New data on the amount of Bitcoin being scooped up by crypto whales and retail traders signals the bottom is in, according to on-chain analyst Will Woo.

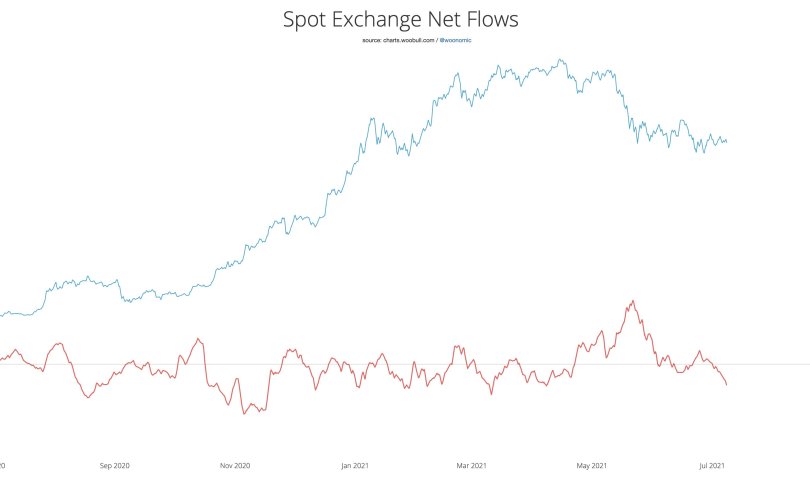

Woo is taking a close look at the flow of BTC to and from crypto exchanges.

He says despite sideways price action, investors appear to be buying coins on exchanges and sending them to private wallets at a healthy pace.

“As price grinds sideways-bearish, coins are being scooped off the exchanges at a very bullish rate…

The latest sizing of withdrawals vs deposits are at local highs at levels that signal a bottom, whales are scooping.”

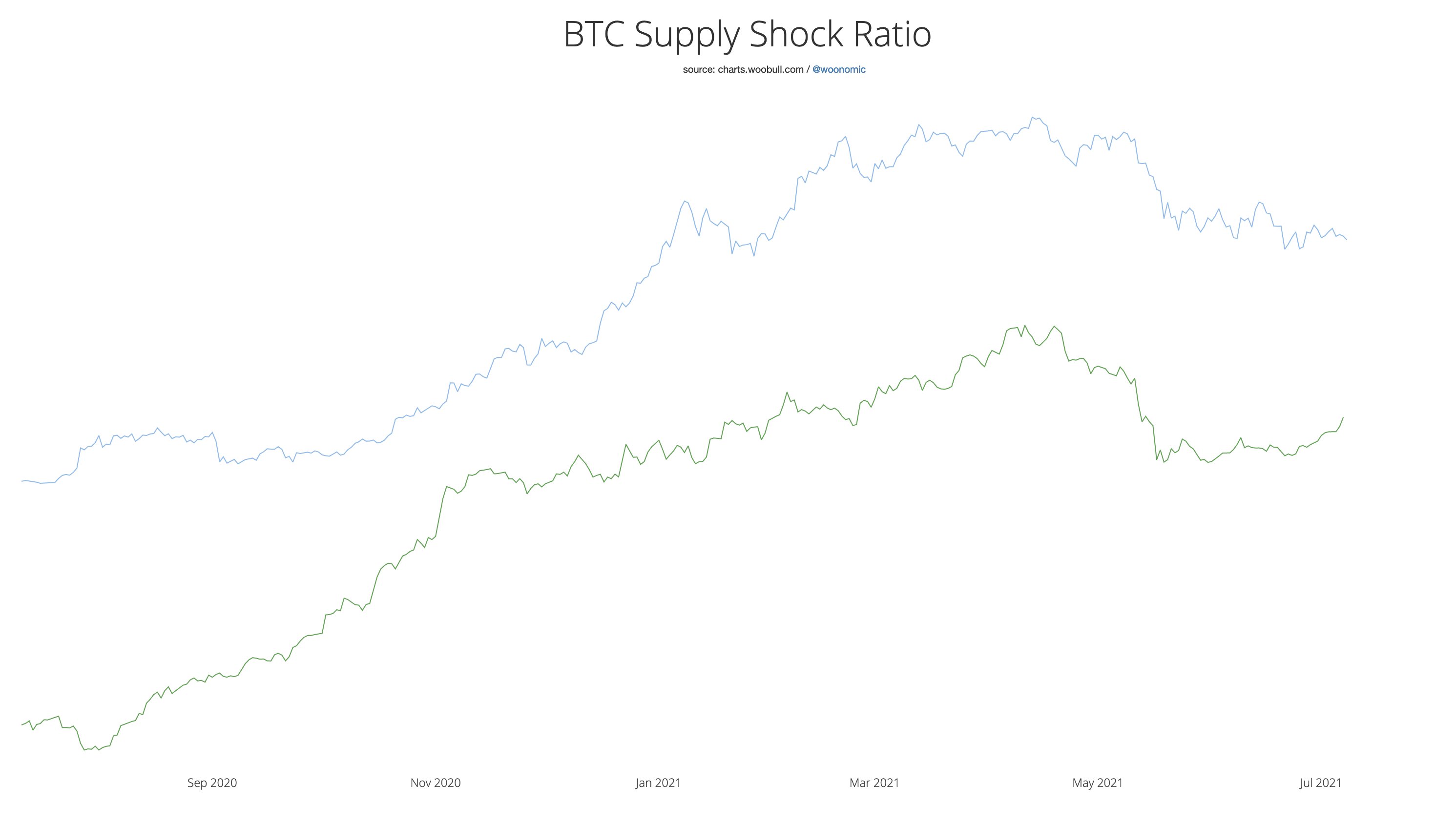

Woo says the numbers imply a supply shock is underway, with demand for BTC steadily outpacing the amount available on the market.

“Here’s another view of it, in terms of supply shock. The ratio of coins available on exchanges vs total supply (inverted so it tracks price).

Quantitative supply shock underway. Last time I saw this, it took some time before price bounced (Oct 2020); it bounced hard.”

Although the timing of a turnaround is uncertain, Woo says the fundamentals are strong enough that he wouldn’t want to be shorting the market.

“In my opinion anyone short this market will get rekt given enough time. It’s just a waiting game until the fundamentals prevail.”

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Malyutin Nikita