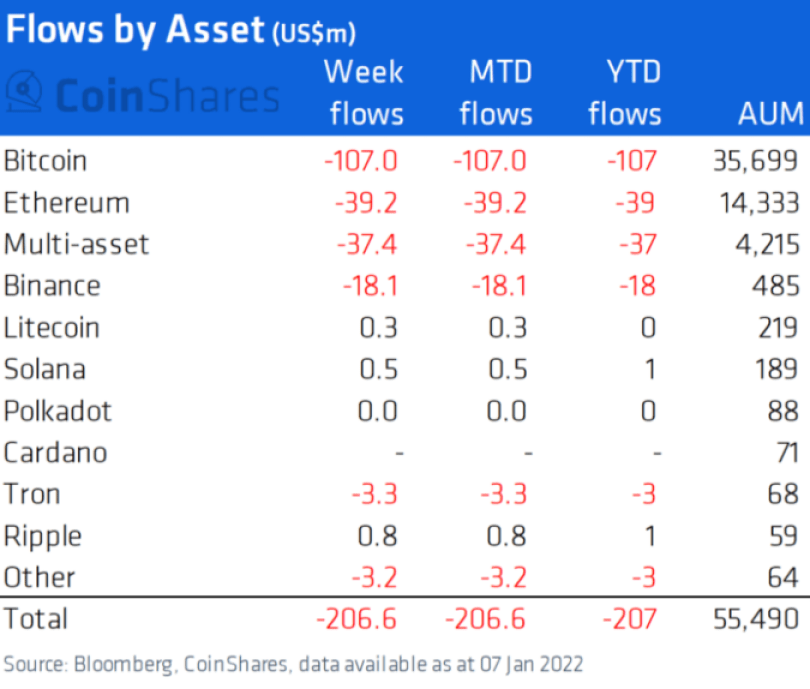

Institutional investors are remaining bearish on the crypto markets, resulting in digital asset investment products seeing record outflows to start the new year.

According to digital asset manager CoinShares, crypto investment products reached a new weekly record outflow of $207,000,000 last week.

“Digital asset investment products saw outflows totaling a weekly record of US$207m.

This follows the outflows that began mid-December and the 4-week run now totals US$465m.”

Bitcoin (BTC), the largest cryptocurrency by market cap, perhaps felt the sting of bearish sentiment more than any other crypto asset.

“Bitcoin saw outflows totaling US$107m last week in what we believe was a direct response to the FOMC [Federal Open Market Committee] minutes which revealed the US Federal Reserve’s concerns for rising inflation.”

The FOMC minutes released on January 5 were from meetings held December 14-15, 2021. The Fed’s focus on inflation has sent jitters through the crypto markets, and most digital assets have been dipping in response.

Leading smart contract platform Ethereum (ETH) also saw significant outflows, continuing a down streak that began in December.

“Ethereum saw outflows totaling US$39m last week, bringing the 5-week run of outflows to US$200m.”

However, not every digital asset suffered outflows in the new year.

XRP and Solana (SOL) enjoyed minor inflows, both totaling less than $1,000,000. The same is true for Litecoin (LTC), with inflows totaling less than $500,000.

Check Price Action

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/phive/Sensvector