Since January 3, 2009, the Bitcoin network has been functional for 99.98662952015% of the time. However, the protocol has had a few hiccups along the way and on a few occasions, the chain split into two. Most people are well aware of the Bitcoin Cash split that took place on August 1, 2017, but the first time the Bitcoin chain split was 11 years ago on August 15, 2010.

Strange Block 74,638

4,019 days ago on August 15, 2010, the Bitcoin community had a problem which was dubbed the “overflow bug.” What was also called a “malicious event” or “Strange block 74,638,” occurred between “11:34:43 CDT and 12:10:33 CDT on August 15th,” according to the bitcointalk.org user called “mizerydearia.” Many well known developers like Jeff Garzik, Gavin Andresen, and Bitcoin’s inventor Satoshi Nakamoto participated in addressing the issue.

Other participants involved with discussing the overflow bug incident included people like “NewLibertyStandard” and “Theymos” as well. The “output-value-overflow bug” was a critical problem because it produced 184.4 billion bitcoin (BTC). The event was not discovered until around 1.5 hours after it occurred, and the patch was finally delivered by Satoshi Nakamoto four hours later. The brunt of the entire ordeal lasted around five hours but the official codebase release by Satoshi was not finished until the next day.

Before the client fix Bitcoin 0.3.10 was released by Nakamoto, a blockchain split had happened. 51 blocks were generated on the chain that split until eventually, the “good” chain reclaimed the proof-of-work (PoW) victory. Consensus for this event was driven by the developer’s concerns over the severity of the issue, the network’s miners, and the patch Satoshi Nakamoto had published.

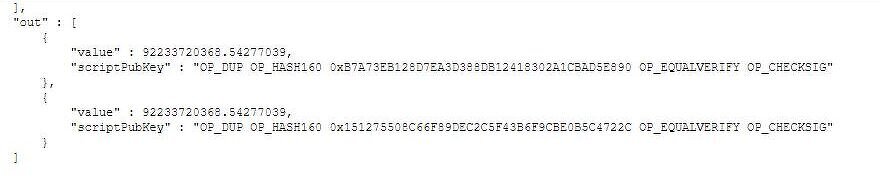

The community believes a malicious unknown entity created the overflow bug, which started at block height 74,638. At this time, two addresses received 92.2 billion BTC with a 0.5 BTC input that has never been spent. We know that approximately 51 blocks that were mined and validated by miners, were reverted back to the original state before the 184 billion BTC overflow bug. This means the Bitcoin chain experienced a blockchain reorganization or reorg after the community updated Bitcoin 0.3.10.

Getting Stuck at Block Height 170,060, and the Controversial March 2013 Reorg

Bitcoin has had other critical bugs and issues along the way during the network’s life cycle of 13 years and seven months. On April 1, 2012, Bitcoin participants got stuck on BTC block height 170,060 and after the fix, for a few months, 45% of Bitcoin miners would occasionally produce invalid blocks. Bitcoin’s second chain split, which saw around 24 blocks validated and then subsequently invalidated, was on March 11, 2013.

This particular issue was a bit more controversial than the 2010 split, because developers coordinated to get a large mining pool (Btc Guild) to revert the chain to prior software after an accidental fork took place. There was also a successful double spend during the March 2013 rollback incident as well.

BTC saw another chain split on the 4th of July in 2015 when the split saw six blocks go forward, up until the “good” PoW took over. The issue in 2015 stemmed from the Bitcoin Improvement Proposal BIP66 (soft fork) designed to make “changes to the Bitcoin transaction validity rules to restrict signatures to strict DER encoding.”

Probably the most memorable chain split that occurred on the BTC chain was on August 1, 2017. On this day, the BTC community initiated a “Flag-day soft fork” in order to enforce BIP148 rules (Segwit). Additionally, the Bitcoin Cash blockchain forked away, as the mining pool Viabtc mined block the first BCH block (nr 478,559). Viabtc also left a message in the block’s coinbase parameter which said: “Welcome to the world, Shuya Yang!”

People Often Forget Old Chain Splits and the Controversy That Surrounds Them

As the years go by, the 2010 and 2013 chain splits have been mostly forgotten by crypto enthusiasts and many people were not involved at that time as well. There have been many arguments over the years concerning blockchain immutability. It is probably not the best term to leverage, even when discussing the strength of the Bitcoin network, as there have been a few blockchain reorganizations and hiccups along BTC’s path. Reorgs will likely continue to be a contentious subject, because it is like turning back time and erasing the ledger’s history, alongside the fact that executive hashpower is needed (March 11, 2013) at times to enforce the rules.

While crypto enthusiasts have made fun of Ethereum over the DAO rollback incident, Vitalik Buterin was critical of the change that took place on March 11, 2013, as well. The Ethereum co-founder stressed that the reason why developers got away with the fix, was because of the mining pool Btc Guild’s large quantity of hashpower.

“The reason why the controlled switch to the 0.7 fork was even possible was that over 70% of the Bitcoin network’s hash power was controlled by a small number of mining pools and ASIC miners, and so the miners could all be individually contacted and convinced to immediately downgrade,” Buterin wrote at the time.

What do you think about Bitcoin first chain split? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Bitcointalk.org,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.