Blockchain analytics firm Glassnode is looking at the state of Bitcoin after the world’s leading crypto by market cap launched a sudden rally starting over the weekend.

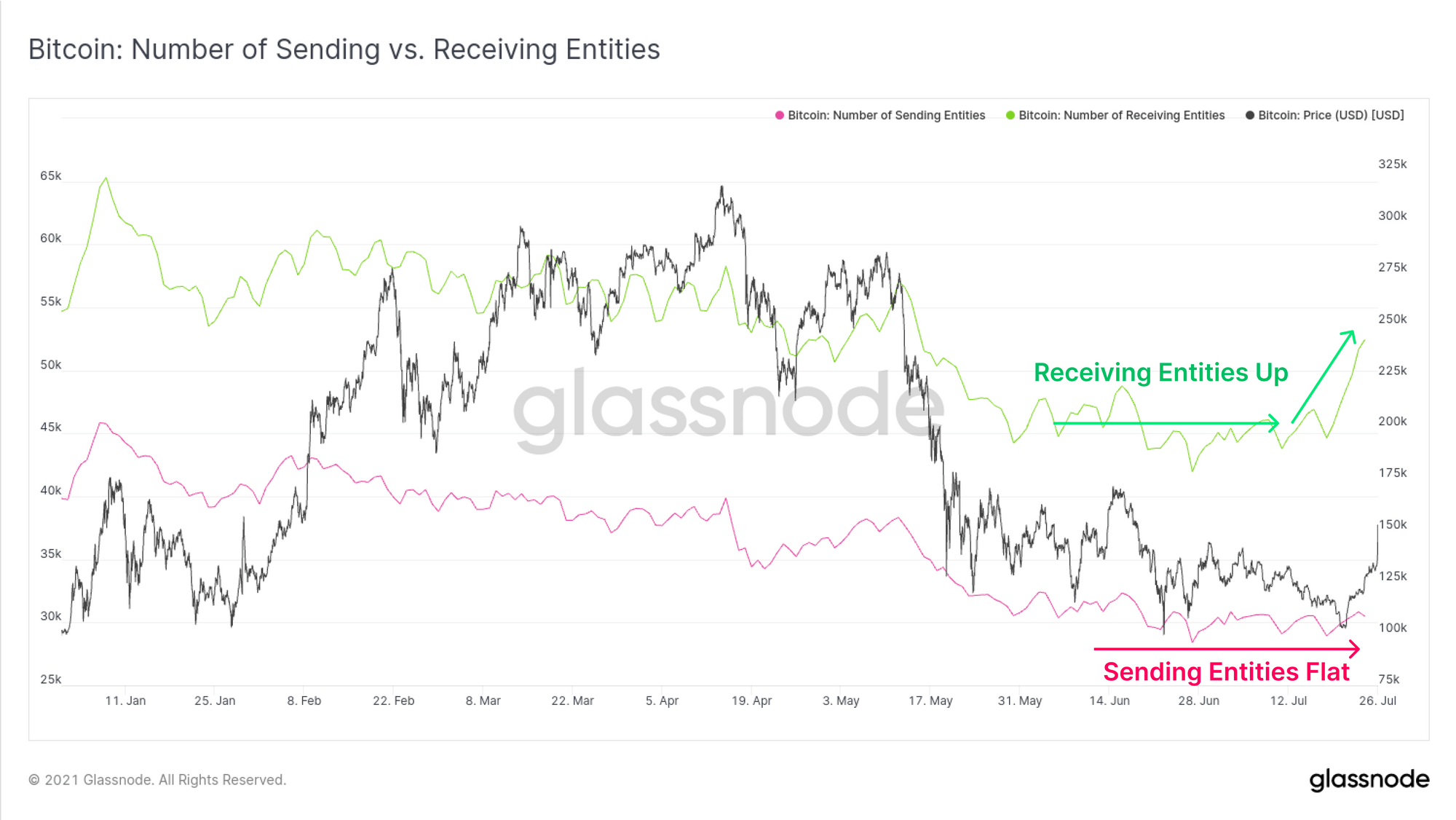

In a new report, Glassnode says that one potentially bullish factor for Bitcoin is the growing number of wallet addresses receiving BTC, rather than sending it.

“On the topic of entities, we can see a more constructive spike in receiving entities (those taking custody of coins) whilst sending entities (those spending coins) remains relatively flat. This is an early trend change and one that would indicate a more positive accumulation type environment if it persists. It highlights that of the volume that is transacting, a reasonable portion looks to be accumulation, and relatively little is entities exiting the network.”

Although the number of addresses receiving BTC is on the up and up, Glassnode points out that on-chain activity for Bitcoin is ominously quiet, sitting at a level vastly below what it was when BTC was rallying earlier in the year.

“In direct contrast to the volatility in spot and derivatives markets, the transaction volume and on-chain activity remain extremely quiet. On a 14-day median basis, the entity-adjusted transaction volume for Bitcoin remains depressed at around $5 billion per day. This remains a significant decline from the $16 billion/day prior to the May sell-off.”

