Last Week In Bitcoin is a series discussing the events of the previous week that occurred in the Bitcoin industry, covering all the important news and analysis.

Summary

Despite briefly dipping below $30,000 earlier in the week, the last week has been relatively steady for bitcoin. Although nothing major happened to either give the bitcoin price a boost or to push it off a cliff, the market bounced back with relative ease after briefly dropping just below $29,000 on some exchanges. However, by the weekend, it started climbing again breaching $34,000 by late Sunday evening. Despite recent dips to $30,000 and below, I am still hyper-bullish with my outlook on the months ahead for bitcoin.

Highlights

Chart Of The Week

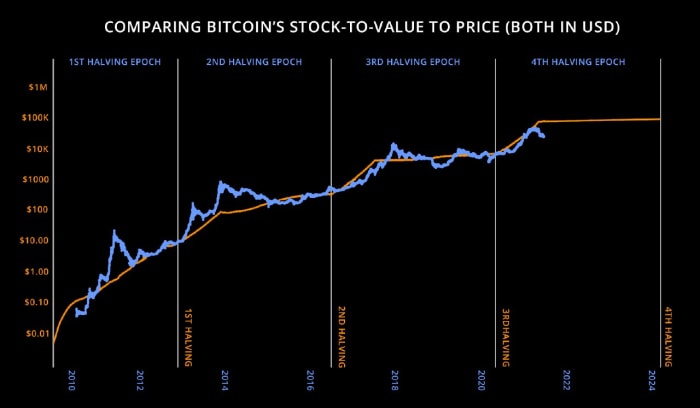

Much like last week’s chart, the long-term outlook on bitcoin is relatively bullish. The chart above compares bitcoin’s price to its stock-to-flow ratio in U.S. Dollars since its inception in 2009. As evident, the data once again suggests that bitcoin is primed for a breakout over the coming months that will far exceed $100,000 per bitcoin. The stock-to-flow model compares the stock (availability) of an asset or commodity to the flow of production.

Let’s look at the reasons to be overly bullish for the months ahead. Later this week, Bitcoin’s mining difficulty will decrease by its highest rate ever. This usually has an upwards effect on the price as miners expel even less energy to obtain bitcoin. However, miners are being squeezed with China’s crackdown, and miners are liquidating bitcoin and spending money to move their operations, or shut down completely. This will likely take a few weeks, if not a couple of months, to resolve.

Then we have El Salvador, an entire country adopting bitcoin as legal tender. This most definitely isn’t priced in yet, not by far. Besides that, other countries are vocal about their intent to follow in El Salvador’s footsteps; earlier this week, Tanzania suggested they may do so. In September, every citizen in El Salvador will receive $30 worth of bitcoin airdropped through the incoming Chivo mobile wallet and El Salvador will officially embrace Bitcoin. Millions of people will receive bitcoin in one of the largest airdrops to date.

In November, Taproot will activate on the Bitcoin network bringing enhanced security, better speeds and more smart contract capabilities. Bitcoin is growing faster than ever and it’s not being reflected in the price. But then again, we are constantly comparing bitcoin to fiat and pricing it in fiat, which is brutally ironic considering we’re rooting for bitcoin to overthrow the aging, failing global financial system and the fiat currencies it’s built on.

The only price that matters is one bitcoin equals one bitcoin.

Bullish News

This week Jack Dorsey and Elon Musk announced they will have a public discussion on bitcoin later in July. This should be bullish, although with Musk you can never be certain.

Michael Saylor, while talking to Bloomberg, said he is not concerned with short term price fluctuations, and neither should we be. Saylor has said before that there is no reason bitcoin can’t be a $100 trillion asset, and if that’s a conservative estimate, then we still have a 20,000% increase in the cards over the next few years. CME Group also announced this week that micro bitcoin futures contracts trading on the platform exceeded 1 million since May, showing increased demand for anything bitcoin.

Finally, there is Q2 Holdings’ announcement that they will partner with New York Digital Investment Group (NYDIG) to offer over 18 million customers access to bitcoin trading. This will only continue to further bitcoin adoption worldwide and push other financial institutions to start offering the same or similar services.

Bearish News

Although I wish it was bullish news, Jack Dorsey and Elon Musk’s decision to have a public discussion on Bitcoin some time in July is poised to be a bearish event. Musk has proven time and time again that he is here to manipulate the market and continue his disinformation campaign against Bitcoin, and it’s unlikely he will have changed his tune by the time the discussion goes live.

In my own home country, South Africa, we’ve experienced a bearish week for the history books. The government has reiterated its stance against purchasing crypto abroad or sending money abroad to purchase crypto. The Africrypt scandal also cements South Africa as the crypto scam capital, following 2020’s Mirror Trading International ponzi scheme falling apart. Over the weekend, the U.K. government warned that Binance cannot conduct “regulated activity” in the U.K. and is sure to do the same with other exchanges.

Instead of paving the way for crypto adoption, some countries are increasingly pushing bans and anti-crypto narratives. It appears as though this is unlikely to stop anytime soon and as Bitcoin adoption grows, more and more countries will fight back, trying to safeguard the control they exert with their aging financial systems, pushing citizens into financial turmoil.

Verdict

My short-term outlook is bearish. Bitcoin seems poised to break below $30,000 at least once more in the weeks ahead; however my long-term outlook remains overly bullish. As my charts and weekly rants continue to suggest, bitcoin is heading for a breakout. It may take weeks, or even months, but I am sticking to my guns. Bitcoin is bringing billions of people financial freedom and as more and more individuals, institutions and even countries adopt bitcoin, the fiat price will boom.

This is a guest post by Dion Guillaume. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.