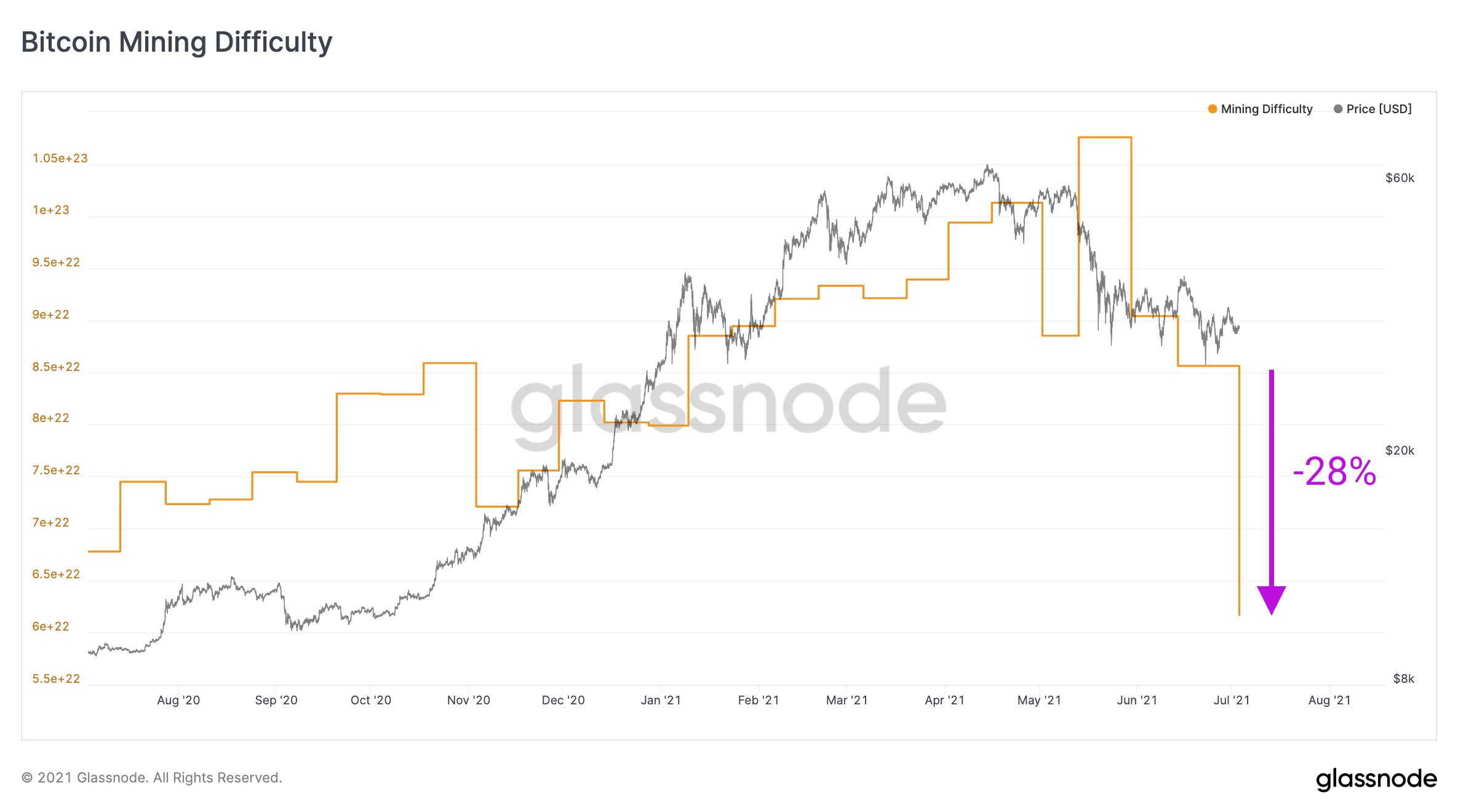

The autonomous Bitcoin network has experienced the largest drop in mining difficulty in its history.

The change has reduced the level of computing power necessary to process Bitcoin transactions by 28%, ensuring new blocks are mined at the target rate of one block every 10 minutes.

The “difficulty adjustment” is a stabilization feature built into the network to ensure miners can stay profitable, and this week’s plunge was triggered by China’s crackdown on Bitcoin mining, which has forced many miners in the country to take their mining rigs offline.

ByteTree Asset Management CEO Charlie Morris says the adjustment appears to be having a positive impact on network fees.

“Nice Bitcoin price move as the downward difficulty adjustment passes as expected this morning. Fees already $6 over the past hour compared to $10 yesterday. Hopefully, transactions can now start to pick up. They need to.”

Although the impact on Bitcoin’s price remains to be seen, on-chain analyst Willy Woo says historically, deep plunges in mining difficulty signal a positive shift in Bitcoin’s fundamentals.

“Today is the political version of ‘miners capitulation’, selflessly brought to you at much sacrifice by China.

Miner’s capitulation has historically been a good bottom indicator.”

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix