Ethereum (ETH) is enjoying a change in sentiment as the second largest crypto asset’s transition to a proof of stake (PoS) consensus mechanism approaches, according to digital asset manager CoinShares.

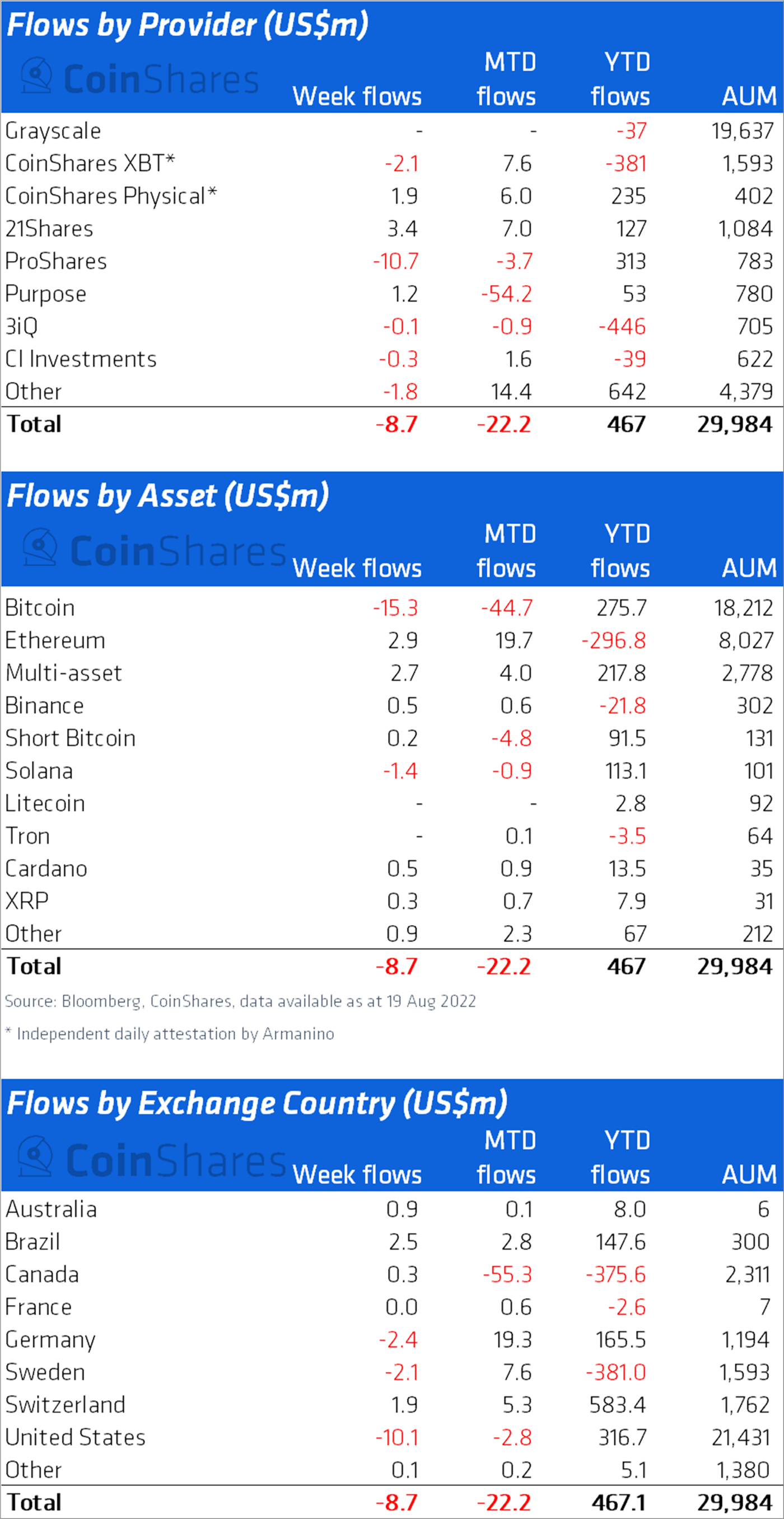

In its latest Digital Asset Fund Flows Weekly report, CoinShares finds that Ethereum is now in its ninth consecutive week of inflows after suffering outflows of nearly half a billion dollars from the start of the year to mid-June.

“Ethereum saw weekly inflows totaling US$3m and has seen a turn-around in sentiment. At the mid-point in June Ethereum investment products had seen year-to-date outflows totaling US$459m. Since this point, as there has been improving clarity on the Merge, Ethereum has seen a 9-week run of inflows totaling US$162m.”

