When people first get into bitcoin as a savings device, or when traditional finance-type people look at it as a potential investment, they’re quickly faced with the sizing problem. What proportion of my assets should I put in this new and promising asset class?

For most maxis, this question is on the ridiculous side: naturally, as much as humanly (or prudently) possible. Die-hard maxis borrow fiat to acquire more sats — the Pierre Rochard speculative attack. If you hold any other asset than BTC, you’re effectively shorting bitcoin; you don’t want to short bitcoin.

If we step back for a moment into the shoes of the risk/diversification strategies of less-convinced — and more risk-averse — fund managers or regular people, bitcoin is only a question of prudent sizing. If you can’t stand 100%, and 0% is too low – what’s a reasonable proportion?

Earlier this summer, Paul Tudor Jones described what he wanted with “bitcoin as a portfolio diversifier” – “The only thing I know for certain, I want 5% in gold, 5% in bitcoin, 5% in cash, 5% in commodities.”

Between 1% and 5% is a common allocation suggestion, even among “crypto-curious” people – mostly, I suspect, because 5% is a nice, easy number (e.g. few people will target a 7.648% allocation). Other recommendations have ranged from low single-digit percentages to upwards of 10%. Single-digit allocations are far from uncommon: even some high-profile university endowments seem to have something like that.

Of course, since things move fast in this space, if you’re targeting a proportion, you also need a rule for when to rebalance your portfolio, and by how much. If you constantly rebalance your bitcoin holdings into other assets if and when bitcoin increases in value, you’re missing out on a lot of that potential upside – and might lose an unacceptable amount in tax liabilities and trading fees. That’s usually fine if all you’re after is a little extra return on top of an otherwise traditional investment thesis, but quite disastrous if bitcoin indeed repeats its tendencies for mulitplying by 10 times its value. In those cases, your meagre extra return is going to look like the people who bought cars or yachts for bitcoin in 2013: terribly expensive.

Economists Yukun Liu and Aleh Tsyvinski of Yale and Rochester universities respectively, concluded in a three-year-old paper that an exposure to bitcoin of between 1% and 6% was the optimal size, depending on how high you projected its future annual excess returns (30, 50, 100, or 200% respectively). These figures are old by now and we’ve had large-scale retail and institutional adoption since, which seems to have increased the correlation with the overall market. Presumably, too, as I have argued elsewhere, the return profile also has to come down. In the view of Liu and Tsyvinski, both those factors ought to reduce the optimal bitcoin allocation to a portfolio. William Baldwin at Forbes writes, correctly in my opinion, that

“…bitcoin’s history is short. It is one thing to look back on a century of history for stocks and bonds and draw conclusions about how much return and how much volatility you can expect from them. It is quite another to extrapolate anything from the freakish first decade of a virtual object.”

Joe Weisenthal at Bloomberg frequently points out that bitcoin has become eerily correlated with other risk-on assets:

“One of Bitcoin’s big selling points is its diversification benefits, but these days it’s almost tick-by-tick just your standard risky asset. It could be a cloud stock or Tesla. Or heck, even gold.”

And Amy Arnott for Morningstar, showing that BTC’s relation to other assets is changing:

“As mainstream investors increasingly embrace bitcoin, its value as a diversification tool is diminishing; as a result, there’s no guarantee that adding bitcoin will improve a portfolio’s risk-adjusted returns, especially to the same extent it did in the past.”

Now, bitcoin isn’t actually trading on forward-looking inflation expectations, but is far more susceptible to real interest rates of which inflation is only a part — over and above to specific events like China miner scares or Elon Musk tweets, anyway. This is how it shares a relation with gold, whose main drawback as a financial asset is its opportunity cost in a high-interest environment. If you don’t think that is coming back, stacking sats is a pretty opportunity-cost free investment choice.

