Crypto analysis firm Santiment is warning traders that leading smart contract platform Ethereum (ETH) is flashing red flag signals on-chain.

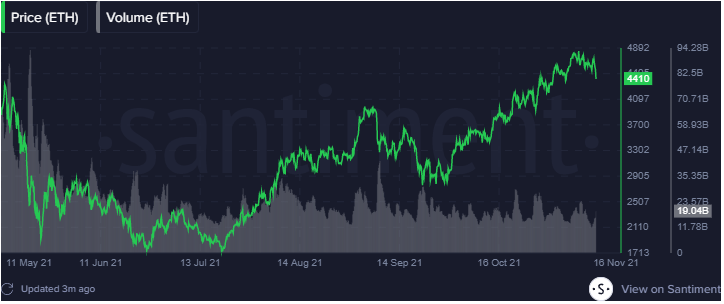

In a new Santiment Insights report, the crypto intelligence company says that while Ethereum is grinding higher, its trading volume has been on a downtrend since September.

“We are seeing a strong divergence between price and trading volume. Price heading up, trading volume trying to pick up but fails and heading down.”

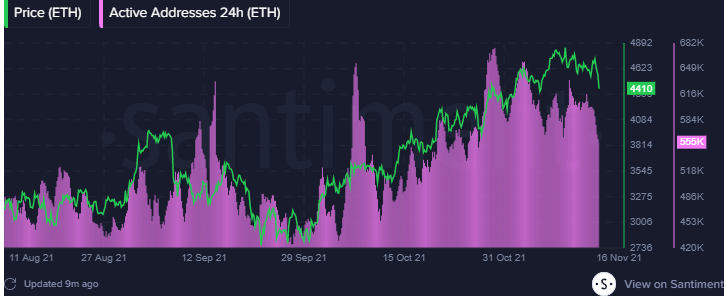

Santiment adds that on-chain volume or the number of active addresses has also dropped over 17% from 675,500 on October 30th to 555,020 at time of writing.

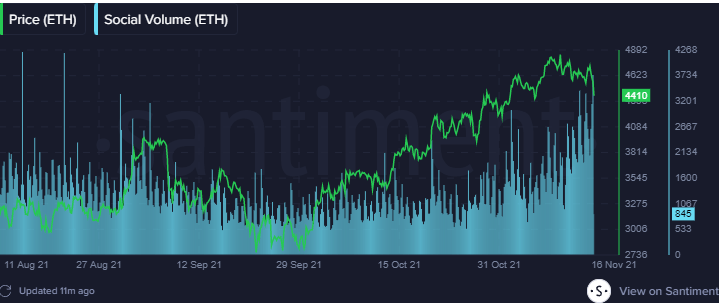

Meanwhile, social volume for the second-largest cryptocurrency is rising, suggesting that market participants are overly optimistic about ETH’s rally.

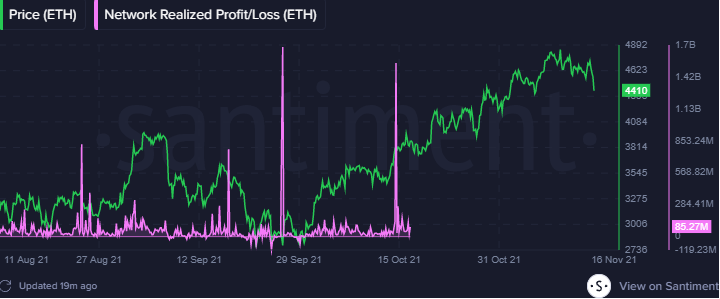

Another metric on Santiment’s radar is network profit/loss (NPL), which measures the overall daily return on investment across all network transactions. According to Santiment, a massive dip in NPL suggests that ETH holders, on average, are selling at a loss.

Santiment says that these on-chain signals are “worrying” and that the firm is “generally bearish” on the smart contract platform.

“A bunch of long-lasting divergences is pointing us to the idea that we need to go down… We see network activity going down even though the price is pushing up. People [are] too relaxed to take profits even though ETH is going up (visible in NPL). There is a good chance they will be punished.”

You can read the full report here.

Check Price Action

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/FlashMovie