A leading digital assets manager says institutional profit-taking lead to heavy outflows in crypto investment products over the last week.

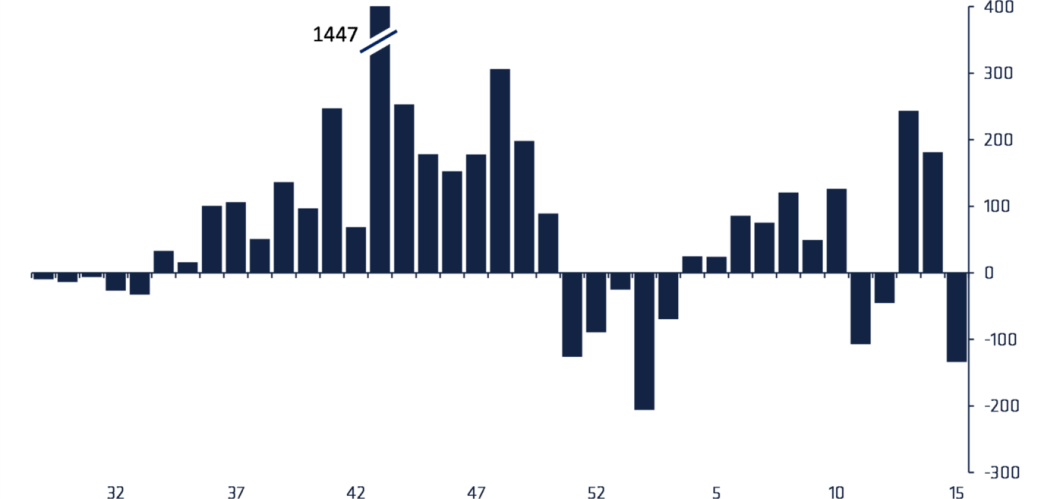

In the latest Digital Asset Fund Flows Weekly report, CoinShares suggests last week’s heavy outflows of $134 million is a result of the previous week’s market value appreciation.

“Digital asset investment products saw outflows totaling US$134m last week, marking the second-largest weekly outflow this year. The outflows were broad-based across providers in both Europe (39%) and the Americas (61%)…

We believe price appreciation the previous week may have prompted investors to take profits last week.”

In step with their share of the market, institutional investment products focusing on leading digital assets Bitcoin (BTC) and Ethereum (ETH) suffered the heaviest outflows last week at $132 million and $15 million, respectively.

Institutional investment products focused on altcoins, excluding Ethereum and XRP, enjoyed minor inflows last week. Multi-asset investment products, those focusing on multiple altcoins, enjoyed five million in inflows. Solana (SOL)-focused products also had a good week, bringing in $3.7 million. Cardano (ADA) digital investment products took in $1 million over the same period.

Altcoin investment products geared towards Litecoin (LTC), Polkadot (DOT) and Tron (TRX) also had positive flows last week, in the amounts of $0.6 million, $0.4 million and $0.1 million, respectively.

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/DEYASA_346