The largest Ethereum (ETH) whales in existence are accumulating decentralized oracle network Chainlink (LINK) and a collection of decentralized finance (DeFi) altcoins as the crypto markets show signs of stability.

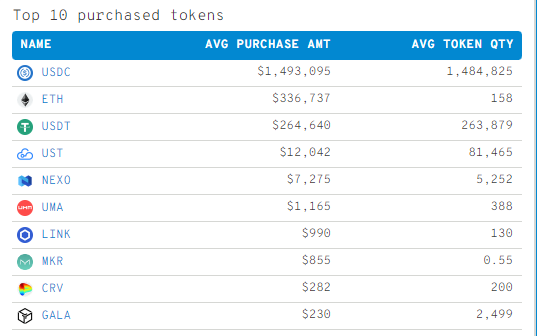

According to blockchain tracker WhaleStats, the top 100 Ethereum whales are currently most interested in three stablecoins and over a half dozen altcoins, with Chainlink in seventh place with the average buy-in of $990 for 130 LINK tokens.

Ethereum whales are diving back into the DeFi sector, particularly crypto lending platform NEXO as well as UMA, a platform designed to allow developers to build synthetic assets.

Eighth on the list is the Ethereum-token Maker (MKR), a governance token that supports DAI, a stablecoin designed to be pegged one-to-one to the US dollar. ETH whales are biting off an average of 0.55 MKR for $855.

The governance token of stablecoin-focused decentralized exchange Curve Finance (CRV) ranks ninth where each whale got an average of 200 CRV tokens for $282.

Rounding out the top 10 is play-to-earn blockchain gaming platform Gala (GALA) with ETH whales acquiring an average of 2,499 GALA tokens for $230.

US Dollar Coin (USDC) and Tether (USDT) are the two most accumulated stablecoins among ETH whales, followed by the embattled algorithmic stablecoin TerraUSD (UST).

Ethereum itself ranks second overall with the whales spending an average of $336,737 to accumulate 158 ETH tokens.

Check Price Action

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/nomadFra/Sensvector/David Sandron