Crypto market intelligence platform Santiment says the impact of this week’s cryptocurrency market crash on Bitcoin (BTC) and Ethereum (ETH) could go either way.

The blockchain analytics firm says it has noticed both bullish and bearish signs.

“I’ve seen some TA analysts set $38k as strong support. On the flip side, I’ve also seen a flood of ‘buy the dip’ tweets in the hours after the drop. Looking at the on-chain and social activity of top caps, it’s looking like a ‘good news, bad news’ kind of situation for the time being.”

Santiment says Ethereum is moving from individual addresses to known exchange wallets, which points to potential sell pressure.

“Starting with network data, yesterday’s dump has left some signs of weak hand shakeout, which could be a positive sign for the bulls.

Source: Sanbase

Source: Sanbase

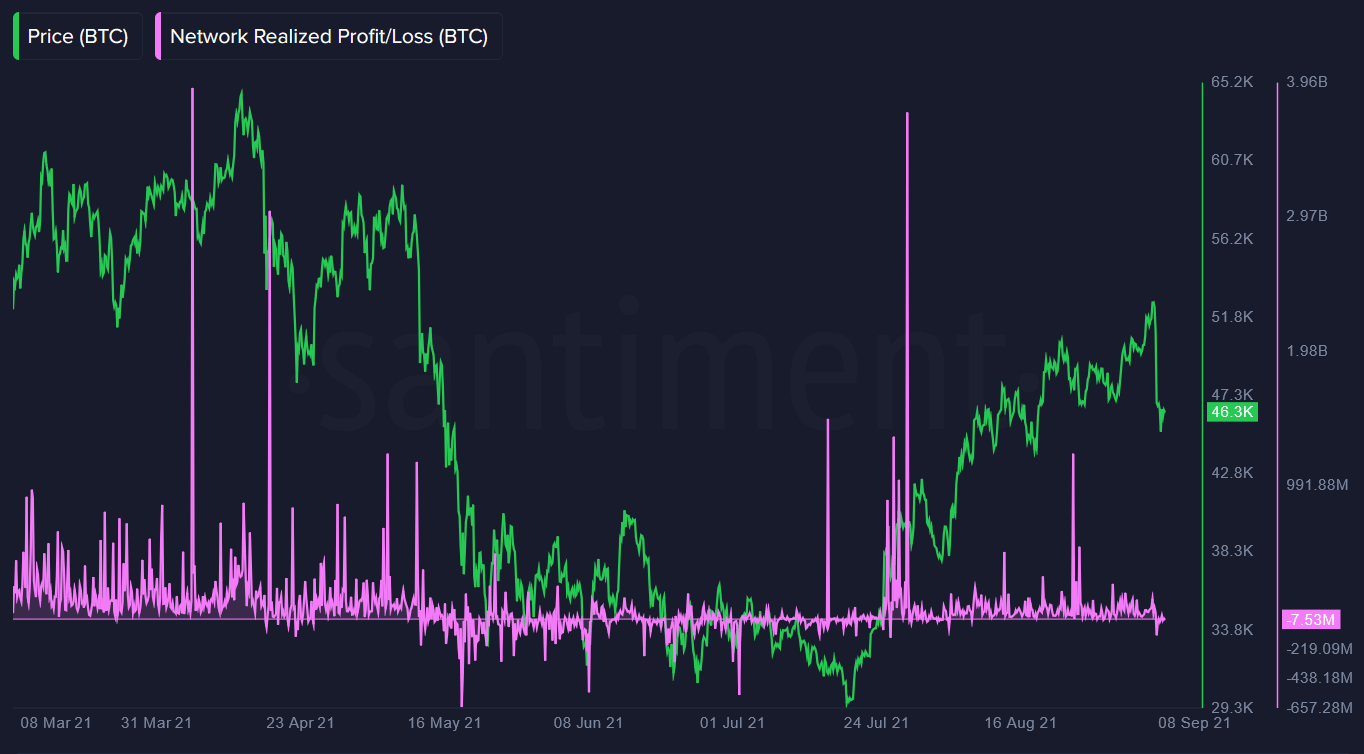

The firm says that Bitcoin’s network realized profit/loss (NPL) dropped to a two-month low, suggesting that BTC holders may be selling at a loss.

