Digital asset manager CoinShares says that last week, the crypto markets saw the biggest inflow of institutional capital ever recorded.

The crypto firm says that digital asset investment products have shattered the record for both weekly and yearly capital flows by a huge margin.

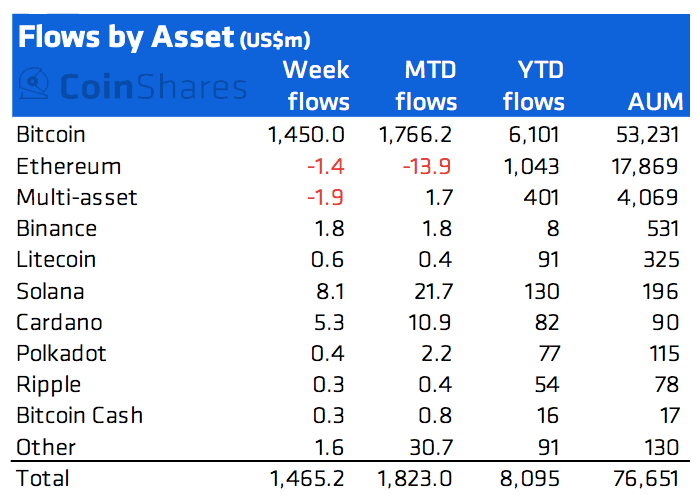

“Digital asset investment products saw inflows last week totaling US$1.47bn, the largest on record by a significant margin. The previous weekly record was seen earlier this year in February with inflows totaling US$640m.

Inflows year-to-date now sit at US$8bn, far surpassing the record in 2020 of US$6.7bn.”

CoinShares says that Bitcoin (BTC) accounted for the overwhelming majority of the funds on the back of positive sentiment stemming from the launch of the new ProShares Bitcoin futures exchange-traded fund (ETF).

“Bitcoin saw 99% of the inflows totaling US$1.45bn last week. The record inflows were a direct result of the US Securities & Exchange Commission [SEC] allowing a Bitcoin ETF investing in futures and the consequent listing of two Bitcoin investment products with inflows totaling US$1.24bn.

Inflows into Bitcoin products were also seen in other regions totaling US$138m, although there was evidence of profit-taking with some older investment products seeing outflows.”

Looking at altcoins, the asset manager says that the most notable coins seeing inflows were smart contract platforms Solana (SOL) and Cardano (ADA), as well as crypto exchange Binance’s BNB. Solana and Cardano saw $8.1 million and $5.3 million in inflows respectively, while BNB recorded $1.3 million.

The full CoinShares report can be read here.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Deniseus