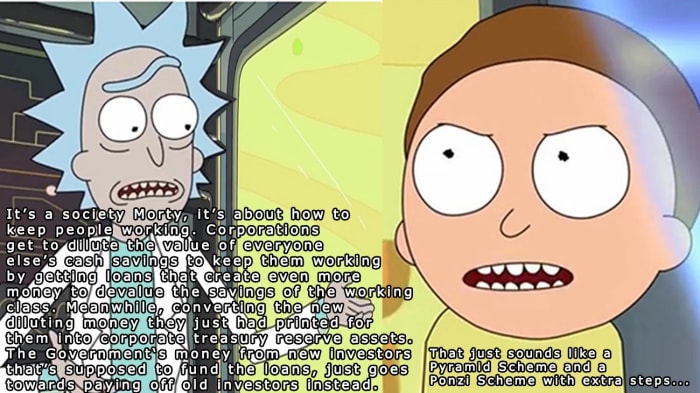

In layman’s terms, the system is a debt-based pyramid scheme with extra steps, fronted on the other end by an investing-based Ponzi scheme with extra steps.

George Carlin said it best: “It’s a big club, and you ain’t invited.”

Everyone else might as well be a WestWorld robot-like wage slave whose time can be rented and traded with a paycheck like a deck of trading cards.

It’s two sides of the same rotten apple, and it is starting to rot down to the core. Two corrupt practices that the government takes other companies and individuals down for when they’re caught doing it. Maybe they just don’t like the competition. Maybe it’s Maybelline. (Sorry, I couldn’t help myself!)

When Bernie Madoff gave his first interview from jail after being caught running a Ponzi scheme, he told the press: “Why are you even talking to me; the federal government is running the biggest Ponzi scheme in the world!”(Paraphrased from NBS News: “Madoff: ‘Whole government is a Ponzi scheme’”)

If there was one thing Maddoff was an expert in, it was Ponzi schemes. Game recognizes game.

All this is inching the U.S. dollar closer to a cliff of hyperinflation. A financial cliff drop in the dollar’s purchasing power that most of us now have a high probability of seeing in our lifetimes.

When we compare where our debt-to-balance ratio is today to other countries in history who have been where we are now. Each of those countries historically fell into hyperinflation within 30 years from when they were at the point we’re at now. Unsustainable increases in inflation rates, which caused a loaf of bread to cost their citizens upward of a million dollars in their currencies.

Where Venezuela is today. Where Argentina, Zimbabwe, and so many more countries are today. All countries who are already experiencing this ahead of us 30 years ago were, 30 years ago, where we are today in our rates of inflation and national debt balance sheets.

“Zimbabwe reintroduces the Zim Dollar” (Source: ThisIsAfrica.me, June 26, 2019

It happened to Germany before they got desperate and fell into wars from the pains of those economic collapses. Wars that were started as last-ditch efforts to save their country. Well, more so to save the wallets of the country’s political leaders and its war profiteering military industrial complex.

The fall of these countries’ currencies always started off with a slow ramp-up in speed like what the U.S. had in 2008, when Satoshi first noticed it during the second bank bailouts. That’s right, the first bank bailouts were done in the late 1990s, and almost nobody paid attention. Next follows a moderate-to-fast increase in speed like we are in now. All finally resulting in one giant uncontrollable drop in the values of their currencies within 30 years. A value-loss rate of inflation that never ended once they fell into hyperinflation.

And with the U.S. dollar being the reserve currency of most countries today, then its collapse will drag the whole world down with it if they all don’t hedge themselves properly to protect themselves against the dollar’s approaching collapse.

El Salvador is a great example of that kind of hedging against the dollar that other countries appear to be taking notes on. If you don’t know, El Salvador made bitcoin a legal currency and treasury reserve asset in their country to protect themselves against the dollar’s increasing rate of inflation.

The signs of the dollar’s collapse and that it’s exponentially picking up speed is obvious when you look at all countries that are experiencing hyperinflation today. Countries that relied on the dollar until its increasing rates of inflation failed them and their currencies. This is further explained in Robert Kiyosaki’s video, “Shocking Prediction: The Price of Bitcoin by 2031.”

Because of all that, I’m more afraid to save dollars long term than I am afraid to save bitcoin. Especially after reading the charts on https://wtfhappenedin1971.com/.

It really paints a good picture of how we started heading down this increasing rate of inflation rabbit hole after Nixon ended the gold standard. Something that even Nixon said was supposed to be temporary. Well, it’s been 50 years since then and the dollar has only lost what? Over 99% or more of its value when compared to things like houses, cars, food or rent. But sure, it’s temporary.

If you want to know why I’m bullish on bitcoin, and why I started using it as my primary savings ever since learning about its system instead of the U.S. dollar then check out my article, “My Best Attempt To Simplify The Math Of A $50 Million Dollar Bitcoin.”

This is a guest post by Fausto Liro. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.