“We have seen similar ‘capitulation’ dips around several local bottoms for BTC during the May-June correction.”

Source: Sanbase

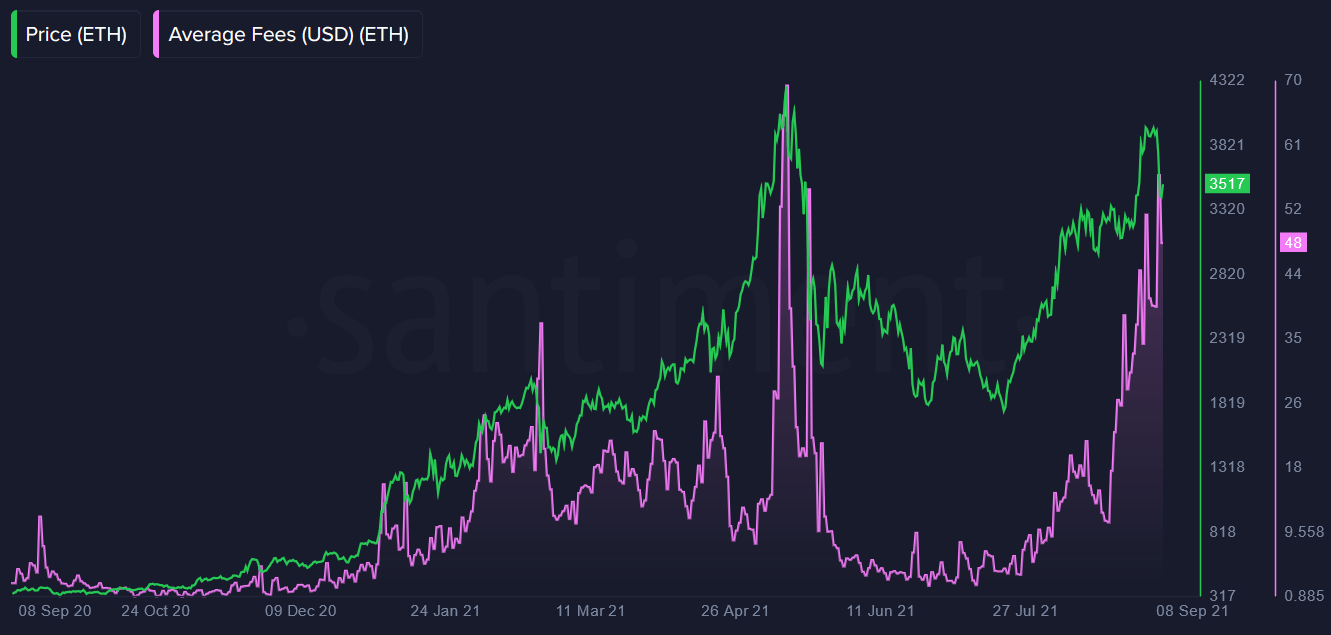

The average Ethereum fee rose to match its second-highest point ever. Santiment says fee spikes like this are a potential bottom indicators because they may be driven by panic sell-offs and “paper hand” capitulation, although NFT hype may also be contributing to surging ETH fees.

