An under-the-radar altcoin’s total value locked (TVL) is on the rise as its affiliated algorithmic stablecoin continues to capture more market share.

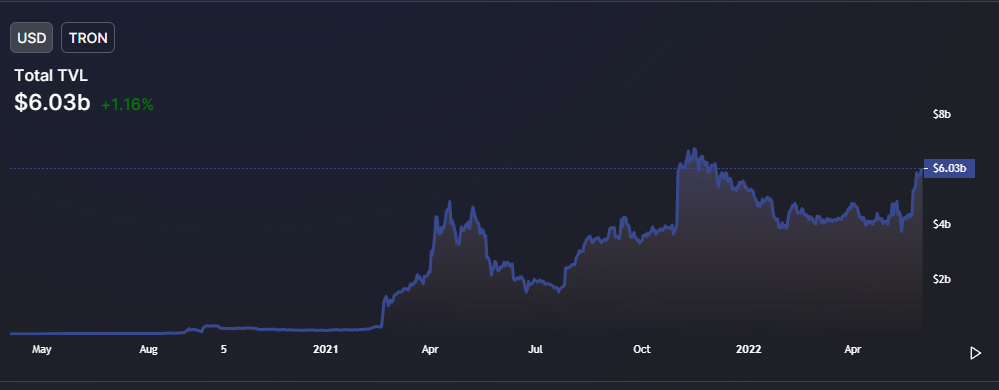

Tron (TRX), a project originally designed to serve as a decentralized storage and distribution platform for social media and digital entertainment content, is now the third-largest blockchain in terms of TVL at $6.03 billion, according to analytics platform DeFi Llama.

The TVL of a blockchain represents the total capital held within its smart contracts. TVL is calculated by multiplying the amount of collateral locked into the network by the current value of the assets.

A closer look at Tron’s ecosystem shows that over half of the capital is locked in decentralized finance lending and borrowing protocol JustLend (JST). The platform’s website reveals that holders of Tron’s algorithmic stablecoin Decentralized USD (USDD) can enjoy an annual percentage yield of over 23% if they lock their crypto asset on JustLend.

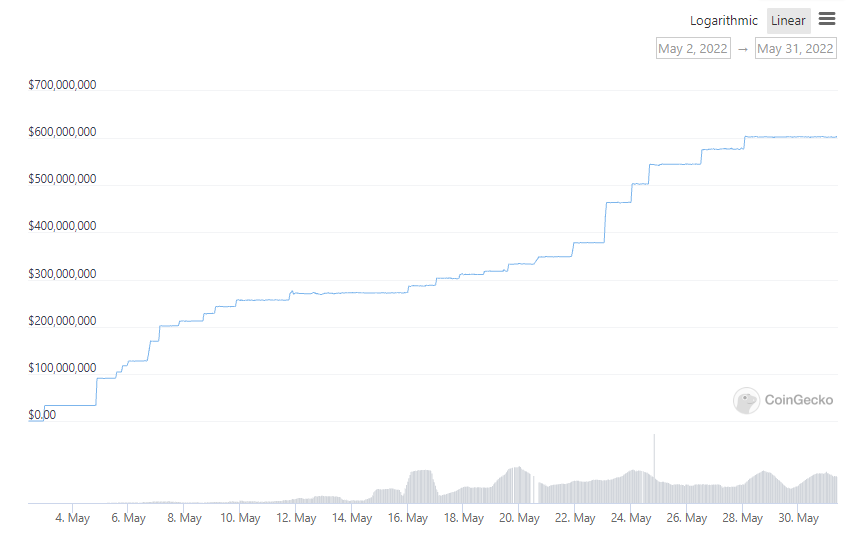

Data from DeFi Llama and CoinGecko shows that Tron’s TVL explosion appears to coincide with the growth of USDD’s market cap. Tron’s total value locked surged from $3.73 billion on May 13th to over $6 billion today. During the same period, USDD’s market cap climbed from $269 million to over $602 million at time of writing, a 123% increase in a little over two weeks.

Popular crypto trader Light recently told his 163,500 Twitter followers that Tron is on the up and up due to its pivot to the algorithmic stablecoin space.

“TRX has displayed enormous relative strength, again at its March highs in an environment where 99% of alts are down 50% or more, driven by Tron’s recent foray into the algo stable space and a 30% yield on USDD. In bear markets, winners win.”

Check Price Action

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Aleksandr Kukharskiy