Datacenter firm Crusoe Energy Systems is sounding investor interest for a loan to expand its bitcoin mining business, Bloomberg reported.

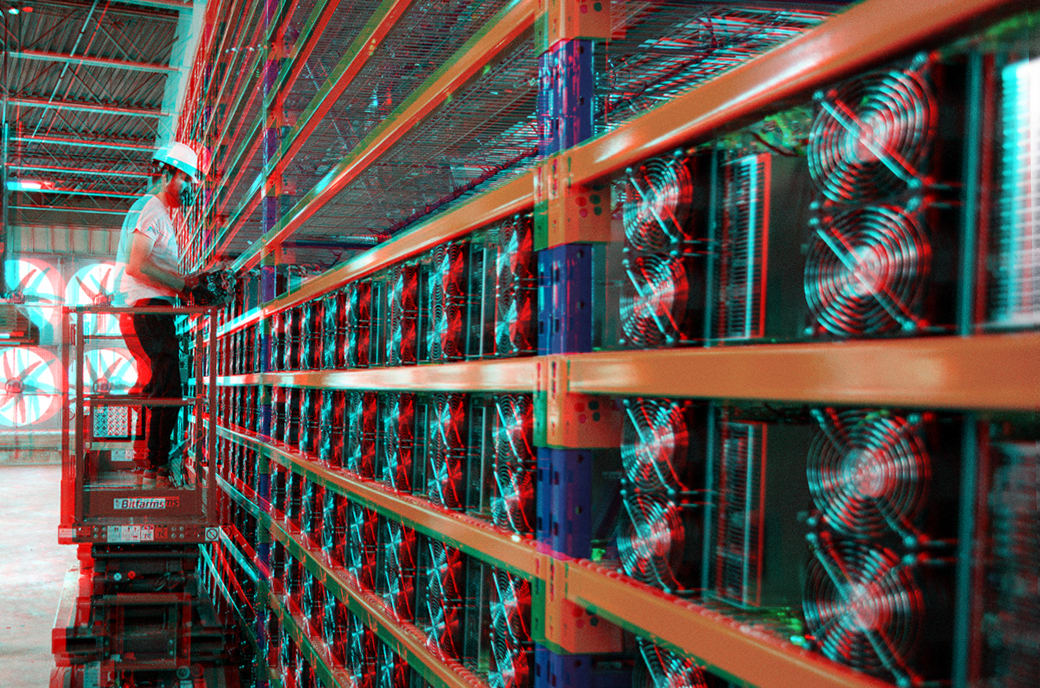

The firm is seeking a $100 million to $125 million debt deal backed by Crusoe’s bitcoin mining and generation equipment. Deal discussions are reportedly in the early stages.

Crusoe wants to close an investing deal by the end of 2021 to capture the exponential growth of bitcoin more quickly, the report said. The company is reportedly working with investment bank Ducera Partners LLC.

Crusoe is a Denver-based firm that seeks to provide oil and gas companies with a solution to natural gas flaring. The firm helps those companies capture otherwise wasted surplus gas from their energy production, convert them into electricity, and use it to power data centers and bitcoin mining operations.

Since renewable energy sources are usually intermittent, oil and gas might continue to play an essential role in providing reliable energy for the future development of society.

Crusoe seeks to help make fossil fuels less harmful to the environment by cutting down on the industry’s standard practice of flaring unwanted natural gas.

The industry usually resorts to burning off gas, a byproduct of oil drilling, because it is often more cost-effective than selling it.

But by leveraging that excess gas to mine bitcoin instead, energy producers can use low-cost energy that they would otherwise waste to reap the outsized returns of bitcoin.

In April, Crusoe closed a $128 million Series B financing round led by Valor Equity Partners to expand its digital flaring mitigation technology. Bain Capital Ventures, Coinbase Ventures, and Winklevoss Capital also participated in the round.