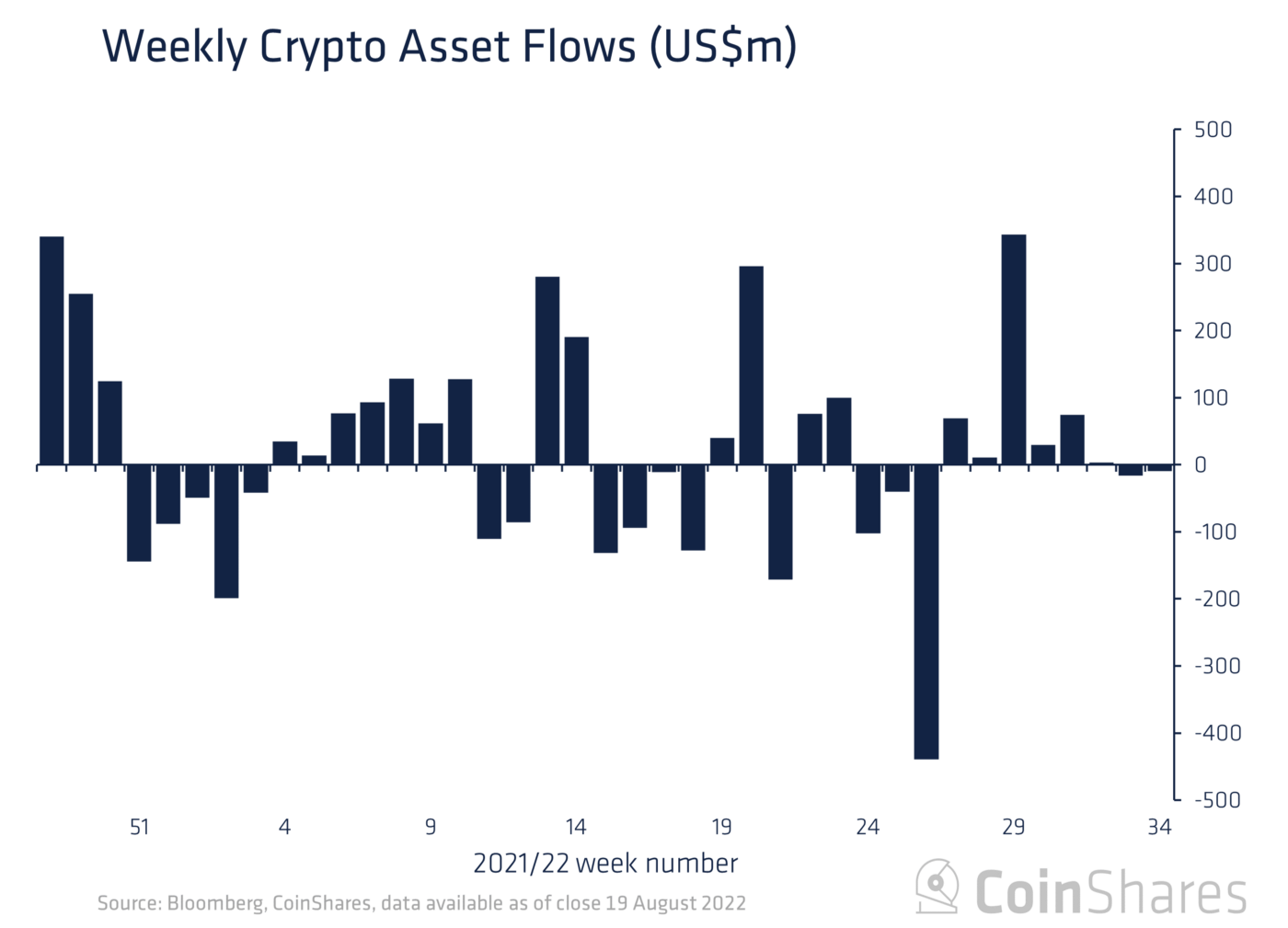

Overall, digital assets investment market products recorded weekly outflows of $9 million.

“Digital asset investment products saw minor outflows last week totaling US$9m last week with volumes at US$1bn, 55% off the year average and the 2nd lowest this year, suggesting low participation from investors at present. The summer doldrums persist for now.”

According to CoinShares, Bitcoin (BTC) witnessed weekly outflows of over $15 million, the third week in a row that the flagship crypto asset was experiencing negative flows.

“Bitcoin, where the mild negative sentiment has been focused, saw a third consecutive week of outflows totaling US$15m. Short-bitcoin saw very minor inflows totaling US$0.2m over the same period.”

Solana (SOL) also recorded outflows while other altcoins witnessed “unremarkable inflows”, according to the digital asset manager.

“Other altcoins saw unremarkable inflows, most notably Cardano with inflows totaling US$0.5m, while Solana saw outflows for a second week totaling US$1.4m.”

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/NextMarsMedia