The sound investment advice of not putting all your eggs in one basket has its academic-finance version in diversification. That doesn’t just mean to hold stocks in a few different companies, if all those companies are exposed to the same risks or more or less trade identically to one another – and with central banks running their money printers hot, everything is slowly becoming the same trade. The theoretical point of what’s known as modern portfolio theory is that different segments of your portfolio compensate for other segments such that random shocks, good or bad, results in having most of your nest egg intact regardless of what happens. You want uncorrelated (or negatively-correlated) assets such that in case of emergencies or one-off events, you preserve your savings.

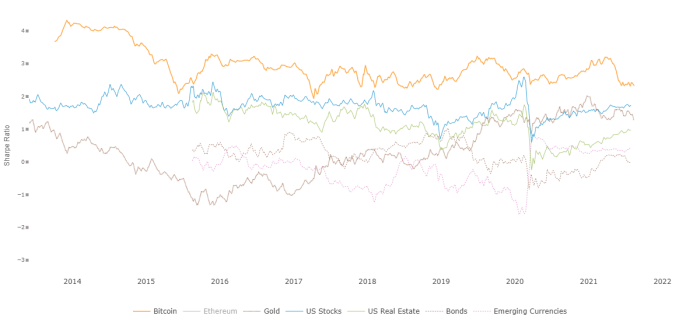

For a long-term investor, managing his or her own funds (or maybe that of a household) and planning over decades, that might not be such a crucial thing. The advice for regular people to dollar-cost average into passive mutual funds or such is precisely this: you are not using the funds in the next 5, 10 or 20 years, and so the worth to you of having a smoother portfolio trajectory makes less sense. What you want is returns over decades — in practice meaning until you retire. Even accounting for financial media’s incessant complaints about price volatility seems to make very few dents in the financial case for this asset. Bitcoin’s Sharpe ratio, i.e., its returns in relation to its volatility, routinely outperforms most other assets:

“Riskadjusted returns is calculated using Sharpe ratio over a 4-year HODL period,” courtesy of Willy Woo

That is to say, even ignoring its obscure early days, a few years’ HODLing of bitcoin more than enough paid for its short-term price risks.

How To Make Sense Of All This?

It’s important to remember that all of these rules are generic and not catered to your financial situation. In fairness, responsible asset advisors couldn’t publicly give much more specific guidance in interviews that are read by millions, i.e., speak to the financial conditions of whom they know very little. To give blanket statements of 2% or 5% or 10% of your savings is completely detached from three crucial elements of your life:

- Timing: when are you going to use or need the funds? Are you retiring at 40? Or are you retiring at a more regular retirement age? Are you acquiring a pristine, infinitely-lived asset to pass on to your heirs?

- Risk Tolerance: how comfortable are you with seeing investments go up and down in value over short or medium timeframes? If you can’t sleep at night because of moves in the price of some asset, that’s a clear sign you’re overexposed. Some people are blasé about this, stacking untouched through 50%+ drawdowns; others are skittish as frightened cats. Size your positions accordingly.

- Income Security: other financial commitments matter, such as “How much do you earn?” “How much does your spouse earn?” “What are your expenditures?” Unless you’re holding BTC as a Hail Mary gamble against what seems like an overwhelming world (in which case I advise you to first get your house in order, metaphorically speaking), I wouldn’t advise someone with nothing to their names to buy bitcoin with their lunch, or rent, money. Don’t max your second credit card to go all in on bitcoin if it means your family or kids can’t eat.

These criteria will look different for all of us, and knowledge and understanding of how bitcoin works — as well as how the incumbent monetary and financial system surrounds all of these criteria. In general, the deeper you go down the rabbit hole, the more convicted you become of bitcoin’s long-term price potential, and therefore the more comfortable you become with a higher allocation share of assets.

The allocation issue is a lot more complicated than a single number. In the limit, you might not even consider BTC part of the rest of your investment portfolio, but a free-floating independent asset to which you have full uninterruptible ownership.

This is a guest post by Joakim Book. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.