Source: Sanbase

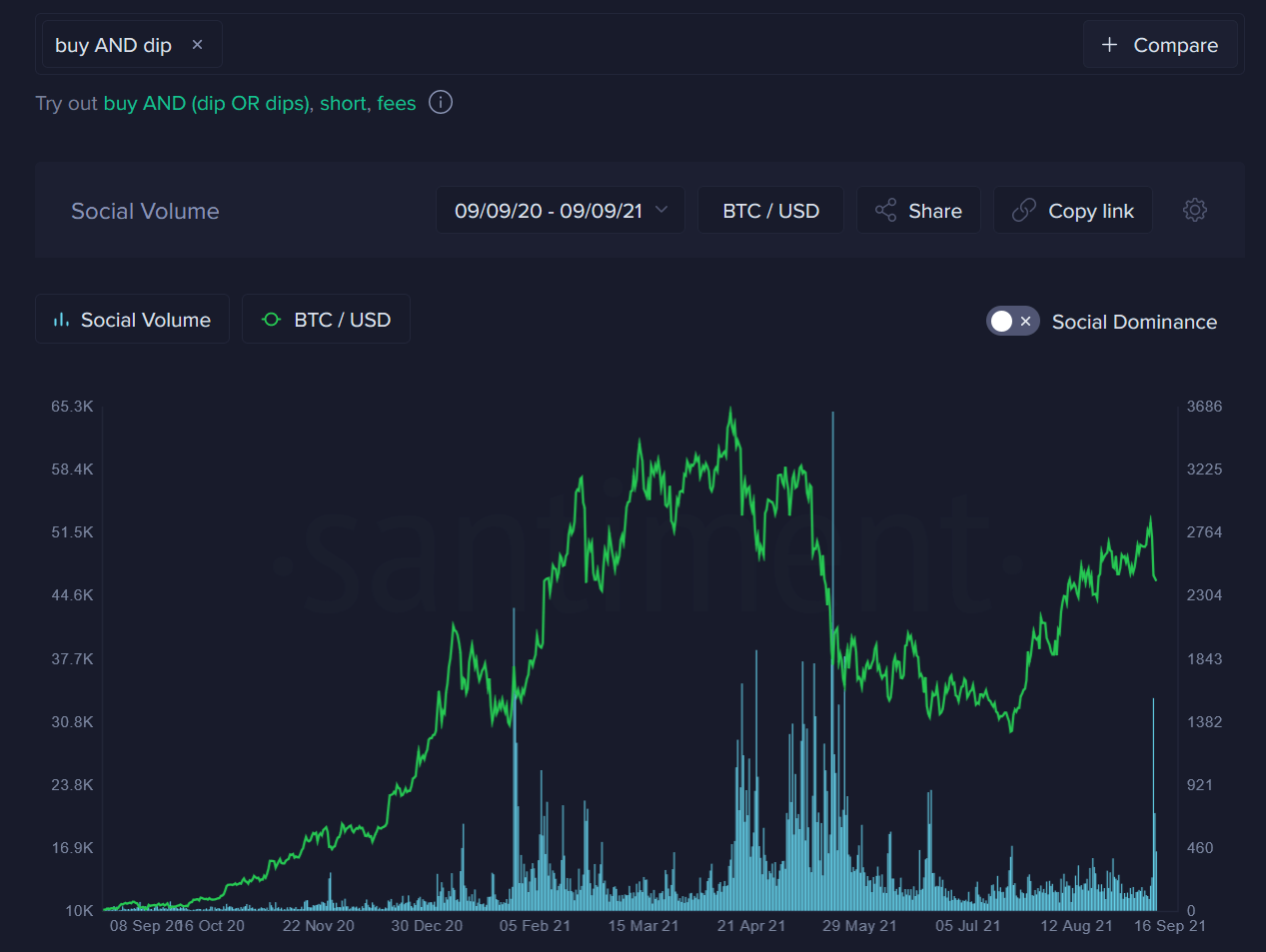

Social mentions of “buy” and “dip” together also soared amid the correction, which correlates to a more bullish bias among retail investors, according to Santiment.

Source: Sanbase

Source: Sanbase

The firm says it sees an uptick in the average social sentiment towards Bitcoin and explains how that could affect the top crypto’s price.

Source: Sanbase

Source: Sanbase

“On the whole, it seems like there’s a fair bit of post-dump excitement on the retail side, which could prove to be an issue in the short term. Just look at the previous spikes in ‘buy the dip’ calls and you’ll notice that they’ve often come early (like back in April and May, respectively), and tend to be accompanied by another leg down before the crowd is finally proven ‘right’.”

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Tithi Luadthong