A leading digital assets manager is finding that institutional investors are pouring larger amounts of capital into short crypto investment products than previously seen before.

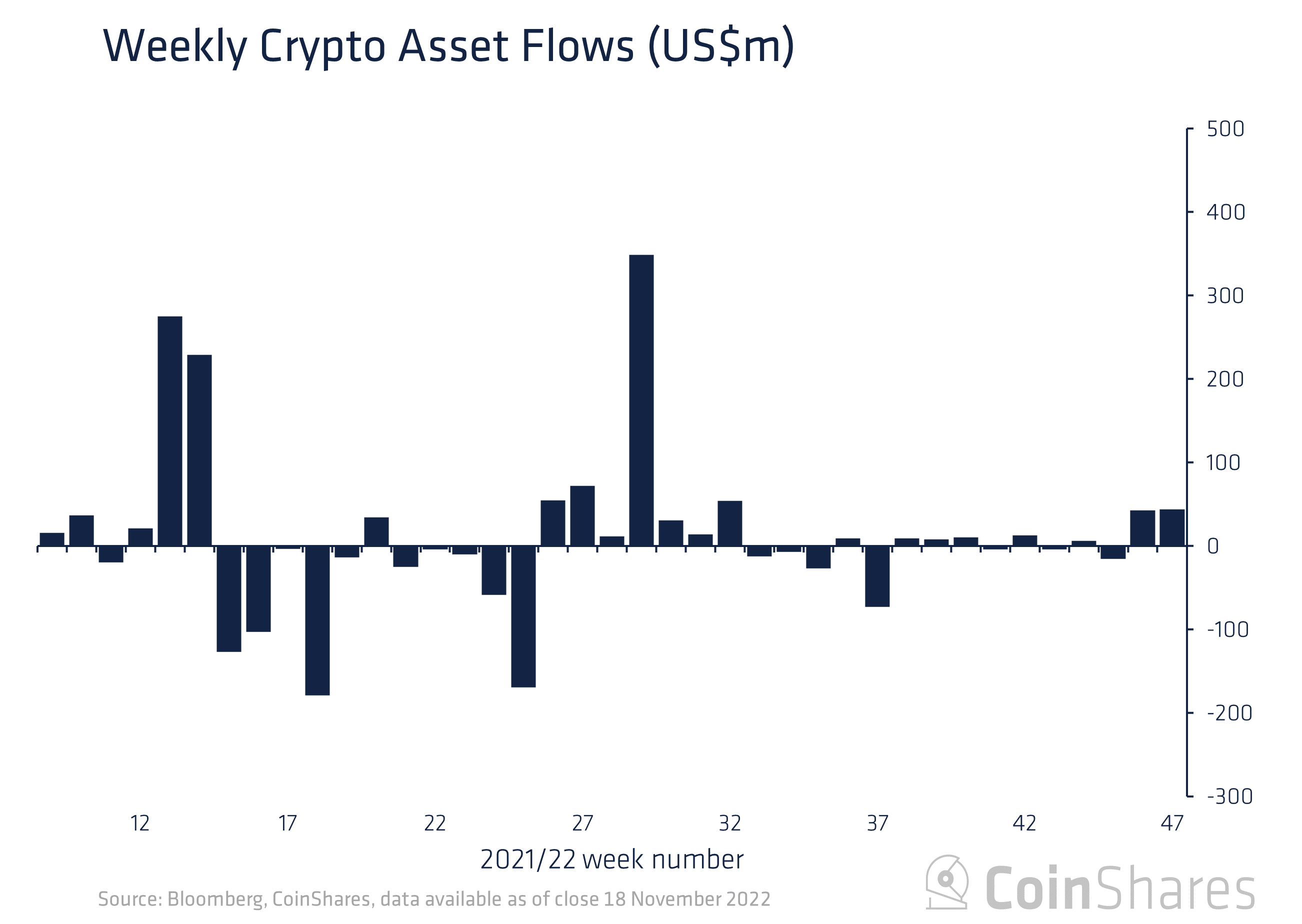

In its latest Digital Asset Fund Flows Weekly report, CoinShares says crypto investment products saw most inflows heading toward short investment products last week.

“Short investment product inflows represented 75% of the total inflows suggesting on aggregate sentiment was deeply negative for the asset class, while total AuM is now at the lowest point in 2 years at $22 billion.”

CoinShares finds that Bitcoin (BTC) short investment products saw inflows across all regions, though it doesn’t necessarily imply investor sentiment is united.

“Regionally, inflows into short investment products were seen in both the US and Europe although some short products saw outflows implying opinion is divided amongst investors as to whether the market has reached its lows.”

BTC investment vehicles comprised most of the inflowing capital among long products, gaining $14.3 million last week, according to the report.

“Bitcoin saw inflows totaling $14 million, but when offset by the inflows into short investment products the net flows were a negative $4.3 million. AuM on short-Bitcoin is now at $173 million, close to the high of $186 million.”

Long Ethereum (ETH) investment products saw minor outflows. On the contrary, short-ETH products saw similar inflows to BTC.

“Ethereum saw minor outflows totaling $0.8 million although it also saw the largest inflows on record into short-Ethereum investment products totaling $14 million. This negative sentiment is likely a result of renewed uncertainty over the Shanghai update, which will allow the withdrawal of staking assets, and the hacked FTX ETH assets which sum to ~$280 million.”

All altcoin long-products saw outflows last week. Solana (SOL) lost $3.3 million, Binance Coin (BNB) dropped $0.6 million, XRP suffered $1.4 million in outflows and Polygon (MATIC) lost $200,000. Multi-asset investment vehicles, those investing in more than one digital asset, saw inflows of $2.8 million.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Susanitah/Vladimir Kazakov