The below is an excerpt from a recent edition of the Deep Dive, Bitcoin Magazine‘s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

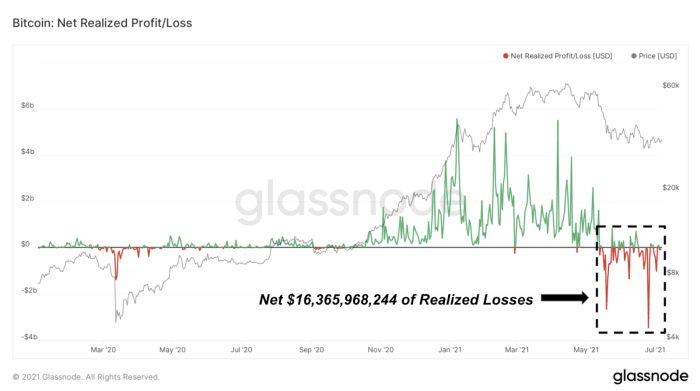

Over the last 55 days, there has been a historic amount of losses on the Bitcoin network. Over $16 billion worth of losses have been realized since May 13.

The steady bleed of the class of 2021 bitcoin investors continues, as shown by the largest capitulation event in the history of bitcoin in terms of aggregate dollar losses.

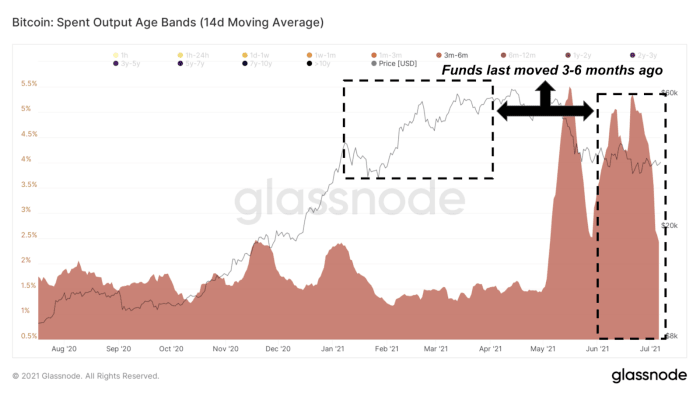

On-chain data shows that a notably large amount of UTXOs in the age range of 3-6 months have recently moved, which further supports the notion that buyers from within the range of $40,000-$60,0000 have been capitulating.

This next point is worth repeating. Do not allocate into bitcoin more than you can afford to lose, especially if the funds will be needed in a short period of time. Bitcoin is extremely volatile, but this is the key point:

During the monetization phase of bitcoin’s history (what we are currently living through), the exchange rate volatility is the price you pay for returns. Without the immense volatility, the upside potential and investment risk/reward would not be as asymmetric.

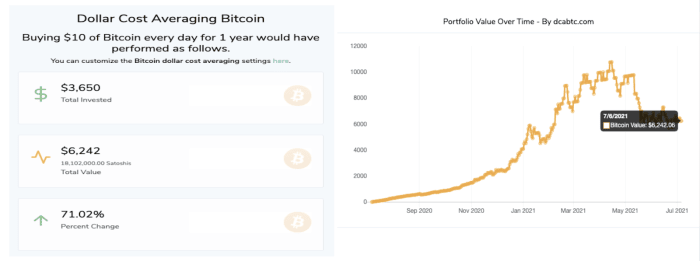

This further highlights the simplicity and elegance of dollar-cost averaging into a bitcoin position. A simple daily dollar-cost average strategy would have you up 71.02% year over year.

For most market participants this is the most prudent strategy, and while The Daily Dive does delve into some advanced trading strategies and concepts, for the average investor daily accumulation is a guaranteed winning strategy.

Acquire domain on the internet’s dominant monetary network.

It’s that simple.

This was an excerpt from a recent edition of the Deep Dive, Bitcoin Magazine‘s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.