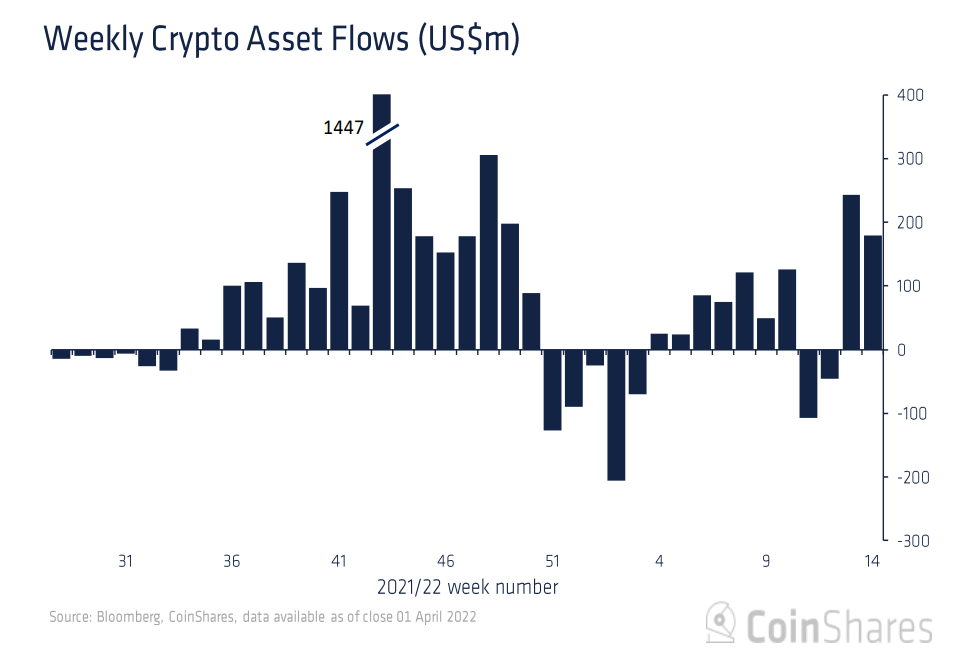

A leading digital assets manager says institutional investors have regained an appetite for altcoins after market sentiment had a rocky start in 2022.

According to the latest CoinShares Digital Asset Fund Flows Weekly Report, crypto investment products saw $180 million in inflows last week, with the vast majority of the inflows deriving from Europe.

“Digital asset investment products saw inflows totaling $180 million last week while the reporting of some late trades pushed up the previous week’s inflows from $193 million to $244 million… A regional divide remains, with 99% of inflows derived from Europe, while the Americas remain hesitant, seeing only $1.7 million of inflows.”

In step with its share of the market, digital asset investment products focused on Bitcoin (BTC) enjoyed inflows of $144 million last week. Despite the big numbers, CoinShares says BTC investments are lagging compared to last year.

“Bitcoin saw inflows [last] week totaling $144 million, bringing year-to-date inflows to $350 million… Inflows are lagging relative to last year, where Bitcoin saw inflows totaling $3 billion in the first quarter, a particularly euphoric period for the asset.”

Although Ethereum (ETH) products also enjoyed heavy inflows last week, CoinShares says ETH’s negative net flows for 2022 fall far behind expectations set in 2021.

“Ethereum saw inflows totaling $23 million last week. While sentiment has improved, net flows remain negative for the year at $111 million. This contrasts to the first quarter [in] 2021 where we saw inflows totaling $705 million.”

Institutional investors also poured money into smart contract platforms Solana (SOL) and Cardano (ADA), officially making Solana the third-best performing investment product year-to-date.

“Solana and Cardano saw inflows totaling $8.2 million and $1.8 million respectively. Solana is now the third-best performing investment product with inflows year-to-date totaling $103 million.”

CoinShares’ data shows that the past two weeks have seen the most institutional inflows of the year by a considerable margin.

Check Price Action

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/NextMarsMedia