainalysis that his platform had seen stark growth in African countries, notably 57% in Nigeria and over 300% in Kenya, over the last year. In fact, Africa has the largest volume of P2P bitcoin trading in the world, as citizens often face banking restrictions to centralized bitcoin on-ramps.

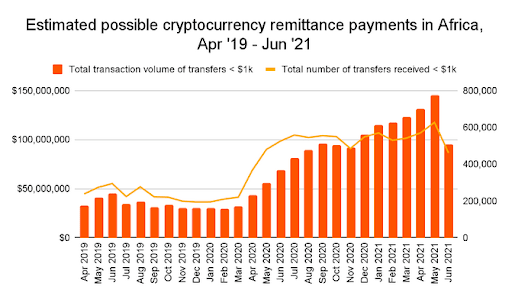

The ability to purchase bitcoin through P2P markets and transact it in a permissionless fashion has also enabled African citizens to bypass government restrictions of remittances and transfer more funds across borders. In 2019, Sub-Saharan Africa received at least $48 billion in remittances, a study by Brookings Institute found.

In addition to remittances, Schaback also explained that bitcoin enables African merchants to perform international commercial transactions more efficiently. Users resort to P2P markets for purchasing bitcoin and paying for the goods they wish to import, which is more efficient than using the traditional banking system.

“If you’re working with a partner in China to import goods to sell in Nigeria or Kenya, it can be hard to send enough fiat currency to China to complete your purchases,” said Schaback. “It’s often easier to just buy bitcoin locally on a P2P exchange and then send it to your partner.”

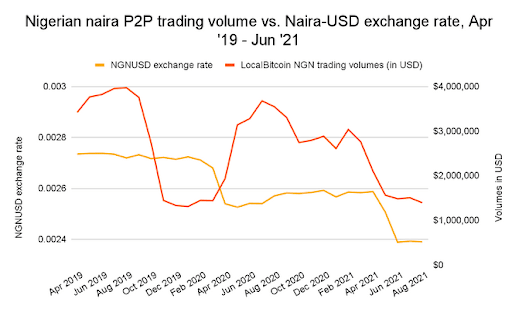

The final use case powering bitcoin adoption in Africa relates to hostile economic conditions in the continent’s countries, where fiat currency debasement is often the norm. Paxful’s growth, for instance, accelerated in Nigeria over the past year amid severe currency devaluation in the nation, Schaback said.

Chainalysis data confirms Paxful COO’s claims. When the value of Nigeria’s national currency, the naira, drops, trading volume increases. Source: Chainalysis

The Nigerian government has sought to respond to the rising bitcoin awareness and usage in their territory by announcing plans to develop the e-naira, their central bank digital currency (CBDC). However, citizens haven’t shown much interest and might keep using the far superior money that is bitcoin, according to Adedeji Owobi, CEO of blockchain consultancy firm Convexity.

“Last week in a Clubhouse room of Nigerian crypto users, I asked the group if they would use the e-naira when the central bank rolls it out,” Owonibi told Chainalysis. “The overwhelming majority of attendees said no because they expect it to have the same instability and management issues the naira has today.”

Bitcoin and Lightning together have the potential to empower not only Africans but people worldwide with sound money, financial freedom, and individual sovereignty — achievements that CBDCs would actually undermine.