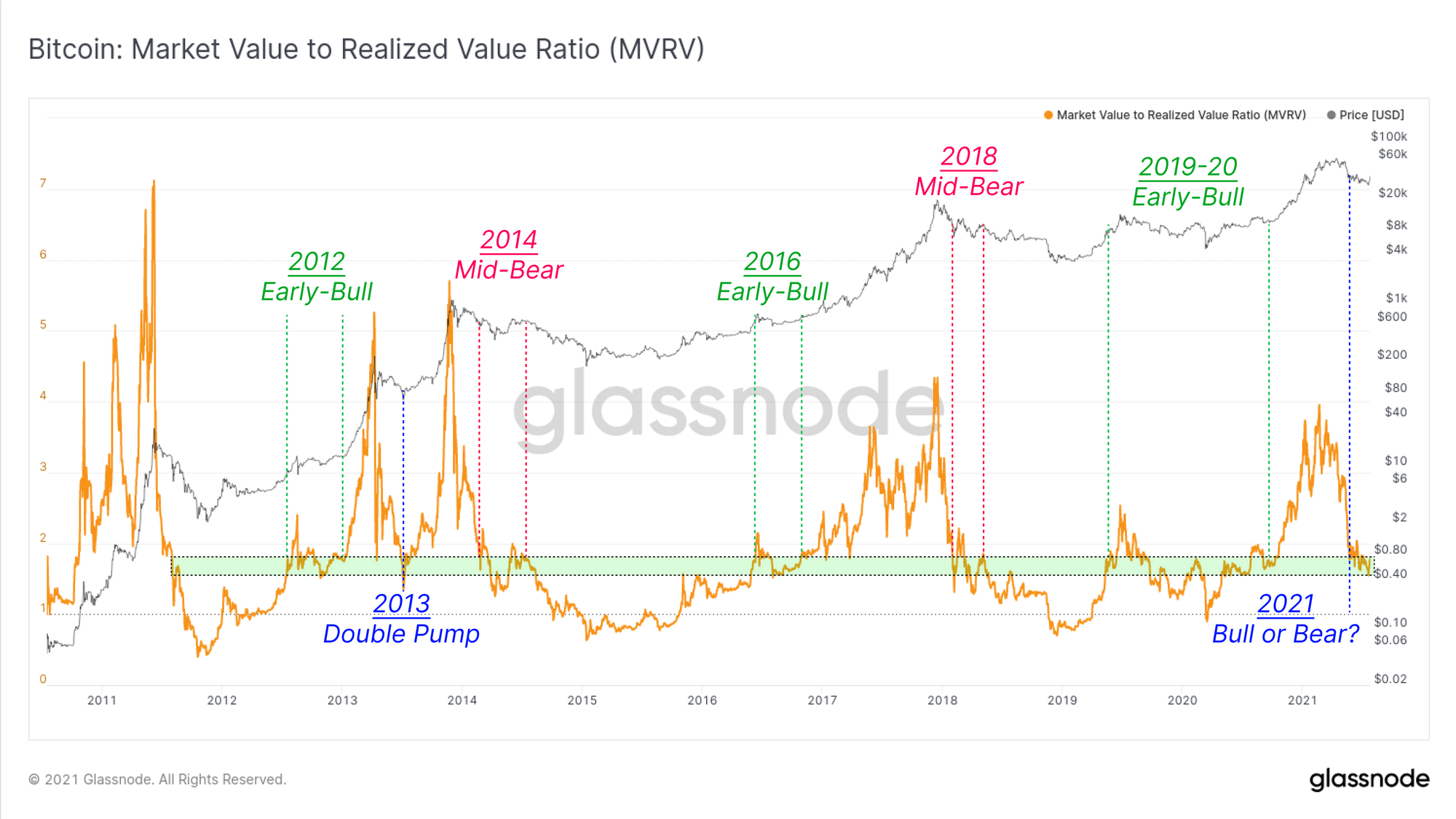

The firm also takes a look at the MVRV (market value to realized value) in short-term holders. MRVR aims to pinpoint market reversals by comparing the total value of the market to the unrealized profits or losses of traders’ positions.

According to Glassnode, the MVRV metric is currently hovering at a critical juncture where BTC could either ignite a full-blown bear market or restart its uptrend.

“The STH [short-term holder]-MVRV rarely trades at such oversold conditions with almost all historical instances being followed by significant price rallies. That said, these fractals typically only occur in bear markets, noting that this includes the final capitulation event which starts a macro bull.”

The crypto insights firm says more time is needed to determine whether Bitcoin can revamp its bull run or break down into a longer-term bear market.

“At this stage, it remains to be seen whether the market can turn the macro trend around and confirm a resumption of the bull market. If so, it would resemble the 2013 ‘double pump’ market. If not, the probability of being a mid-Bear fractal may increase.”

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Bryan Vectorartist