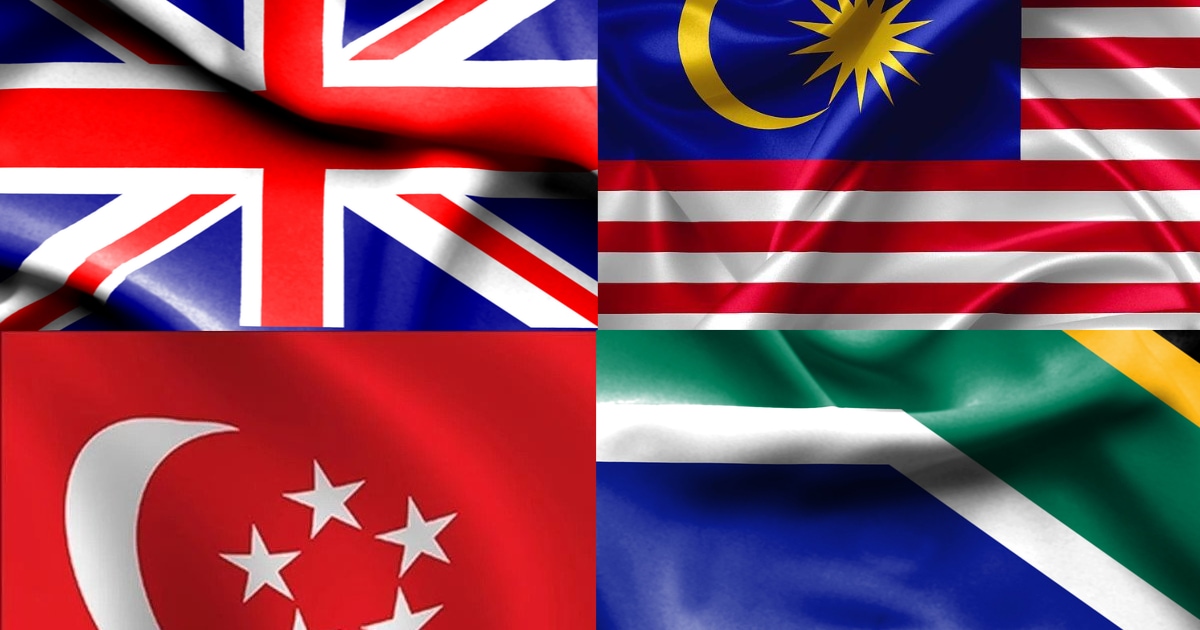

The Bank for International Settlements (BIS) has joined forces with the central banks of South Africa, Malaysia, Singapore, and Australia to kick start a project dubbed Dunbar aimed at testing the use of central bank digital currencies (CBDCs) in cross border payments.

Per the announcement on Thursday:

“Led by the Innovation Hub’s Singapore Centre, Project Dunbar aims to develop prototype shared platforms for cross-border transactions using multiple CBDCs. These multi-CBDC platforms will allow financial institutions to transact directly with each other in the digital currencies issued by participating central banks.”

By rolling out the trial, the central banks intend to enable financial institutions to cut the time and cost of transactions and eliminate the need for intermediaries.

CBDCs represent the digital form of a nation’s fiat money. They are controlled directly by the country’s central bank and are backed by national credit and government power.

To stabilise the control over the supply and demand of currency for the seemingly inevitable cashless society in the future, countries are now launching experiments to test the workings of CBDC.

Enhancing the G20 roadmap for cross-border payments

According to the report:

“Project Dunbar’s work will explore the international dimension of CBDC design and support the efforts of the G20 roadmap for enhancing cross-border payments.”

The CBDC payment trials facilitate seamless multi-currency fund transfers, which is a significant step towards the global vision of making payments cheaper and faster.

In October 2020, the BIS released a report identifying the foundational principles necessary for any publicly available CBDCs to help central banks meet their public policy objectives. Some of the principles entailed CBDCs coexisting with cash and other types of money in a flexible and innovative payment system.

Image source: Shutterstock