With the evolution of the Ethereum roadmap, ETH 2.0 has emerged as an inaccurate representation, and this has necessitated its rebranding so that a broader audience can comprehend its content.

The Ethereum Foundation explained:

“One major problem with the ETH2 branding is that it creates a broken mental model for new users of Ethereum. They intuitively think that ETH1 comes first and ETH2 comes after. Or that ETH1 ceases to exist once ETH2 exists. Neither of these is true.”

The advancement of the Ethereum network calls for more measures beyond protocol development, like a critical shift in terminologies used, according to the Ethereum Foundation.

As a result, Ethereum 1.0 will be renamed as “the execution layer”, whereas Ethereum 2.0 will change to the “consensus layer”. Therefore, Ethereum will be made up of the execution and consensus layers.

Furthermore, rebranding is expected to keep bad actors at bay. Per the announcement:

“Unfortunately, malicious actors have attempted to use the ETH2 misnomer to scam users by telling them to swap their ETH for ‘ETH2’ tokens … we hope this updated terminology will bring clarity to eliminate this scam vector and help make the ecosystem safer.”

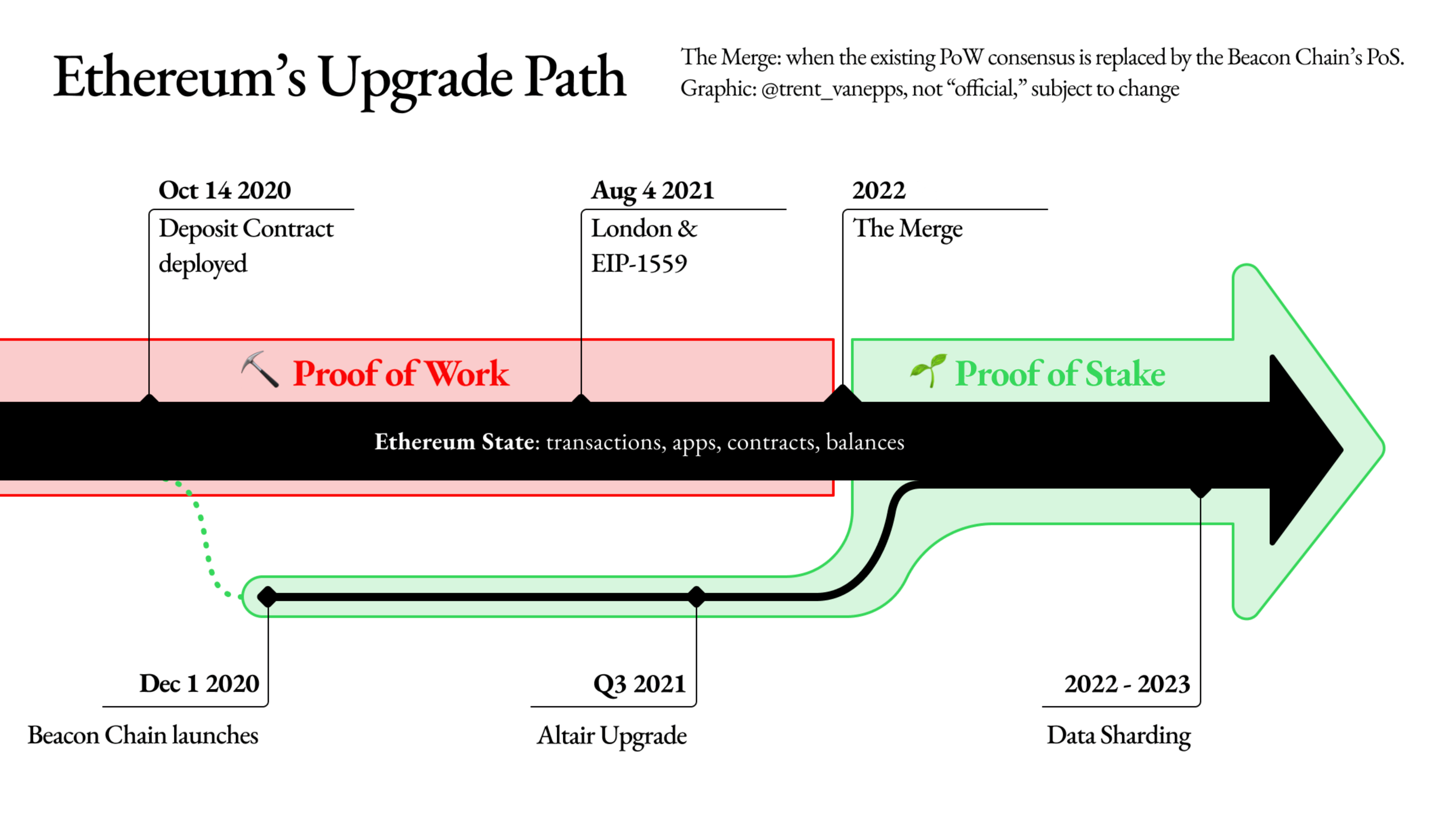

With the merge of the two layers slated for Q2 2022, a transition to the proof of stake (PoS) consensus mechanism is expected, deemed more environmentally friendly and cost-effective.

Source: The Ethereum Foundation

The shift is also anticipated to prompt a 1% annual deflation rate, according to research by crypto service provider LuckyHash. The study noted:

“When the quantity of pledge exceeds 100 million, the annual issuance rate will stabilize at 1.71%, that is, the average daily output is about 5600. If by then the upgraded Ethereum can maintain the current burn volume, it can achieve 1% deflation every year.”

Ethereum edged Visa in terms of trading volume in 2021 by hitting $11.6 trillion.

Meanwhile, ETH regained some momentum by up 0.1% in the last 24 hours, hitting $2,385 during intraday trading after plugging to a 6-months low, according to CoinGecko.

Image source: Shutterstock