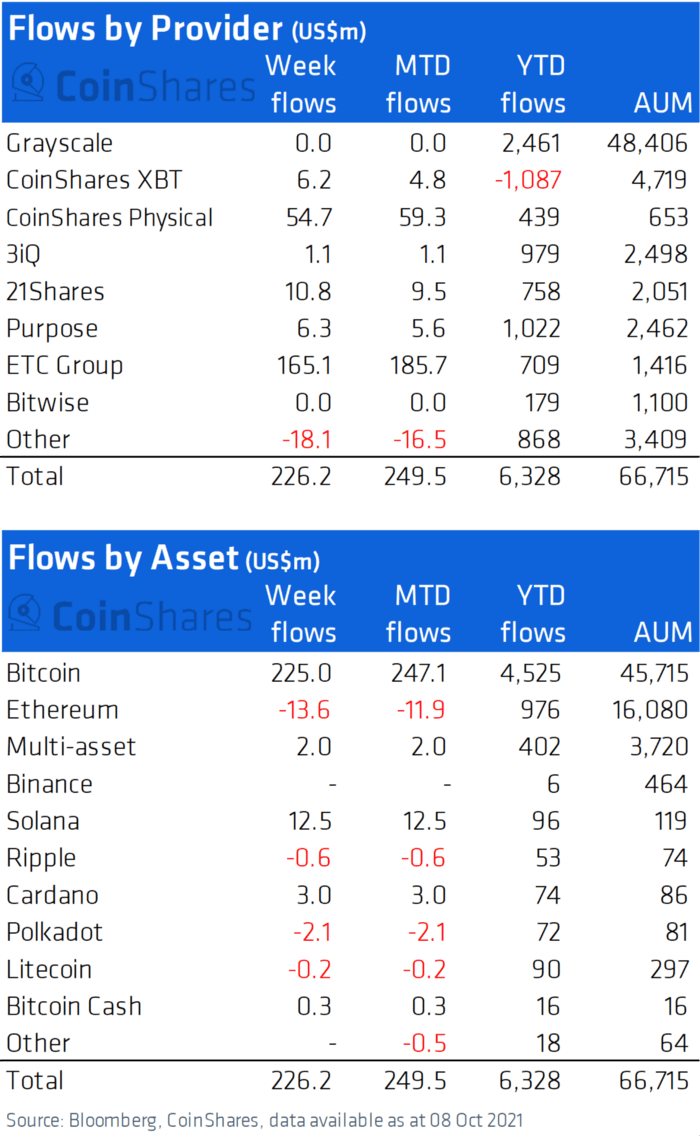

Digital asset manager CoinShares says Bitcoin (BTC) is taking the lion’s share of institutional capital as sentiment in the crypto markets remains upbeat.

In their weekly report, CoinShares says that the total amount of crypto assets under management (AUM) is only 5% away from setting all-time highs due to recent positive price action.

The firm also says that SEC head Gary Gensler’s recent hints about possibly supporting a Bitcoin futures exchange-traded fund (ETF) could have fueled the rise in sentiment.

“Bitcoin saw inflows totaling US$225m, comprising a significant majority of the total.

We believe the turnaround in sentiment towards Bitcoin is due to constructive statements from SEC Chair Gary Gensler, potentially allowing a Bitcoin ETF in the US.”

CoinShares says that Etheruem (ETH) once again conceded a portion of institutional flows to Bitcoin, giving up 1% of total AUM over the last week. Looking at altcoins in general, the firm has mixed findings.

“It was a mixed picture in other altcoins with recent favorites Solana [SOL] (US$12.5m) and Cardano [ADA] (US$3m) continuing to see inflows, suggesting the focus hasn’t entirely switched to Bitcoin.

Other altcoins, namely Polkadot [DOT,] XRP, and Litecoin [LTC] didn’t fare so well with outflows of US$2.1m, US$0.6m, and US$0.2m respectively.”

The full CoinShares report can be read here.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/camilkuo