It’s crunch time for Bitcoin and the crypto markets, according to a popular analyst.

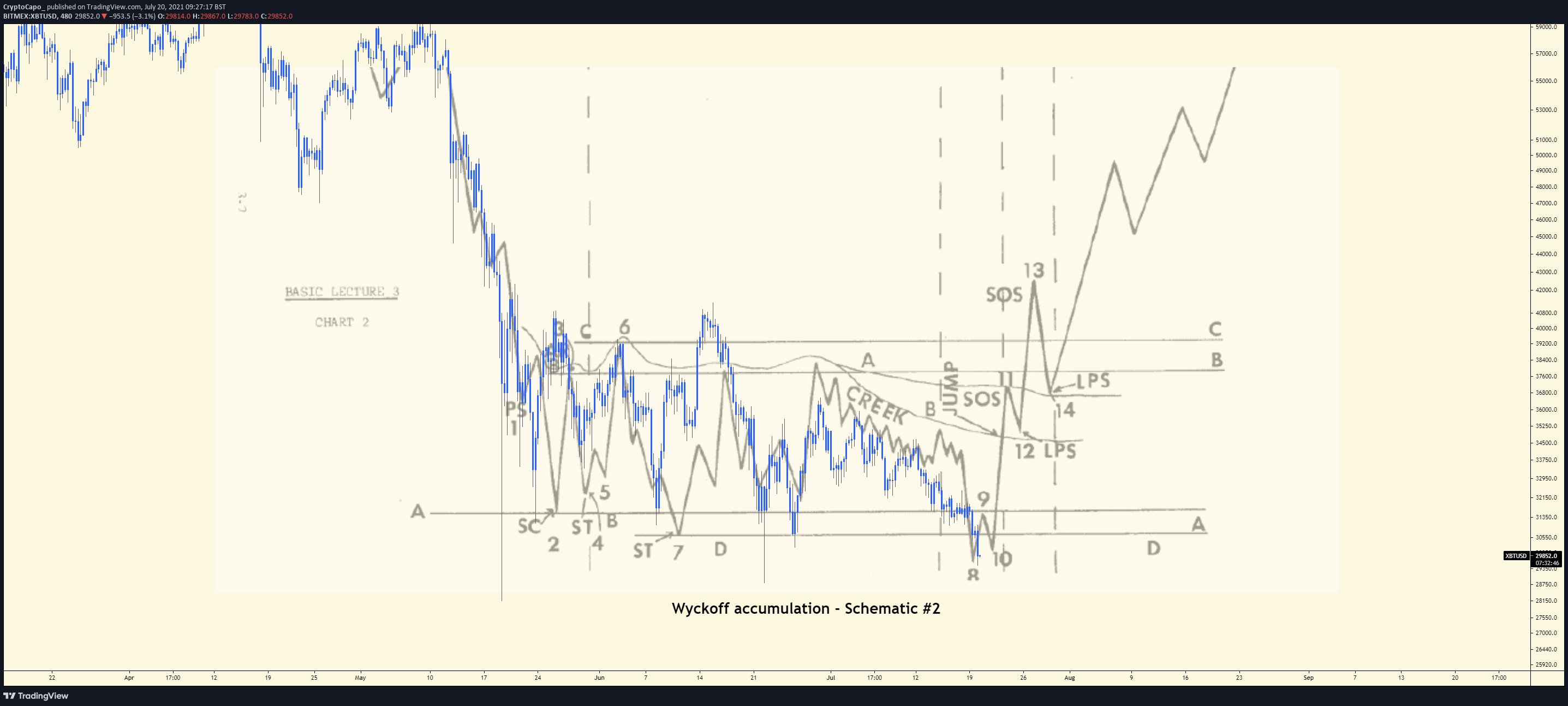

The pseudonymous trader known as Capo tells his 140,000 Twitter followers that Bitcoin may still be in a Wyckoff accumulation pattern, with BTC setting itself for a big move to the upside when the pattern completes.

The Wyckoff method is a technical analysis approach that aims to identify whether big-money investors are accumulating or selling an asset. An accumulation pattern highlights a period where institutional investors are controlling an asset’s price in an effort to buy at discounted prices.

According to Capo, Bitcoin may be forming a near-perfect Wyckoff schematic #2, implying that the bottom is almost in for the world’s biggest crypto asset by market cap.

Contrary to what some high-profile investors have said, the analyst is doubtful that investors waiting on the sidelines will have a chance at buying BTC around $20,000.

“I am convinced that this is accumulation. Do you really think that the majority will get $25,000 or $20,000?”

Capo also puts the spotlight on the prolonged negative funding rates, as well as the lack of a sell signal from the widely-followed Puell Multiple indicator as reasons to be bullish.

$BTC funding & premium

Another reason I’m bullish is because funding and premium have remained negative throughout this range.

The Puell Multiple indicator showed a buy signal some days ago. pic.twitter.com/tigu40eK7M

— il Capo Of $NOIA (@CryptoCapo_) July 19, 2021

The crypto analyst points out that the Puell Multiple – which divides the daily issuance value of BTC by a 365-day moving average of daily issuance value – hasn’t yet flashed the typical top signal that it formed in previous bull markets.

Though Capo maintains his bullish stance on Bitcoin, he cautions that if BTC finishes the week under $30,000, things could get ugly.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/sdecoret