The below is from a recent edition of the Deep Dive, Bitcoin Magazine‘s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

Supply squeeze: that has been the topic of many of the past Daily Dives and it will be the topic today, because the underlying story remains the exact same.

Demand for an absolutely scarce, inelastic monetary asset continues to increase, supply is getting pulled off the market at feverish pace, and price isn’t reacting.

The market is finally starting to wake up.

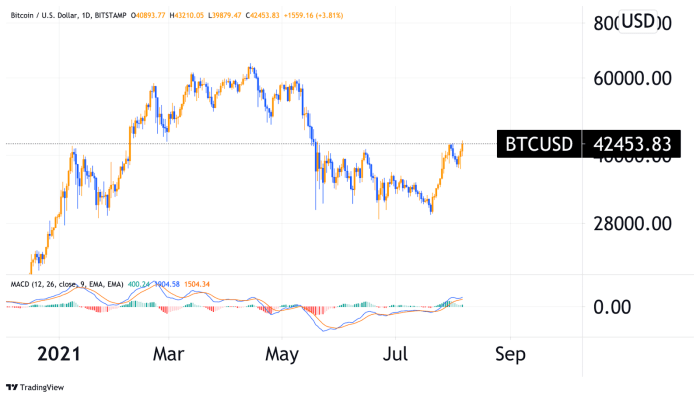

The BTC daily chart looks ripe for a monster breakout, with a lot of hot air above the $43,000 level.

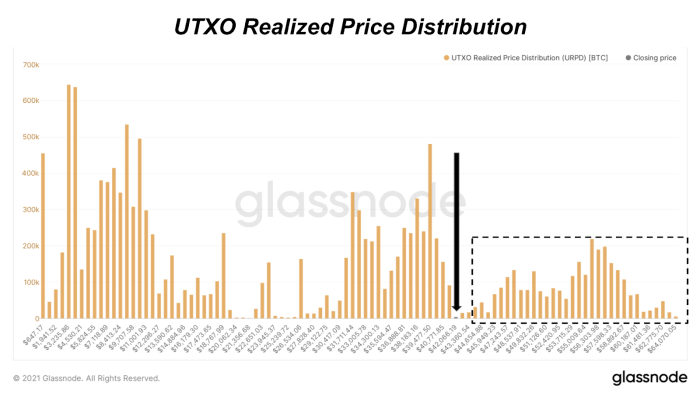

On-chain volume tells a similar story, with little resistance above the $43,000 level, with a massive wall of UTXO distribution below. Following the months of accumulation in the range of $30,000 to $40,000, bitcoin has very strong support and it would most likely take a large meltdown in global equity markets for bitcoin to break the range low and fall below $29,000.

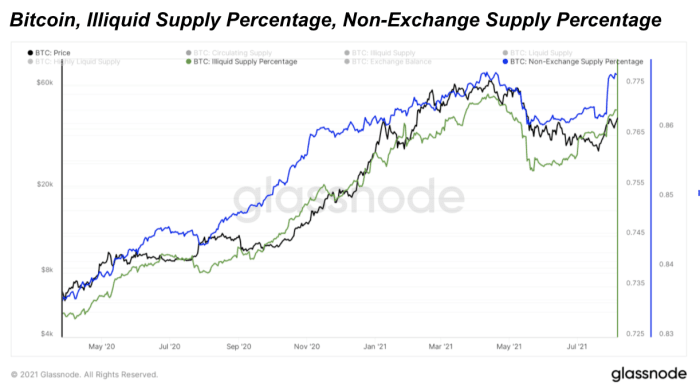

As we have been highlighting the supply shortage and dichotomy between derivative market bearishness and spot market accumulation, we present a fascinating chart below.

Plotted below is the price of bitcoin, the percentage of circulating supply not on exchanges and the amount that is illiquid. Derivative market bearishness is like trying to fight gravity when the supply side is squeezed as hard as it currently is.

With the way that bitcoin trades, it is entirely possible for all-time highs to be made in short order, as in over the next month or two. Bitcoin price action is reflexive in bull markets, as higher price increases demand, driving price even further.