Closely followed crypto strategist Justin Bennett believes leading smart contract platform Ethereum (ETH) is gearing up for a breakout this month.

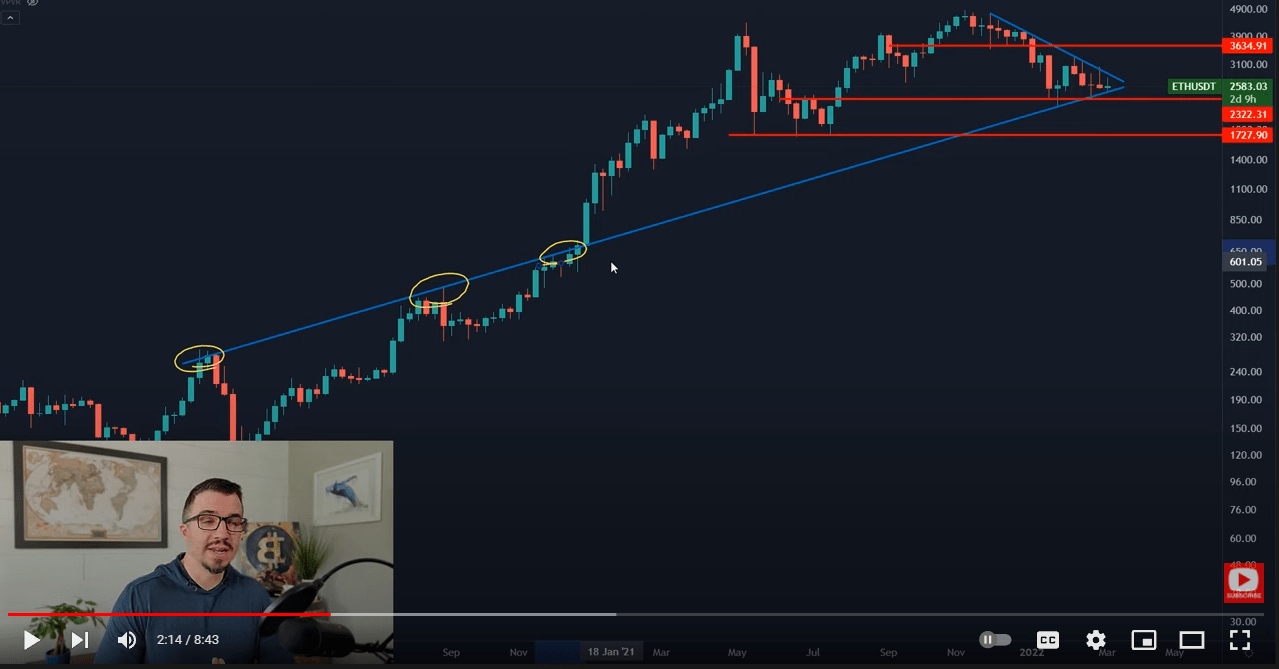

In a new strategy session, Bennett says that Ethereum is facing a diagonal resistance that has kept the market in a downtrend for about four months.

“We have a trendline that extends from the November high. Ever since this time, Ethereum has carved lower highs. It has not been able to carve a higher high ever since late last year.”

Although Ethereum continues to respect its diagonal resistance, Bennett says that the second-largest altcoin by market cap is being supported by an uptrend line that extends all the way back to 2020.

“At first glance, it looks like this lower level extends from this low back here in January… However, if you go back, this level actually extends back to 2020… This level extends from the February 2020 high right before the March Covid sell-off… You can see that it was once resistance in August [2020] and then right here before the breakout [November 2020].

Throughout [2020], during the last portion of the bear market for Ethereum, this level was resistance. Fast forward to today, you can see where over the past few months, so far in 2022, this level is serving as support.”

According to Bennett, Ethereum is now trading inside a symmetrical triangle, and ETH is approaching the apex of the pattern. The crypto analyst says that he expects the smart contract platform to break out of the pattern this month.

However, he highlights that the breakout can happen in either direction as he says Ethereum has yet to provide cues for a clear directional bias.

“Right now, this is still a waiting game because at the moment, the market is still caught in consolidation… So in order to confirm the break one way or the other, we need to see Ethereum close above this level right here, so this trend line right around $2,800. Or, see a daily close below this area around $2,500.”

Should bulls break the diagonal resistance, Bennett says the target is ETH’s immediate resistance at $3,600. On the other hand, a break of the long-term support will likely send Ethereum down to $1,700.

“Basically, we can say that Ethereum is setting up for a 30% move either higher or lower. The key is waiting for that confirmation.”

I

Check Price Action

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Liu zishan/pikepicture