Crypto analytics firm Santiment says recent moves by big players could be a bullish indicator for scalable decentralized blockchain platform Cardano (ADA).

In a tweet, the firm says that deep-pocketed Cardano investors who took profits at the right time last summer have been reloading their bags with massive amounts of ADA in recent weeks.

“Cardano shark addresses holding 10k to 100k ADA have historically done a pretty outstanding job at calling tops.

And over the past 5 weeks, these addresses have added ~6% more of the overall ADA supply.”

The data firm goes even further in-depth on its website by discussing the impact of negative funding rates on potential future price action.

“Typically, these negative funding rates are a promising sign that the crowd expects prices to go lower. And this very often leads to short liquidations that can propel prices upwards.

It goes without saying that these negative funding rates are a great sign.”

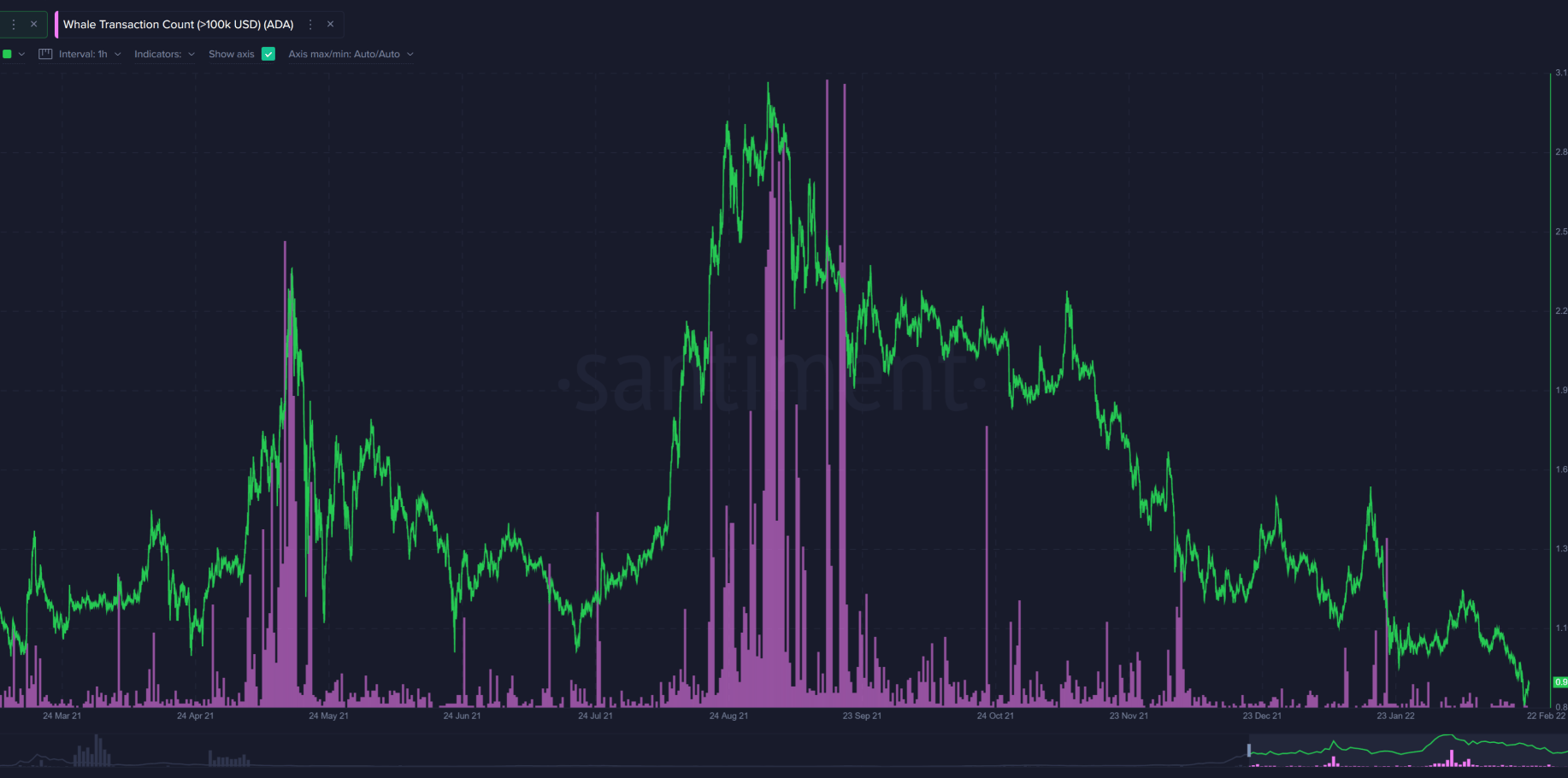

Santiment concludes its ADA analysis by looking at historical activity among whales with transactions larger than $100,000 to gauge when Cardano might return to all-time highs.

“We see that the major clusters of whale transactions both happened right at local tops in both May and at its all-time high in September.

Look for an uptick in these transactions as some great alpha that Cardano will see a long-term turnaround.”

At time of writing, Cardano is down 1.82% and trading for $0.87.

The 7th ranked crypto asset has seen some choppy price action during the first two months of 2022, having risen from the $1.30-range to as high as $1.59 in mid-January before falling to as low as $0.82 this past Monday.

Check Price Action

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Tithi Luadthong