A closely followed crypto analyst believes Ethereum (ETH) could be gearing for a rally en route to liquidating traders who are bearish on the leading smart contract platform.

In a new blog post, Justin Bennett says that the S&P 500’s (SPX) rally on Friday could hint at the short-term performance of the crypto markets.

According to the analyst, crypto tends to follow in the footsteps of the stock market but there appears to be lag between the two asset classes. Bennett adds that should crypto take cues from equities, he sees Ethereum taking out resistance at $1,840.

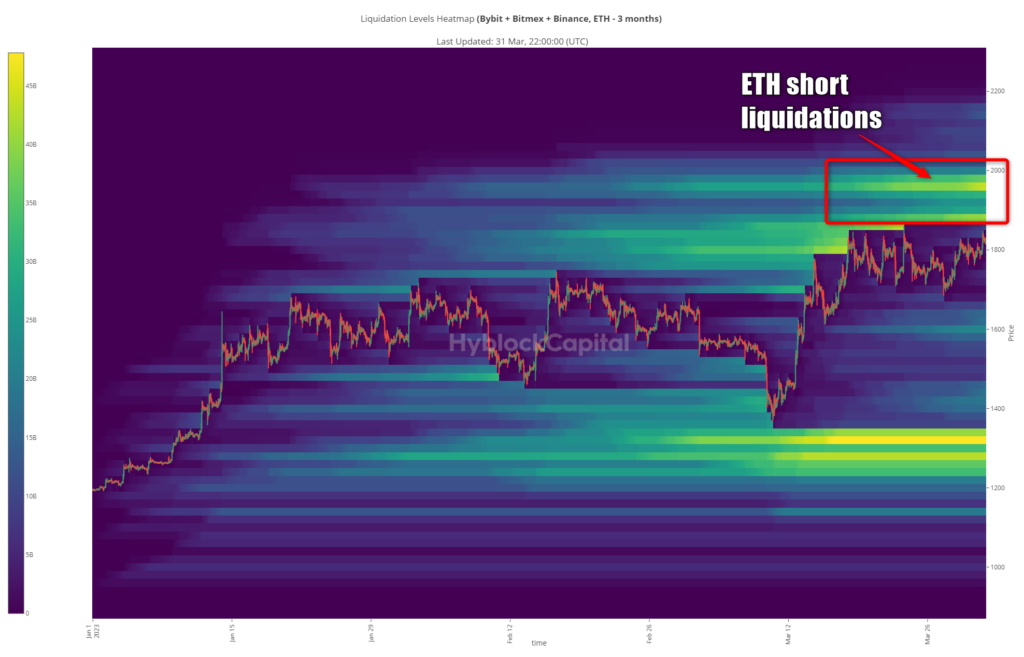

Bennett says an Ethereum breakout could trigger a short squeeze as he notes that there’s a “significant cluster” of short liquidations up the the $2,000 price level for ETH.

A short squeeze happens when large numbers of traders who shorted an asset decide to cut their losses in response to an unexpected price bump. The squeeze then triggers additional rallies.

Says Bennett,

“That could be telling, as cryptocurrencies like to target these areas, and $2,030 is the August 2022 high. Far more long liquidations are below current levels, but proximity matters, so the short liquidations up to $2,000 may influence ETH in the short term.”

However, Bennett says that the clock is ticking for crypto and Ethereum. According to the trader, the Ethereum short squeeze must happen in the coming days. Otherwise, he says that the rally may not materialize at all.

“But I’d like to see crypto play ‘catch up’ to equities sooner rather than later if this is to materialize.

If we don’t see ETH flush these shorts in the next few days, it’s less likely to occur.”

At time of writing, Ethereum is trading for $1,818.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney