A leading crypto asset manager says large institutional investors are backing out of Ethereum (ETH) as the merge approaches.

In their latest Digital Asset Fund Flows Weekly report, CoinShares suggests investors may have anxiety over the outcome of the smart contract platform’s highly-anticipated transition to proof-of-stake (PoS).

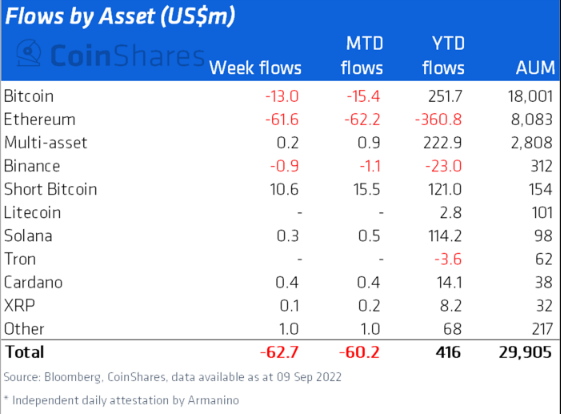

“Digital asset investment products saw outflows totaling $63 million, the fifth consecutive week of outflows…

Ethereum was the primary focus of the outflows, totaling $62 million last week, this comes despite the improved certainty of the merge and perhaps highlights a concern amongst investors that the event might not go as planned.”

CoinShares also says the last month of outflows has been relatively small and doesn’t necessarily reflect current price action.

“The outflows remain relatively small in size, totaling $99 million over the last five weeks, while volumes remain only 46% of this year’s average at $1 billion for the week. Despite the uptick in prices on Friday, it was the largest day of outflows.”

Bitcoin (BTC) investment products also suffered their fifth straight week of outflows at $13 million.

Solana (SOL), Cardano (ADA), XRP, and multi-asset investment vehicles saw minor inflows on the week. Solana leads all other altcoins in fund flows this year with $114 million, according to the firm.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Sergey Nivens