Bitcoin (BTC) has seen a week of institutional investment inflows, breaking a five-week outflow trend, according to digital asset manager Coinshares.

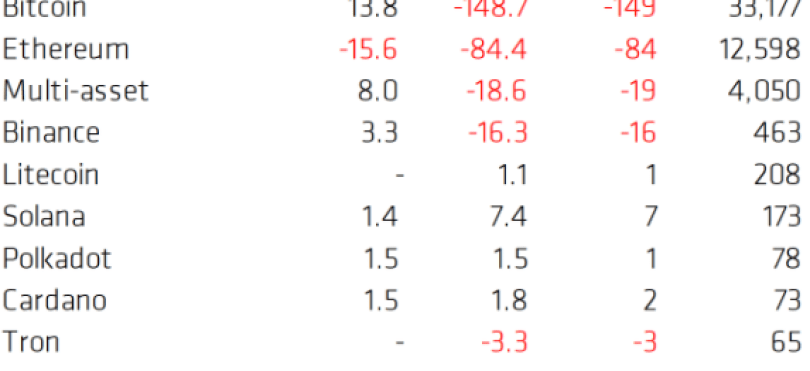

CoinShares says Cardano (ADA), Solana (SOL) and Polkadot (DOT) also enjoyed inflows on the week, suggesting that investors are anticipating a possible market turnaround on the horizon.

“The inflows came later in the week during a period of significant price weakness, suggesting investors, at current price levels, are seeing this as a buying opportunity.”

Among major digital assets, Ethereum (ETH) was the only crypto to suffer outflows last week, continuing a downward seven-week trend for the leading smart contract platform.

“Ethereum continues to see outflows, with US$16m of outflows last week. The current 7 week run of outflows now total US$245m… highlighting much of the recent bearishness amongst investors has been focussed on Ethereum rather than Bitcoin.”

While Ethereum lost $16 million in outflows last week, Ethereum competitors Solana, Cardano, and Polkadot all enjoyed minor inflows on the week at $1.5 million, $1.5 million, and $1.4 million respectively.

Negative crypto sentiment showed signs of cooling in last week’s CoinShares analysis, and that trend appears to be continuing among institutional investors with this week’s minor inflows.

Bitcoin enjoyed inflows last week of $14 million after losing nearly $320 million in outflows over the last five weeks. The minor inflows have not driven BTC’s price up, however, as the leading crypto by market cap is trading for $35,471 at time of writing, down 20% over the last seven days.

Check Price Action

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/jiang jie feng